NKVO is an online platform that claims to offer cryptocurrency trading services, with a domain registration history dating back to 2007. However, it has serious issues in terms of transparency, legality, and the security of funds. This article will reveal shocking facts, thoroughly analyzing NKVO’s background, its lack of regulation, security vulnerabilities, and trading environment. The aim is to help investors recognize potential risks and avoid the tragedy of losing all their funds.

1. Platform Background and Transparency Issues

1.1 Basic Information About NKVO: Appears Reliable, But is It Actually Transparent?

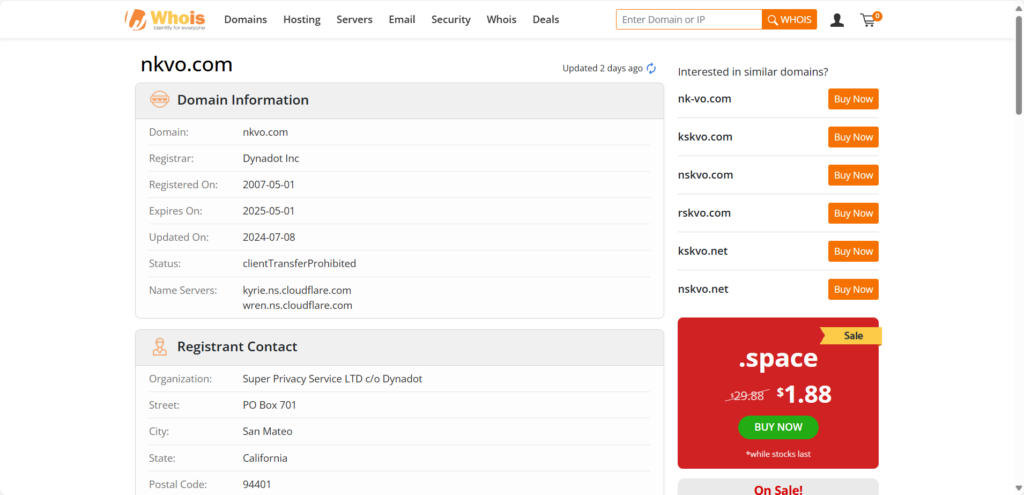

The official website of NKVO is https://www.nkvo.com/, and its domain was registered as far back as May 1, 2007. Does a domain registration dating back to 2007 indicate platform stability and reliability? In reality, many fraudulent platforms use older domain names to create a false impression of being established and trustworthy, with the aim of deceiving investors. The big question is: why doesn’t the platform provide more concrete information about its operations? Shouldn’t this be the most basic responsibility of a compliant platform?

1.2 Missing Corporate Registration Information: Why Does NKVO Hide Basic Company Details?

NKVO’s official website provides no information about company registration, legal representatives, or the operational team. Why would a trading platform fail to disclose its true identity? The address listed at the bottom of the site (555 17th St. Denver, CO 80202) – can it be verified? Is this even a real location? Why does NKVO choose to hide such crucial details?

1.3 The Simplicity of the Website: Can a Professional Platform Really Earn Trust With Such a “Minimalistic” Design?

NKVO’s website is extremely simplistic. Beyond the FAQ section, there is almost no detailed information about trading conditions, account types, fees, etc. Can such a “simple” website really prove the platform’s professionalism and trustworthiness? A legitimate trading platform should make all essential information publicly available and transparent.

2. NKVO’s Lack of Regulatory Support: No Regulation Equals High Risk?

2.1 Lack of Regulatory Credentials: Without Regulation, How Can the Platform Ensure the Security of Your Funds?

NKVO’s website does not mention any financial regulatory certifications. Without regulation by reputable bodies such as the FCA, ASIC, or CySEC, how can investors feel secure? The absence of regulatory credentials raises concerns about whether the platform operates under any legal supervision. How can investors entrust their funds to a platform that is not under regulation?

2.2 Unregulated Platform: Could the Platform Misuse Investors’ Funds?

On an unregulated platform, how can the safety of funds be guaranteed? Without mechanisms like segregated accounts or customer protection measures, financial transactions could be completely opaque. Without third-party oversight, the platform might easily manipulate fund flows, and investors could risk losing their money. Isn’t this exactly the uncomfortable truth that platforms like NKVO hope to hide?

2.3 The Importance of Regulation: Why Do Legitimate Platforms Emphasize Their Regulatory Compliance?

Regulated financial platforms gain the trust of investors because of their transparent and lawful operations. Regulation not only ensures that the platform operates legally but also protects investors’ interests. Without regulation, how can investors safeguard their rights?

3. Account Registration and Security Risks: A Start Without Protection?

3.1 Simple Registration Process: Easy to Get Started, But Hard to Detect the Risks?

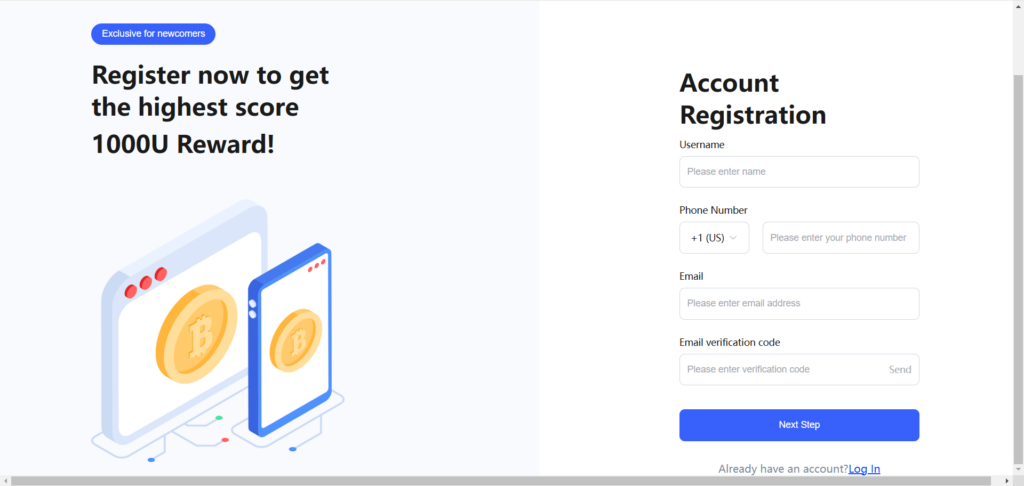

NKVO’s registration process is incredibly simple. Users only need to fill out basic information to get started. But why isn’t there a requirement for ID verification or stricter identity checks? Shouldn’t account security be the platform’s highest priority? Does the lack of identity verification mean accounts are more vulnerable to hacking or exploitation by malicious actors?

3.2 Lack of User Data Protection: How Can Personal Information Be Safe Without Protection?

The platform does not disclose any measures for protecting user data. Without encryption or privacy policies, is user information exposed to unauthorized access? Are there dark transactions lurking behind these privacy issues?

3.3 Absence of Security Warnings and Protection Measures: Why Doesn’t the Platform Warn Users About Risks?

Legitimate platforms provide clear security measures such as two-factor authentication and strong password policies. However, NKVO lacks any such protections. There are no warnings about how to avoid phishing attacks or how to secure accounts from being hacked. Can a “professional” platform really neglect such critical security concerns?

4. What Are the Real Costs of Trading on NKVO?

4.1 Unclear Account Types: What Services Can Investors Expect?

NKVO has not disclosed any information about account types. Does the platform offer VIP accounts, regular accounts, or different levels of user benefits? Why aren’t investors informed about the distinctions between account types? Does this lack of transparency hint at hidden “charging traps”?

4.2 Hidden Trading Fees: Are Investors Fully Aware of Every Cost?

NKVO does not disclose details about trading fees or spreads. Could investors discover hidden costs during trading that lead to losses? A platform that does not make its fees clear should raise serious concerns.

4.3 Ambiguous Trading Rules: How Do the Platform’s Rules Protect Investors?

NKVO has not published clear trading rules, leverage ratios, or margin requirements. Without understanding the rules, how can investors be aware of potential risks? A platform without clear regulations cannot offer a fair and transparent trading environment for its users.

5. Lack of Trading Software and Technical Support: Can the Platform Be Trusted Technologically?

5.1 No Mention of Trading Software: Can the Platform’s Technology Be Trusted?

NKVO does not specify the trading software it uses. How can investors know whether its trading platform is stable and secure? Without technical details, can users trust the platform’s system to be safe and smooth? What if technical problems arise and users can’t get support?

5.2 Insufficient Technical Support: When Issues Occur, Who Can Investors Rely On?

NKVO does not provide sufficient technical support channels. If users encounter issues, can they get timely assistance? Does the platform expect users to deal with issues on their own? The lack of clear technical support raises concerns about the platform’s ability to solve user problems.

6. Fund Withdrawal and Security Risks: Can You Safely Access Your Funds?

6.1 Lack of Transparency in Deposit and Withdrawal Methods: Will Your Funds Be Transferred Smoothly?

NKVO does not disclose specific methods for deposits and withdrawals. How can investors be sure their funds will be successfully processed? Without clear information on fund transfers, could the platform delay or deny withdrawals?

6.2 Absence of Fund Segregation: Is Your Money at Risk?

Reputable trading platforms often use fund segregation measures to ensure the safety of client funds. However, NKVO has not disclosed any such protections. Could investors’ funds be misused by the platform, leading to potential “disappearance” of funds?

7. Lack of Customer Support and Services: How Can Investors Get Help?

7.1 Insufficient Customer Support: Can Investors Get Timely Help?

NKVO does not clearly provide customer support channels. How can investors get help when problems arise? Does the platform expect users to rely on automated services, or is it simply neglecting investor needs?

7.2 Lack of a Complaints Mechanism: Where Can Investors Seek Help if Funds Go Missing?

Without an effective complaints system, how can investors protect their interests? If something goes wrong, can they file a grievance and expect fair treatment? Without a transparent complaint mechanism, investors’ rights might be unprotected.

8. Conclusion: Why Investors Should Avoid NKVO

From its transparency issues, lack of regulation, account security risks, vague trading rules, and insufficient customer support, NKVO clearly poses serious risks. Choosing a platform that is unregulated, opaque, and lacks security is essentially gambling. If you’re still hesitating about investing in NKVO, it’s worth reconsidering. A true investment platform should ensure the safety of users’ funds while providing clear and fair services.

Ask yourself: Can a platform with no transparency, no regulatory oversight, and no security really be trusted?

FAQ:

- What is NKVO?

NKVO is an online platform that claims to offer cryptocurrency trading services, but it has serious concerns regarding transparency, legality, and fund security. - Is NKVO regulated?

No, NKVO lacks proper regulatory oversight, which increases the risks for investors, as the platform is not bound by financial regulations. - Can I trust NKVO with my funds?

Given the platform’s lack of transparency and regulation, there are significant risks regarding the safety of your funds on NKVO. - What are the risks of using NKVO?

The main risks include the potential loss of funds, lack of legal protection, and weak security measures, which make the platform unsafe for investors. - How can I avoid the risks of using NKVO?

It’s advisable to avoid using NKVO and choose regulated and transparent platforms with strong security measures to protect your investments. - How do I identify a safe cryptocurrency platform?

Look for platforms that are fully regulated, have transparent business practices, clear fee structures, and robust security protocols.