Hero FX might seem like an attractive platform at first glance, offering a wide range of trading options, including forex, precious metals, cryptocurrencies, and more. But are these offerings too good to be true? Upon closer inspection, several red flags emerge, making it clear that this broker comes with significant risks.

1. Regulatory Absence: Why Does It Matter?

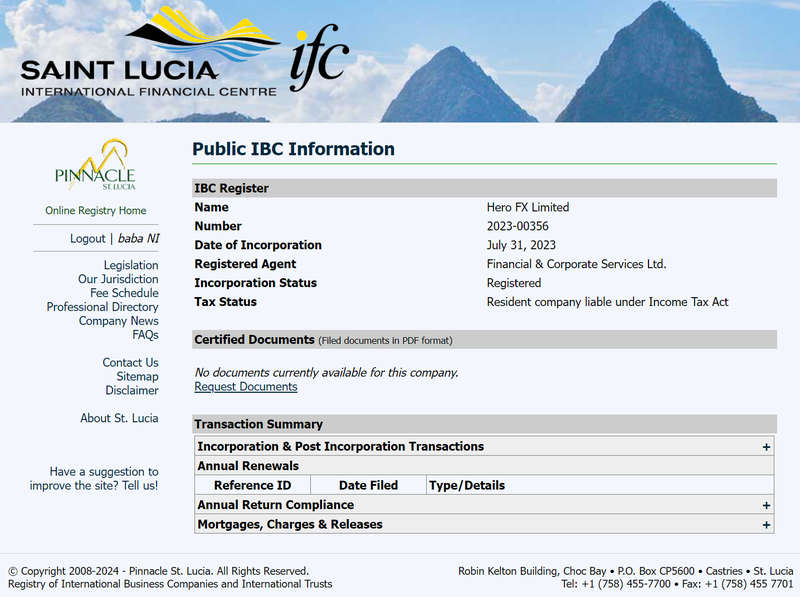

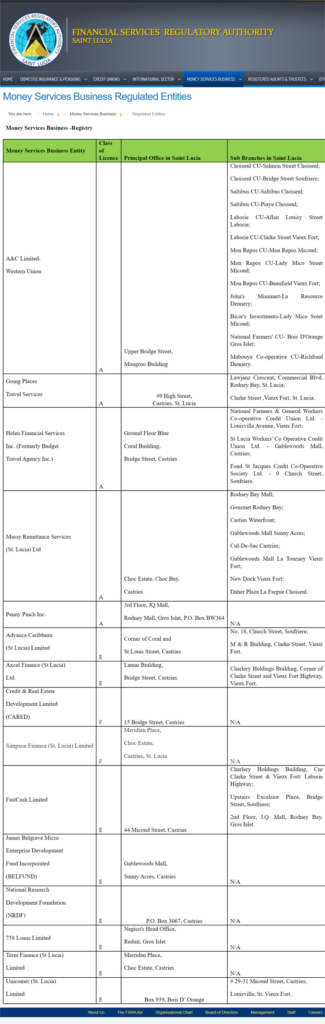

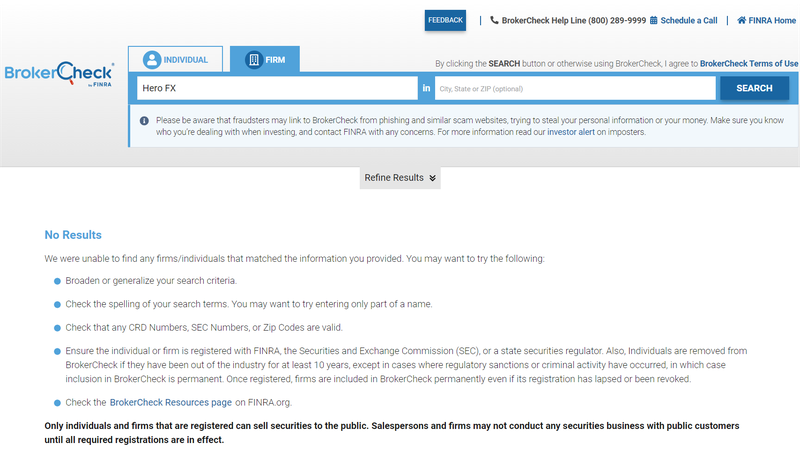

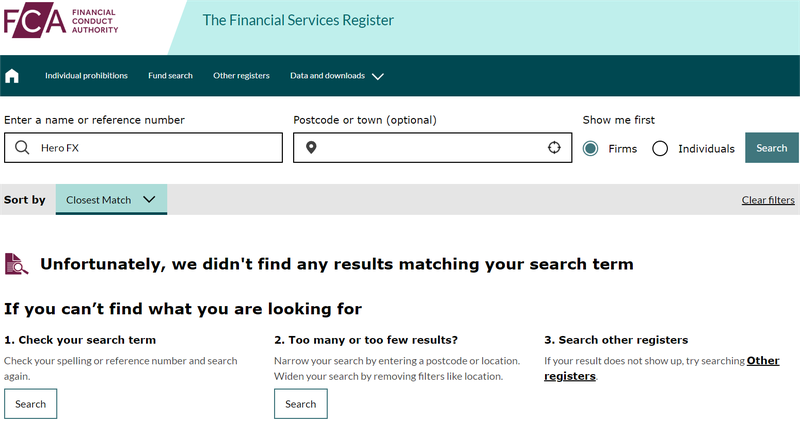

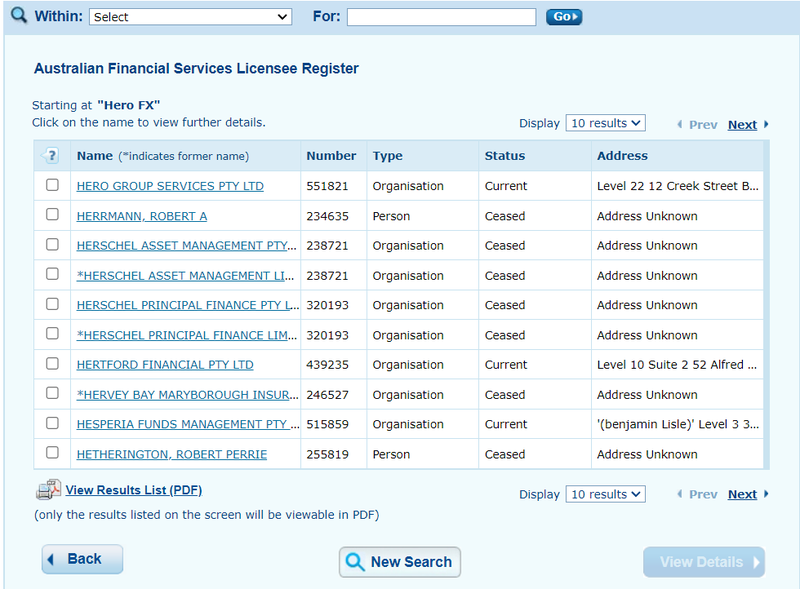

Hero FX claims to be registered in Saint Lucia, but the absence of credible regulatory oversight raises serious concerns. The broker’s registration with the International Business Companies and International Trusts Registry (IFC) is not accompanied by any verification from recognized authorities like the UK’s FCA, Australia’s ASIC, or the US’s FINRA.

Why is this important? Regulatory bodies exist to protect traders by ensuring transparency and security in financial markets. Without this oversight, Hero FX is free to operate without any checks, leaving traders vulnerable to potential fraud or malpractice. If something goes wrong—be it a dispute, fraud, or even bankruptcy—there’s little recourse for investors.

2. The Risk of Fund Loss: Can You Trust Your Investment?

The lack of regulation often means that the security of your funds isn’t guaranteed. Regulated brokers are required to keep client funds in segregated accounts, ensuring that they aren’t mixed with company funds. However, Hero FX has not made such assurances. This raises the risk that, should the platform face financial difficulties, investors’ funds could be at risk.

Moreover, Hero FX doesn’t explicitly mention whether it offers negative balance protection, a safeguard that ensures traders can’t lose more than their initial investment, even in volatile markets. Without such a safety net, there’s a real risk of owing more money than you’ve deposited.

3. Hidden Fees and Misleading Marketing: What’s the True Cost of Trading?

Hero FX advertises accounts with low spreads and zero commission, but how transparent are these offers really? For example, the Zero Commission Account claims to have spreads starting at 1.5 pips, but many regulated brokers offer lower spreads with or without commissions. On top of this, Hero FX doesn’t provide detailed information about withdrawal fees, account maintenance charges, or other potential costs that may apply.

Are you getting what you’re promised? The platform also offers a Raw Spread Account, which claims to have spreads as low as 0.0 pips. However, this account comes with fixed commissions. What might appear to be a great deal could quickly become more expensive, especially if these hidden costs aren’t fully disclosed upfront.

4. The Risk of Fraudulent Practices: Could This Be a Scam?

In an unregulated environment, fraudulent practices are more likely. Platforms like Hero FX might use tactics such as manipulating spreads, delaying withdrawals, or offering fake “social trading” features where traders copy the strategies of others. While these services are common in many brokers, the lack of regulatory oversight means there’s no guarantee that the people you’re copying are legitimate or that the platform itself is acting in good faith.

With no clear regulatory body watching over them, Hero FX could potentially close shop suddenly, taking your funds with it. Can you afford that kind of risk?

5. Account Registration: How Easy Is It to Sign Up?

Signing up with Hero FX seems simple enough. You just fill out basic personal details and wait for an email confirmation. However, this ease of registration might be a tactic to attract as many customers as possible, without truly verifying their identity. The platform claims to require identity verification before you can deposit or trade, but given its lack of regulation, this process may not be as thorough as it should be.

Is this the kind of platform you want to trust with your money?

6. Trading Conditions: Are They Really as Good as They Seem?

Hero FX offers several account types, each with varying spreads and commissions. However, is the promise of low spreads and zero commissions enough to outweigh the platform’s many risks? The lack of transparency about fees and the potential for hidden costs makes it difficult to assess whether these accounts are truly as competitive as they claim to be. Moreover, the lack of oversight means that these conditions could change at any time without notice.

Shouldn’t trading conditions be clearer, especially if your money is at stake?

Conclusion: Hero FX – A Platform to Avoid?

Given its lack of regulation, potential for hidden fees, and the risk of fraudulent activity, Hero FX should be considered high-risk. While it may offer attractive account types and competitive spreads, the absence of proper oversight and the platform’s questionable practices make it an unsafe choice for traders. If you’re serious about investing in forex or other financial markets, it’s always better to choose a broker regulated by reputable authorities like the FCA, ASIC, or FINRA.

FAQ

1. Is Hero FX regulated?

No, Hero FX is not regulated by any reputable financial authority, leaving your investments unprotected.

2. What are the risks of trading with Hero FX?

The main risks include a lack of regulatory protection, hidden fees, and the potential for fraudulent practices.

3. Can I trust Hero FX for trading?

Given its unregulated status and lack of transparency, Hero FX is not a trustworthy platform. It is advisable to avoid trading with them.

4. What account types does Hero FX offer?

Hero FX offers Zero Commission, Raw Spread, and Islamic Accounts, but the costs and fees associated with these accounts are unclear.

5. Is my money safe with Hero FX?

No, your money is at risk because the platform is unregulated, and there’s no guarantee your funds will be protected.