ManCu is an online trading platform offering a variety of financial products, including forex, CFD stocks, indices, and commodities. However, the platform’s corporate registration information is vague, and its regulatory status is unclear, casting doubts on its credibility and security. While ManCu claims to be regulated by several authoritative financial bodies, these assertions are contradicted by the facts. This article will thoroughly analyze ManCu’s services, trading conditions, platform transparency, and risks, helping you make an informed investment decision.

1. ManCu Platform: The Real Face of Financial Trading

ManCu is an online financial trading platform that provides a variety of trading products, including forex, CFD stocks, commodities, and indices. Users can choose from a range of trading options and account types. However, the legitimacy of the platform and its regulatory issues raise concerns for many potential users.

Why Is the Platform’s Registration and Regulation So Vague?

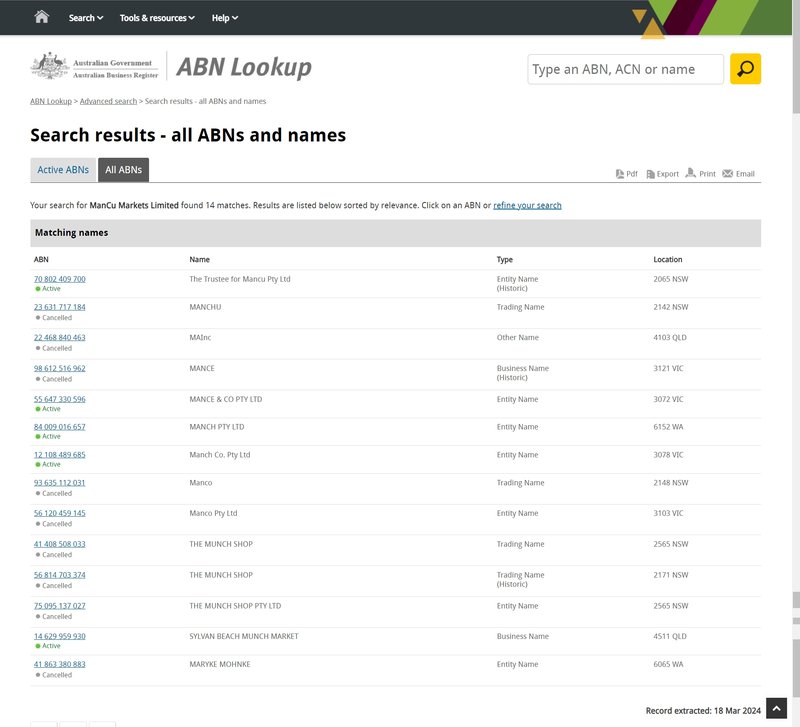

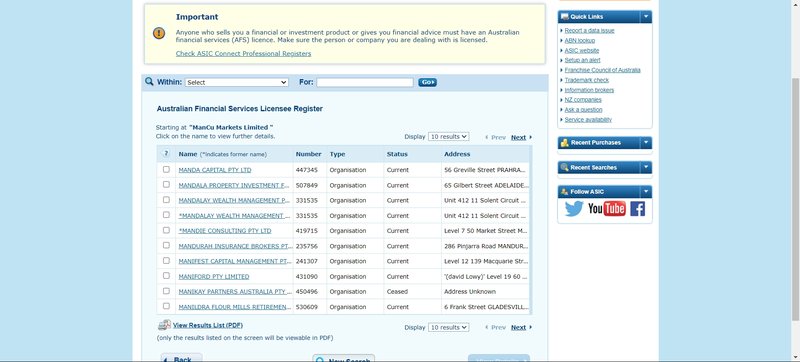

Although ManCu claims to be registered in Australia, a detailed search reveals that ManCu Markets Limited is not listed in any relevant Australian regulatory body. The platform also claims to be regulated by multiple international financial authorities, such as ASIC, FCA, and CySEC, but these claims have not been substantiated. ManCu’s domain name can be traced back to 2001, but this doesn’t prove the company has been operating in the market for that long, nor does it provide sufficient evidence of the platform’s legitimacy.

2. Corporate Registration and Regulation: Should You Trust It?

Is ManCu Actually Regulated by These Authorities?

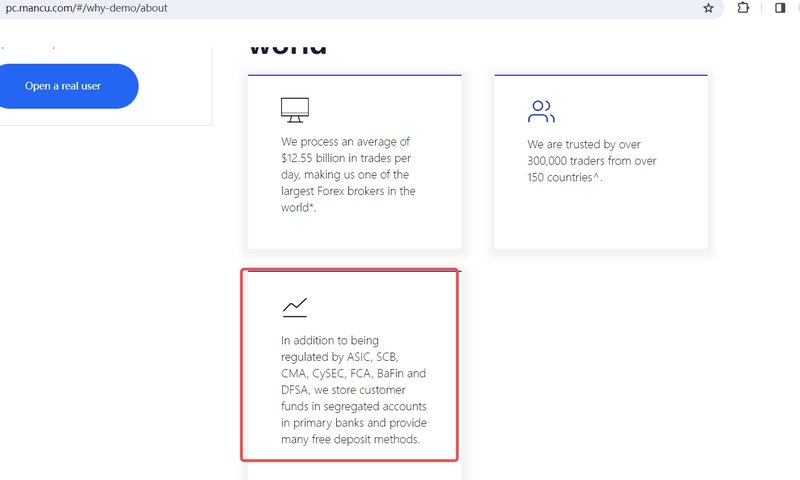

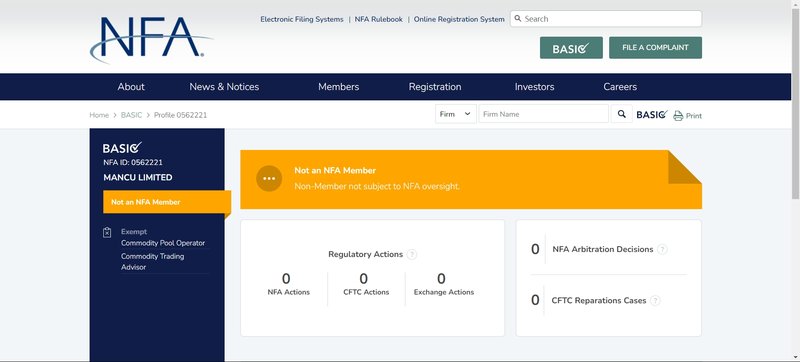

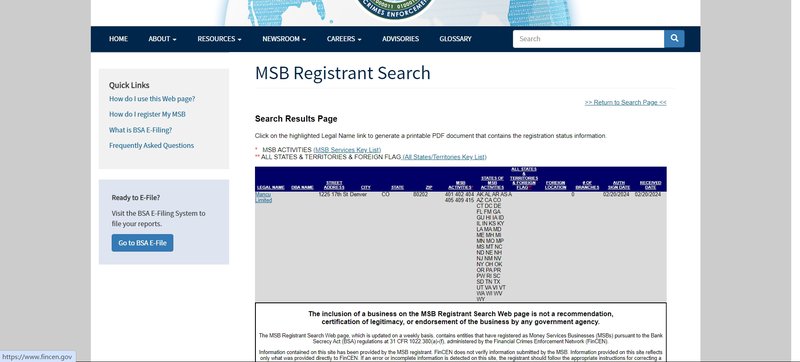

ManCu claims to be regulated by several prominent financial authorities, including the U.S. Financial Crimes Enforcement Network (FinCEN), the Australian Securities and Investments Commission (ASIC), the Cyprus Securities and Exchange Commission (CySEC), and the UK’s Financial Conduct Authority (FCA). However, further investigation reveals that ManCu is not registered with or licensed by any of these agencies.

Does the Lack of Regulation Mean the Platform Is Unsecure?

Without proper regulation, ManCu cannot offer the necessary customer protections. Financial regulatory bodies ensure that trading platforms adhere to basic principles such as fund security, transparency, and legality. Without these guarantees, traders’ funds are exposed to greater risk. If you choose to trade on this platform, you face higher uncertainty and potential losses.

3. Trading Products: Appealing on the Surface, But What’s Hidden Behind?

ManCu offers a wide range of financial products, including forex, CFDs, stocks, precious metals, and indices. While these products seem to provide traders with abundant options, it’s worth investigating whether these offerings genuinely meet the needs of investors.

Are Forex and Stock Trading Really Competitive?

ManCu offers a variety of forex trading options, covering major currency pairs and cross-currency pairs, with different leverage ratios available. However, the high leverage of up to 30:1 is not suitable for every trader. High leverage can lead to large returns but also comes with significant risks. Many traders may find themselves in financial trouble, especially in volatile market conditions.

Additionally, ManCu’s CFD stock trading allows users to trade stocks from major companies like Apple, Boeing, and Tesla. However, CFD trading means that traders do not own the actual stocks but instead profit from the price differences. This creates a less transparent market and increases the exposure of investors’ funds to potential risks.

4. Account Types: Razor vs. Standard – The Pros and Cons

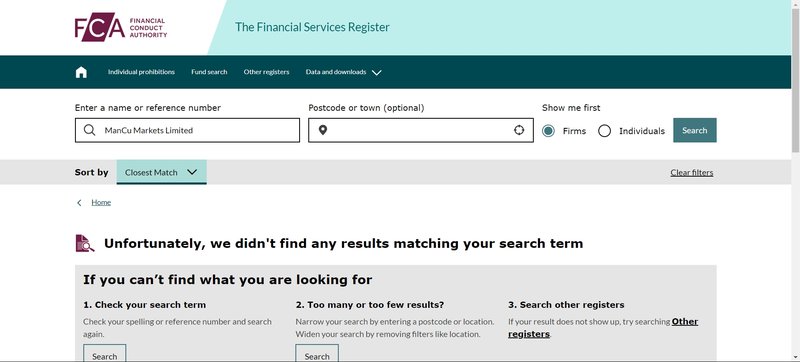

ManCu offers two main account types: the Razor account and the Standard account. While these account types offer different trading conditions, can they really meet the diverse needs of investors?

Razor Account: A Potential Trap Under High Leverage

The Razor account provides ultra-low spreads (EUR/USD average spread of 0.0 – 0.3), but with a commission charged per trade (approximately 7 AUD per 100,000 units traded). While the low spreads attract many experienced high-frequency traders, the high leverage and commission structure mean that inexperienced traders may struggle to manage the associated risks. For beginners, the Razor account’s high-risk features may not be suitable.

Standard Account: Appealing to Beginners, But Still Contains Potential Issues

The Standard account, which is commission-free, is designed for beginners. However, the EUR/USD average spread of 1.1 pips is not particularly low. While not very high, this spread can still affect the profitability of short-term traders. Despite its simpler structure, the Standard account still cannot escape the platform’s lack of transparency.

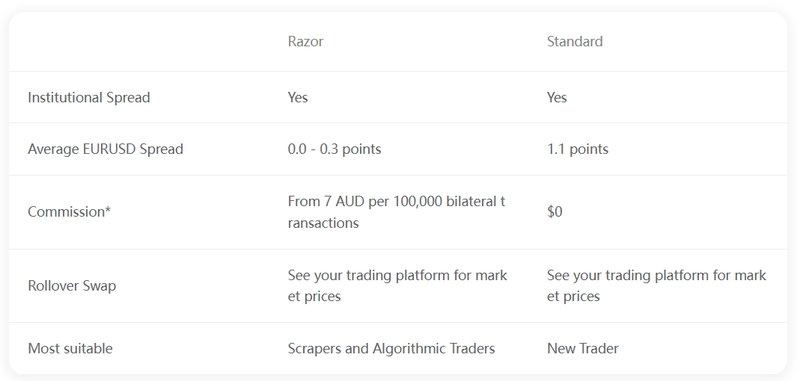

5. Platform Technology and Trading Experience

Is the Trading Experience Stable?

ManCu offers three platforms for trading: MetaTrader 4 (MT4), MetaTrader 5 (MT5), and its own proprietary ManCu trading platform. While these platforms offer some basic trading features, user feedback suggests that the platforms may suffer from technical issues. Some users have reported delays during peak trading periods, and the proprietary platform’s charting capabilities are considered relatively basic compared to other leading platforms in the industry.

How Does Platform Stability Affect Trading?

The stability of a platform directly impacts the execution speed of trades and the accuracy of orders. In financial markets, even a few seconds of delay can result in significant losses. If ManCu’s platform cannot ensure stability, traders may experience issues like slippage or delayed order execution, which can negatively affect the overall trading experience.

6. Deposit and Withdrawal Methods: Are the Hidden Costs Too High?

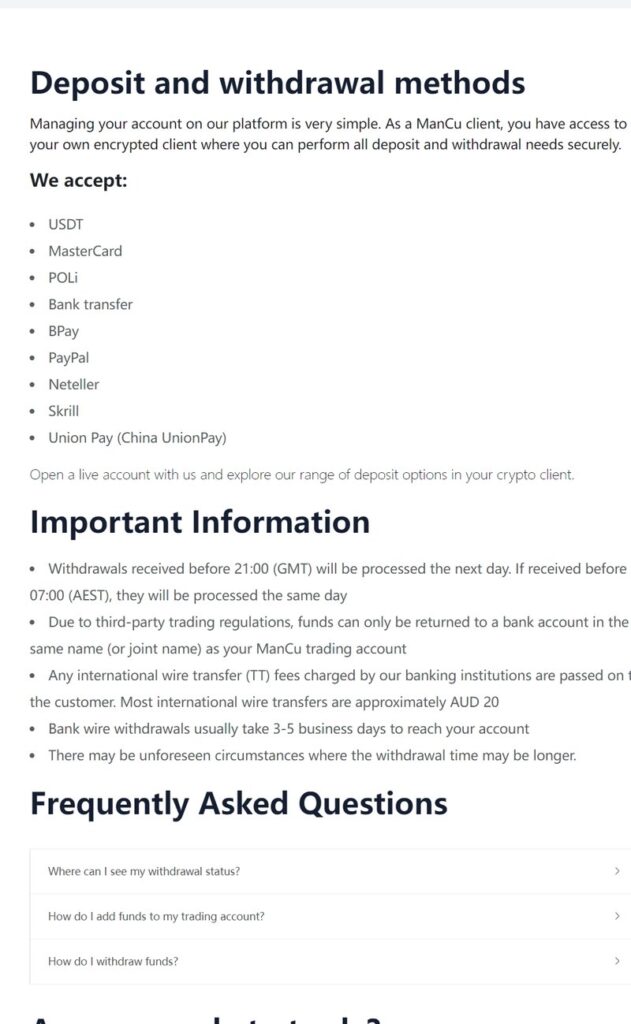

ManCu offers several deposit and withdrawal methods, including bank transfers, PayPal, Neteller, and Skrill. However, withdrawal processing times can vary depending on the chosen method. International wire transfers, in particular, come with high fees and slow processing times.

Is the Deposit and Withdrawal Process Transparent?

While ManCu offers various deposit and withdrawal options, the transparency around fees and processing times remains an issue. The platform does not clearly state its fee structure, and withdrawal times can be unpredictable. This may cause inconvenience for traders who need quick access to their funds.

7. Customer Support: Can They Solve Problems in Time?

ManCu offers 24/7 customer support via phone and email. However, user feedback indicates that while support is responsive, it is often not professional enough when it comes to handling platform security or trading issues. Some problems take a long time to resolve, which can be frustrating for traders who need immediate assistance.

8. Conclusion and Risk Assessment

While ManCu offers a variety of financial products and flexible account types, its unclear corporate registration, dubious regulatory status, and platform-related issues create a risky environment for traders. Without effective regulation, investor funds and trading security are exposed to significant risks. If you are considering ManCu as your trading platform, be sure to assess the potential risks carefully and consider more reliable platforms.

Frequently Asked Questions (FAQ)

Q1: Why is ManCu’s registration information so vague?

A1: ManCu claims to be registered in Australia, but there is no valid registration found in the relevant Australian regulatory bodies. Furthermore, the platform has not been registered with the mentioned authorities.

Q2: Why are ManCu’s regulatory claims questioned?

A2: ManCu claims to be regulated by several prominent authorities, but investigations reveal these claims are untrue. The platform is not licensed by any of these regulatory bodies.

Q3: Is the ManCu trading platform stable?

A3: While ManCu offers multiple platforms, user feedback suggests that the platform experiences delays during peak trading periods and that the proprietary platform lacks advanced charting features.

Q4: Is the Razor account suitable for beginners?

A4: The Razor account is designed for experienced traders due to its high leverage and commission structure. Beginners may struggle to manage the associated risks.

Q5: Are deposits and withdrawals transparent?

A5: ManCu offers multiple deposit and withdrawal options, but the fee structure and processing times are not clearly communicated, leading to potential frustration for users.

Q6: How reliable is ManCu’s customer support?

A6: While ManCu offers 24/7 customer support, user reviews indicate that the support team is often slow to resolve issues and not always professional in handling critical matters.