Opixtech (Opix Technology Limited), a company established in 2017, claims to specialize in CFD trading, algorithmic trading, and copy trading services. However, questions surrounding its registration, regulatory status, and customer support raise doubts about its credibility. Investors are advised to thoroughly understand its operational background and potential risks before making investment decisions.

Opixtech Overview

Opix Technology Limited, also known as Opixtech or its Chinese name “辰德外汇,” claims to be a Seychelles-registered fintech company. Its core services include CFD trading, algorithmic solutions (OpixAlgo), and copy trading. The platform supports 12 languages, including English, Spanish, French, and Japanese, catering to a global audience.

Through its website and promotional materials, Opixtech attempts to project an international and technology-driven image. However, deeper scrutiny reveals inconsistencies in its transparency and operational practices.

1. Company Background and Development History

1.1 Founding and Corporate Growth

Opixtech was reportedly founded by Joseph Culter in 2017. Initially, the company focused on options and commodity market-making services before expanding into stock and CFD trading. According to its official timeline:

- 2017: Opixtech launched as a market maker in the options and commodities sectors.

- 2019: Expanded to include stock trading services.

- 2020: Introduced CFD trading and algorithmic solutions through the OpixAlgo system.

- 2023: Released a simplified version of OpixAlgo, targeting retail investors.

While the development path appears structured, the lack of third-party validation raises questions about its authenticity.

1.2 Key Milestones and Current Status

Currently, Opixtech offers services across various markets, but it struggles to distinguish itself from competitors. Transparency and customer support remain critical issues.

2. Registration Information and Legitimacy

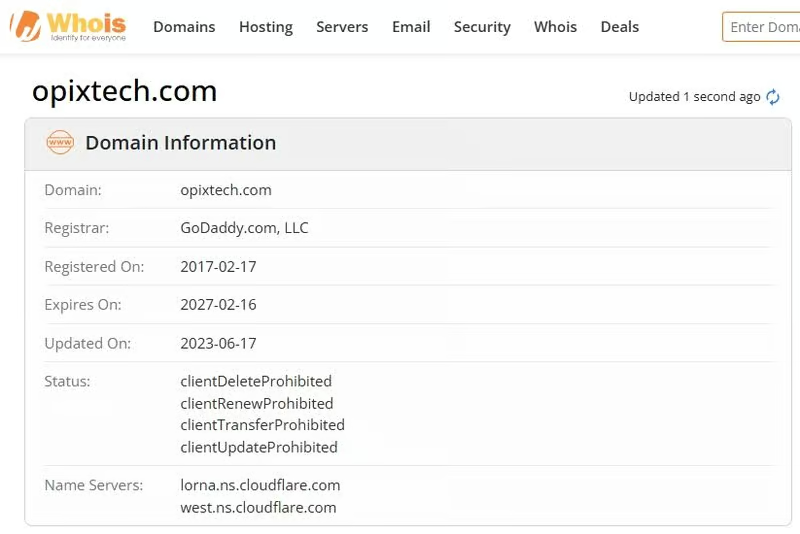

2.1 Questionable Registration Details

Opixtech claims to be registered under number 193365 in Seychelles. However, a search of the Seychelles corporate registry yields no matching records, casting doubt on its legal standing.

2.2 Regulatory Claims and Risk Assessment

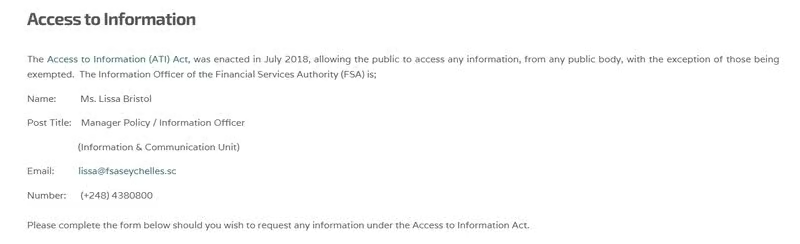

Opixtech asserts that it is regulated by the Seychelles Financial Services Authority (FSA), yet no records of the company exist in the FSA’s public database. Seychelles is known for its relatively lax financial oversight, meaning even legitimate regulatory status might offer limited investor protection compared to stricter authorities like the UK’s Financial Conduct Authority (FCA) or the US Commodity Futures Trading Commission (CFTC).

The unclear registration and regulatory claims raise significant concerns about Opixtech’s legitimacy and safety.

3. Core Products and Technology Evaluation

3.1 OpixAlgo: The Algorithmic Trading Core

OpixAlgo is Opixtech’s flagship algorithmic trading software, which claims to enhance trading efficiency through automated strategies. Key features include:

- Customizable Strategies: Investors can configure algorithms to meet specific trading needs.

- Catering to Retail and Institutional Users: Solutions tailored for both small-scale and large-scale investors.

- Real-Time Data Integration: Provides market analysis to optimize decision-making.

However, there is limited market feedback or independent reviews on OpixAlgo’s actual performance, making its effectiveness difficult to gauge.

3.2 Opixtrade: The CFD Trading Platform

Opixtrade is designed for CFD trading, offering a streamlined trading experience with the following features:

- Support for trading in forex, commodities, and stocks.

- Multilingual interface for global accessibility.

- Integrated copy trading functionality, allowing beginners to replicate strategies from experienced traders.

While the platform covers diverse financial instruments, it lacks robust user reviews and independent performance evaluations, limiting its appeal.

4. Customer Support and Service Issues

4.1 Limited Support Channels

The only contact option provided by Opixtech is an online “CONTACT” form on its website. No phone number or live chat support is available. This lack of direct communication channels can be a significant drawback, particularly during emergencies.

4.2 Efficiency and Trust Concerns

Compared to competitors offering 24/7 support, Opixtech’s limited customer service options reduce its reliability. This deficiency may deter potential clients and diminish trust in its services.

5. Social Media Presence Analysis

5.1 Multi-Platform Coverage with Low Activity

Although Opixtech operates accounts on Facebook, Instagram, YouTube, Twitter, and Medium, its content updates are infrequent. For example, its YouTube channel has not been updated for months. This lack of consistent engagement suggests limited internal resources or a lack of emphasis on branding.

5.2 Impact on Customer Interaction

In the financial services sector, social media serves as both a marketing tool and a channel for customer communication. Opixtech’s low activity diminishes its ability to build and maintain relationships with its audience.

6. Key Risks and Investor Considerations

6.1 Registration and Regulatory Ambiguity

The inability to verify Opixtech’s registration and regulatory claims poses potential financial and legal risks to investors.

6.2 Limited Customer Support

The absence of robust, multi-channel support could leave clients vulnerable during critical situations.

6.3 Lack of Product Transparency

There is minimal independent feedback on OpixAlgo and Opixtrade’s performance, leaving potential users uncertain about their reliability.

6.4 Competitive Market Pressure

Compared to rivals like UEZ Markets and DMT Tech, Opixtech’s deficiencies in transparency, customer service, and market reputation may hinder its growth.

Conclusion

Opixtech attempts to position itself as a global fintech player through technological innovation and multilingual support. However, its questionable registration details, unclear regulatory status, and limited customer support undermine its credibility. In a highly competitive and regulated industry, these shortcomings raise serious concerns about its long-term viability.

Investors are strongly encouraged to conduct thorough due diligence before engaging with Opixtech to minimize potential financial risks.

FAQ

1. Is Opixtech legally registered?

Currently, there is no record of Opixtech in the Seychelles corporate registry, making its legal status uncertain.

2. Is Opixtech regulated by any authority?

Opixtech claims to be regulated by the Seychelles FSA, but no corresponding records exist in the FSA’s public database.

3. How reliable is Opixtech’s customer support?

The company provides limited support through an online form and lacks phone or live chat options, which can delay problem resolution.

4. What are Opixtech’s main products?

Its key offerings are OpixAlgo (an algorithmic trading tool) and Opixtrade (a CFD trading platform).

5. What risks should investors be aware of?

Investors should consider the lack of verifiable registration, regulatory ambiguity, limited customer support, and potential financial risks.

6. How does Opixtech compare to its competitors?

Opixtech faces significant challenges in transparency, customer interaction, and market reputation when compared to competitors like UEZ Markets and DMT Tech.