BIupreFX is an emerging CFD broker established in November 2024. Although the company claims to be regulated in several countries, investigations reveal that its regulatory information may not be authentic. The broker offers a wide range of financial instruments, but the lack of proper regulation and transparency poses significant risks to investors. This article provides an in-depth analysis of the broker’s features, account types, regulatory status, and user experience to help investors make informed decisions.

1. Overview of BIupreFX: Emerging Platform with Hidden Risks

BIupreFX is a relatively new CFD broker offering forex, energy, commodities, and stock indices. Although it aims to provide a user-friendly trading platform, the broker has several issues that raise concerns. Can investors trust this platform with their funds? Here are some key risks.

1.1 Platform Background: Emerging but Controversial

While BIupreFX claims to be a diversified CFD broker, its background remains unclear. The company was founded recently, and its regulatory claims have proven to be questionable. For example, it asserts that it is regulated by multiple authorities, but it fails to provide credible documentation. This lack of transparency raises doubts about the broker’s reliability.

1.2 Variety of Trading Instruments, But No Safety Nets

BIupreFX claims to offer over 250 trading instruments, including forex, energy, commodities, and stock indices. Although this wide range of instruments can attract investors, the lack of proper regulation raises questions about the security and transparency of these trading tools. High leverage (up to 500:1) increases the risk of substantial losses, especially for novice traders.

2. Trading Platform: False Advertising or Innovative Attempt?

2.1 The “Fake” MetaTrader 4 Link

According to its official website, BIupreFX supports MetaTrader 4 (MT4), describing it as one of the most popular retail trading platforms in the world. However, when users attempt to download the platform, the link directs them to a platform called NativeFX6, not MetaTrader 4. Was this an oversight, or is it intentional? This inconsistency significantly impacts the platform’s credibility.

2.2 Platform Features and Functions: Powerful or Questionable?

BIupreFX claims to offer ultra-fast trade execution, a wide array of market analysis tools, support for automated trading systems (EAs), and 24 charting tools. But do these features live up to the promises? Given the platform’s youth, can investors truly rely on these functions for effective trading? Moreover, what is the platform’s stability? Can it handle market volatility?

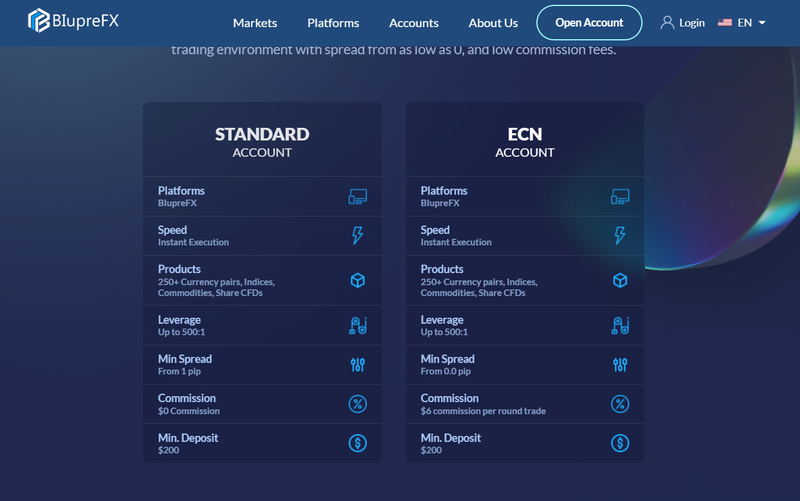

3. Account Types: Standard and ECN Accounts

3.1 Standard Account: Hidden Risks Behind High Leverage

BIupreFX offers two account types: the Standard Account and the ECN Account. The Standard Account requires a minimum deposit of $200, offers minimum spreads starting from 1 pip, and charges no commissions. At first glance, this seems to be an attractive option for most retail investors. However, with high leverage, even small market fluctuations could lead to significant losses, especially for beginners.

3.2 ECN Account: Higher Commissions, But Lower Spreads

The ECN Account also requires a $200 minimum deposit and provides a minimum spread of 0.0 pips. However, it charges a $6 commission per round-turn trade. For active traders, the lower spread may be appealing, but the commission could make it less cost-effective, especially if leverage is not managed carefully. In some cases, the ECN account may actually lead to higher losses than the Standard Account.

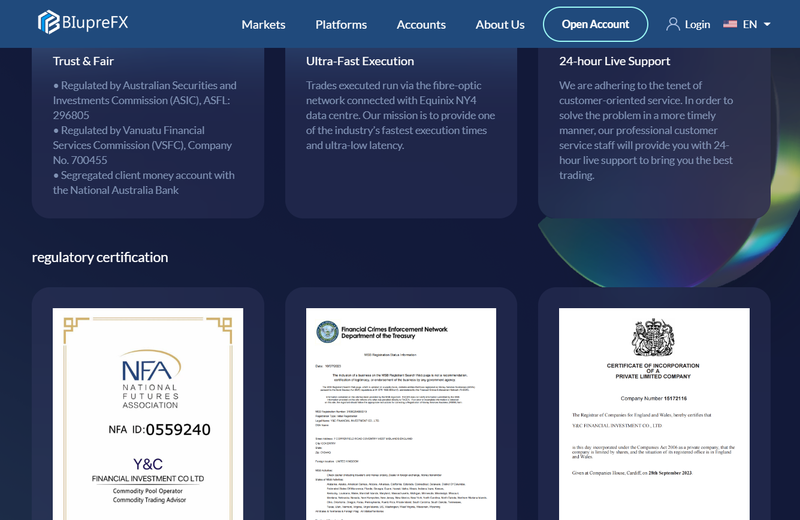

4. Regulatory Status: Doubts Over Regulatory Claims

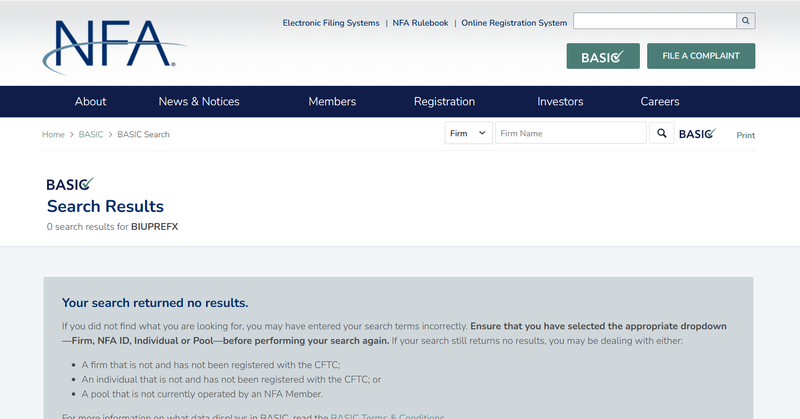

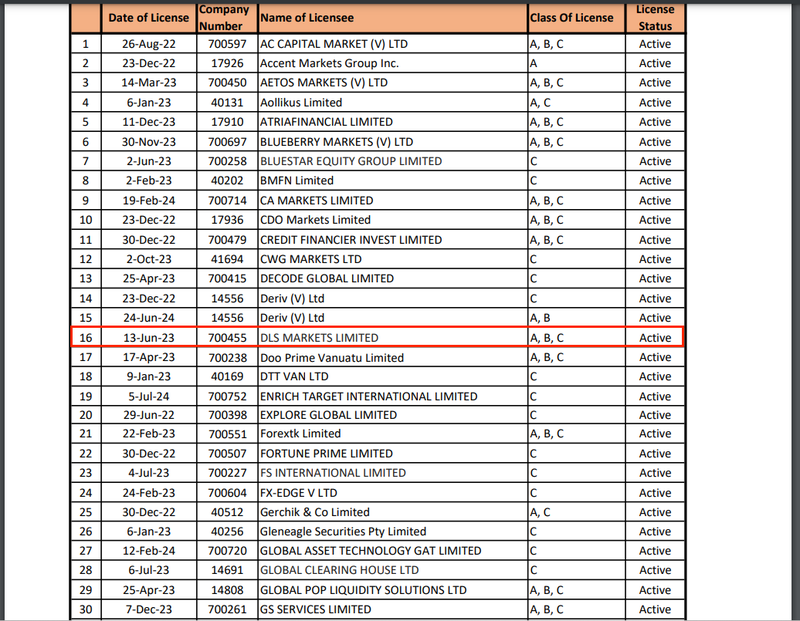

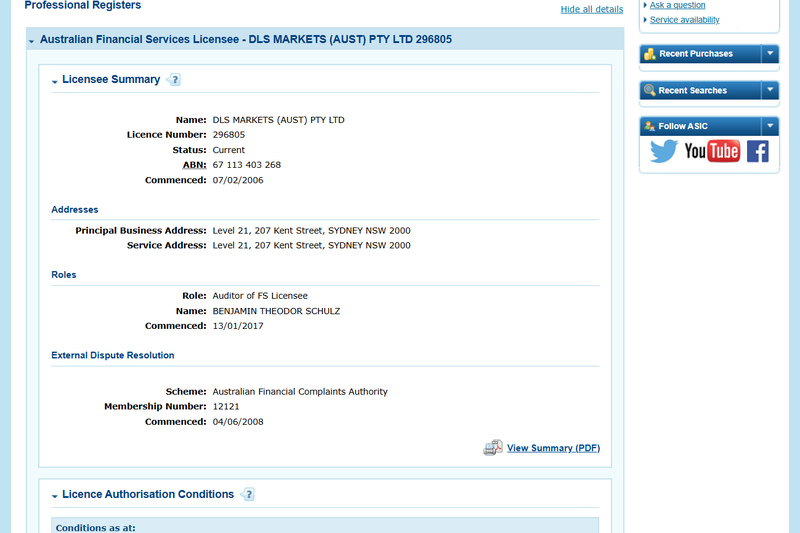

Although BIupreFX claims to be regulated by multiple authorities, investigations reveal that these certifications are false. The platform showcases certificates from the Australian Securities and Investments Commission (ASIC), the Vanuatu Financial Services Commission (VSFC), and the US National Futures Association (NFA). However, upon investigation, it is clear that these certificates are not legitimate.

4.1 Fake Regulatory Certificates: A Major Safety Concern

In particular, the NFA website shows no record of BIupreFX, and the NFA and Fincen MSB licenses displayed by the broker actually belong to another company, “Y&C FINANCIAL INVESTMENT CO LTD,” which is known to be involved in scams. The ASIC and VFSC certificates are also fake, as they use the details of another company, DLS MARKETS (AUST) PTY LTD, without authorization. This means BIupreFX is not properly regulated, leaving investors exposed to significant risk.

5. Customer Support and Educational Resources: Lack of Support

BIupreFX offers no visible customer support channels and does not have any social media presence. The website lacks a contact section, making it difficult for users to reach out for assistance. For beginners, this lack of support and educational resources makes the platform even riskier. In the event of issues or disputes, investors may struggle to resolve them quickly.

5.1 Funds Deposits and Withdrawals: How Safe Is Your Money?

The broker supports deposits and withdrawals via credit card, e-wallets, and bank transfers. However, due to the lack of transparent fund management and customer support, investors might face challenges when depositing or withdrawing funds. Can users trust that their money will be managed properly? This remains a significant concern.

6. Online Reputation and User Reviews: Low Visibility

Currently, there are almost no user reviews or feedback about BIupreFX online, and the platform has a very low traffic volume. According to Semrush, the site has fewer than 50 visits per month. This makes BIupreFX virtually unknown in the forex brokerage industry. Does its lack of exposure and user feedback suggest a lack of trustworthiness?

7. Conclusion: Caution is Key, Risks Are Significant

Overall, BIupreFX is a relatively new CFD broker that offers a wide range of financial instruments and account types. However, its lack of credible regulatory status, questionable platform transparency, and poor customer support make it a risky choice for investors. In selecting a CFD broker, it is crucial to opt for platforms with a proven track record, strong regulation, and positive user feedback to ensure the safety of your funds and a positive trading experience.

Frequently Asked Questions (FAQ)

1. Is BIupreFX legitimately regulated?

Although BIupreFX claims to be regulated by multiple authorities, investigations reveal that these certifications are fake. The broker is not properly regulated, posing a significant risk to investors.

2. Is the trading leverage at BIupreFX safe?

BIupreFX offers leverage up to 500:1, which can be very risky for most investors. Especially for beginners, using high leverage can lead to substantial losses in volatile market conditions.

3. Is the BIupreFX trading platform reliable?

While BIupreFX claims to offer MetaTrader 4, the actual download link leads to another platform, NativeFX6. This inconsistency raises concerns about the platform’s reliability and stability.

4. How safe are deposits and withdrawals on BIupreFX?

BIupreFX supports various deposit and withdrawal methods, but the lack of transparent fund management and customer support could cause issues for investors when withdrawing their funds.

5. Does BIupreFX offer good customer support?

The platform lacks effective customer support channels. Without clear contact information or social media presence, investors may face difficulties when trying to resolve issues or get help.

6. How can investors avoid risks associated with BIupreFX?

Investors should avoid platforms that lack genuine regulatory oversight and transparency. Choosing a broker with a solid reputation, authentic regulation, and positive user feedback is crucial for ensuring a safe and secure trading environment.