In recent years, the forex trading market has grown rapidly, attracting a large number of investors seeking high returns. However, with the increase in forex brokers, unscrupulous platforms have also entered the market, deceiving investors to steal their funds. Bit Peak is one such platform that has drawn significant attention. Despite offering a variety of trading options and seemingly attractive conditions, the underlying issues with the platform, such as a lack of proper regulation, poor customer support, and hidden fees, pose significant risks to investors. This article will delve into the potential risks of Bit Peak and provide warnings to investors about the platform.

1. Bit Peak Platform Background and History

Bit Peak claims to have been established in 2006 and positions itself as an online contract for difference (CFD) trading service provider. The platform states that over the years, it has earned recognition within the industry and that its technology and tailored services have been highly praised by clients. According to the platform, its vision is to become the preferred choice for traders by offering transparent pricing, low-latency execution, and a stable trading environment.

However, upon investigation, there is no verifiable information confirming Bit Peak’s operational history. The company’s background is lacking in concrete evidence, and while it claims a long history of operations, no public records or official certifications support these claims. Furthermore, the platform’s stated achievements and business background lack independent verification, making it difficult to trust the platform’s assertions.

2. Bit Peak’s False Regulatory Information

Regulation is a critical factor for investors when choosing a trading platform. However, Bit Peak’s claims about its regulatory status are highly misleading and do not match the facts.

2.1 U.S. Financial Services Commission (FSC)

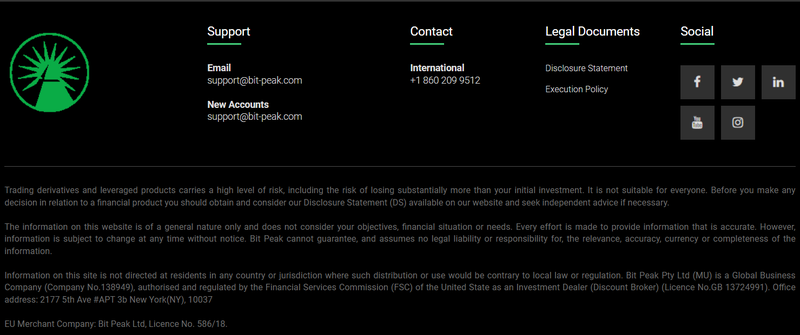

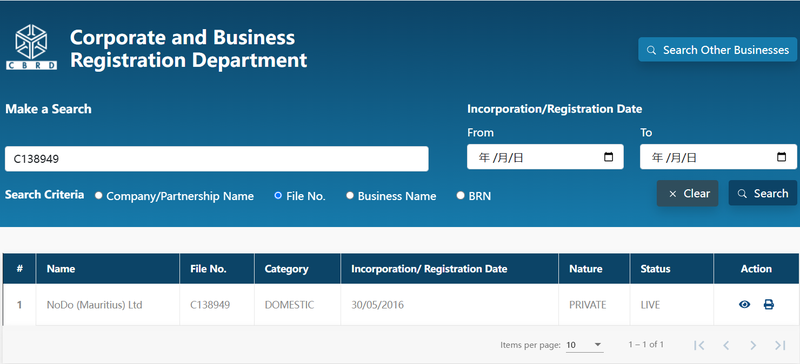

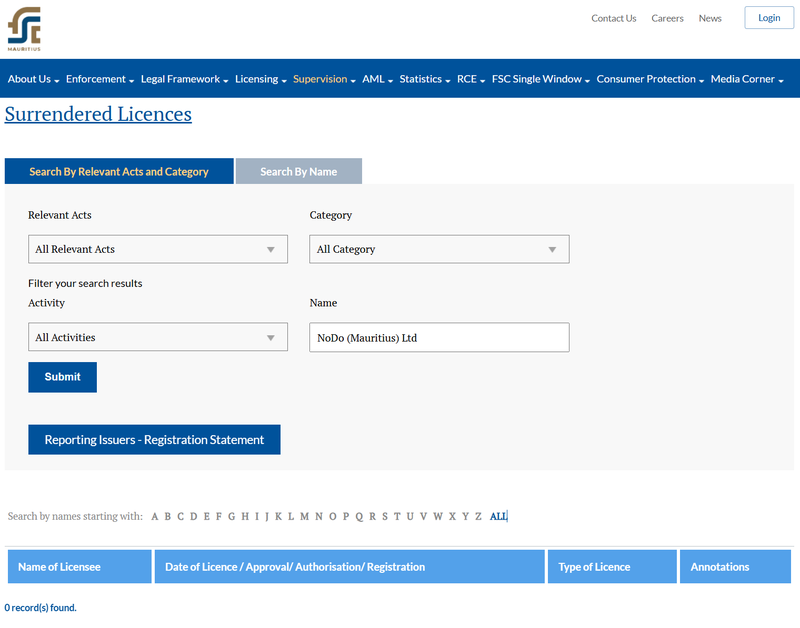

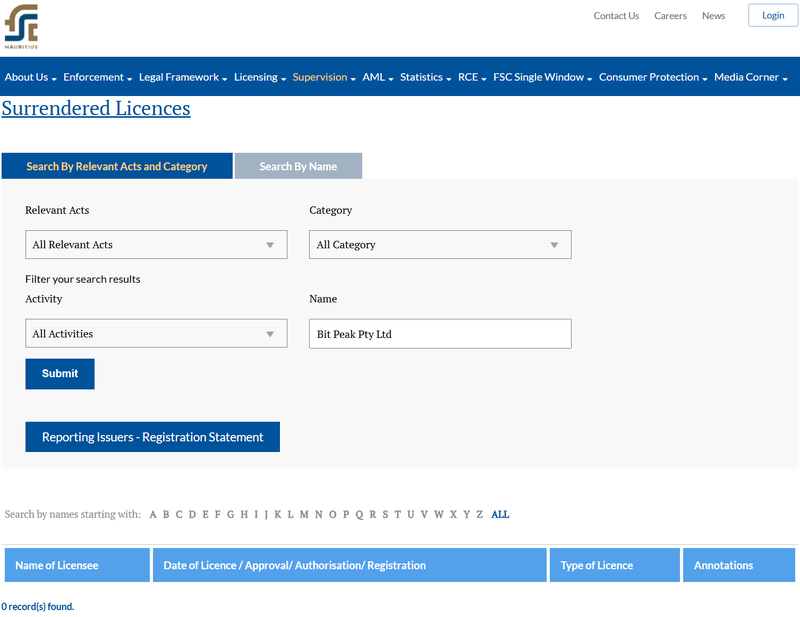

Bit Peak claims to be regulated by the “U.S. Financial Services Commission (FSC)”, but there is no such official regulatory body by this name in the United States. After further investigation, it appears that the platform may be referring to the Mauritius Financial Services Commission (FSC). However, upon checking Mauritius’s corporate and business registration records, we found that “GO MARKETS PTY LTD” with company number 138949 is not licensed by the FSC. Moreover, no financial license corresponding to the number GB13724991, or related to “GO MARKETS PTY LTD,” could be found on the FSC website.

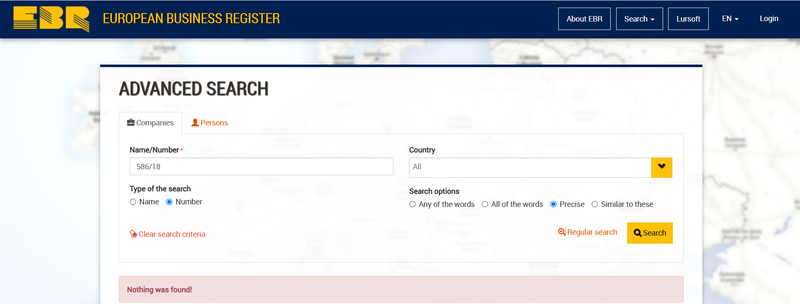

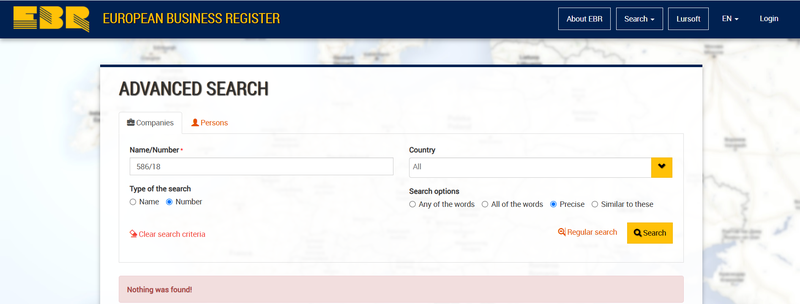

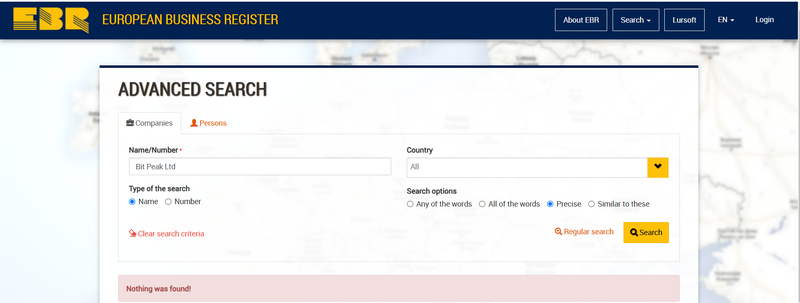

2.2 EU Business Registration

Bit Peak also claims to be registered as an EU business with registration number 586/18. However, a search on the European business registry reveals no records for this registration number, nor can any information be found for a company named “Bit Peak Ltd.” This indicates that Bit Peak’s claims about being an EU-registered business are entirely false.

2.3 Australian Securities and Investments Commission (ASIC)

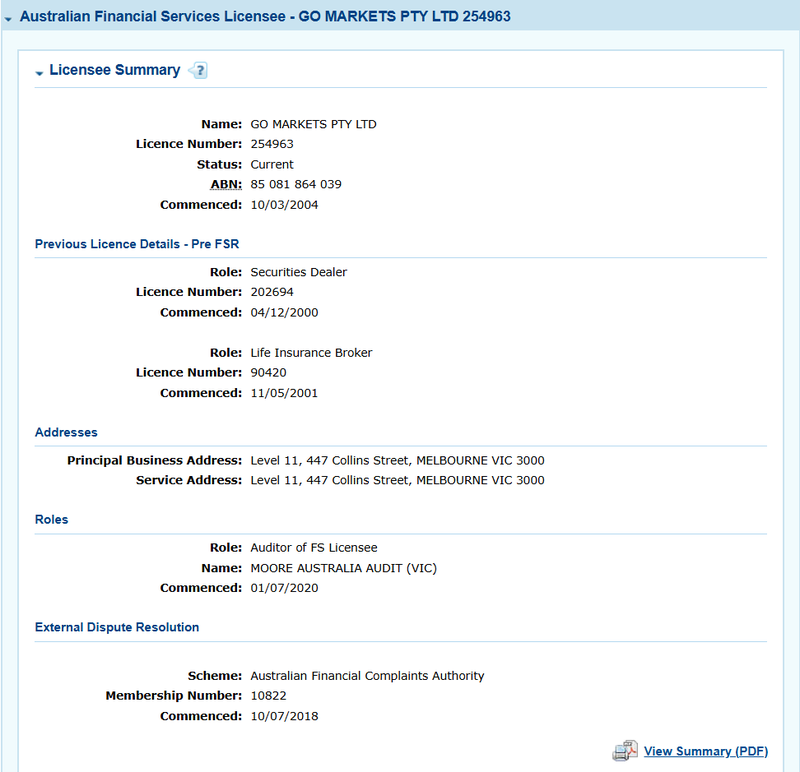

Bit Peak further asserts that it is regulated by the Australian Securities and Investments Commission (ASIC) and holds an AFSL license with license number 254963. However, according to ASIC’s official website, the license number 254963 actually belongs to “GO MARKETS PTY LTD,” not Bit Peak. This means that Bit Peak does not hold a legitimate ASIC license, and its claim to be regulated by ASIC is fraudulent.

3. Bit Peak’s Brand Exposure and Traffic Issues

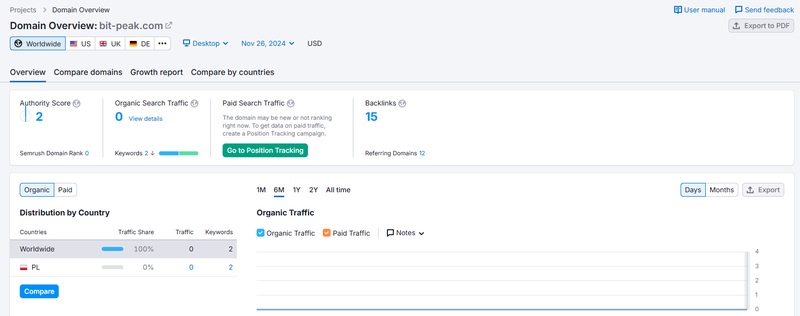

3.1 Website Traffic

According to Semrush, the official Bit Peak website receives an average monthly traffic of zero, indicating that it has no organic traffic or online visibility. The platform has not gained significant attention or recognition in the forex trading industry, and there is very little presence of the platform in global forex markets.

3.2 Lack of Brand Promotion

Additionally, Bit Peak has almost no brand promotion online, and there are no related news articles or industry reviews about the platform. This further highlights the platform’s lack of market presence and raises concerns about its legitimacy. Every legitimate trading platform needs to build brand recognition, but Bit Peak has failed to do so, which undermines its trustworthiness.

3.3 Lack of Company Management Information

The Bit Peak website provides no information about the company’s management team or key personnel. Transparency in leadership is crucial for investors who want to know the people behind the platform. The absence of such information on the site increases skepticism about the platform’s operations and raises concerns about its legitimacy.

4. Bit Peak’s Trading Conditions and Fee Issues

Although Bit Peak offers a wide range of trading products, including forex, CFDs on stocks, commodities, and metals, there are serious concerns regarding its trading conditions and fees.

4.1 Opaque Trading Conditions

While Bit Peak offers various trading options, it does not provide clear details about trading conditions, particularly in terms of spreads, commissions, and other fees. The platform does not disclose the details of different account types, making it difficult for investors to understand the costs associated with each trade. This lack of transparency in fee structures could mislead investors and lead to unexpected costs.

4.2 High Deposit Fees and Hidden Charges

Bit Peak claims not to charge deposit fees, but when using credit cards, a 5.5% fee is applied, with a minimum charge of $10. Such high deposit fees add extra costs to investors, especially for larger deposits. Moreover, the platform does not clearly disclose withdrawal fees or processing times, leaving investors uncertain about potential delays or hidden fees.

4.3 Spread and Commission Issues

Bit Peak offers multiple account types, but it fails to disclose the spread and commission structure for each account type. Customer feedback suggests that the spreads on standard accounts are high, while ECN accounts have lower spreads but come with additional commissions. This lack of clear information makes it hard for investors to make an informed decision about which account type to choose.

5. Bit Peak’s Customer Support Problems

5.1 Inadequate Customer Support

Bit Peak claims to provide 24/7 customer support, but in reality, the platform only offers email support and lacks phone support or live chat options. The response time from their support team is slow, and many users report that their complaints and issues remain unresolved. This lack of timely and effective customer service can cause frustration for investors who need assistance.

5.2 Limited Educational Resources

Bit Peak provides very few educational resources for investors. While there are some basic explanations about forex trading on the site, there are no advanced learning materials or training courses available. For new investors, the lack of comprehensive educational content makes it difficult to understand the intricacies of trading and increases the risk of making uninformed decisions.

6. Potential Risks of Using Bit Peak

6.1 Lack of Effective Regulation

One of the most significant risks of using Bit Peak is its lack of valid regulatory oversight. The platform claims to be regulated by multiple authorities, but these claims are proven to be false, leaving investors without proper regulatory protection. Without proper regulation, investors’ funds are at risk, and the platform could shut down at any time, leading to the loss of invested funds.

6.2 Unstable Platform Infrastructure

Bit Peak’s platform also shows signs of technical instability, with frequent website outages and issues accessing the platform. This technical instability can disrupt users’ trading experience and expose them to increased operational risks. Furthermore, the platform’s lack of technical support only exacerbates these problems.

6.3 Hidden Fees and Opaque Terms

Although Bit Peak offers a wide range of trading options, its fee structure is not transparent, and there may be hidden costs involved in trading. The lack of clear and upfront disclosure of spreads, commissions, and other fees can result in unpleasant surprises for investors when they face high transaction costs that erode their profits.

7. Conclusion and Investment Warnings

In conclusion, Bit Peak platform presents multiple risks, including misleading regulatory information, poor customer support, an opaque fee structure, and technical issues. While the platform may seem attractive at first glance, its actual conditions raise serious concerns about its legitimacy and reliability. Investors should exercise extreme caution when dealing with such platforms and always choose those with transparent fees, legitimate regulatory oversight, and strong customer support.

Frequently Asked Questions (FAQ)

1. Is Bit Peak a legitimate forex broker?

No, Bit Peak is not a legitimate forex broker. It lacks valid regulatory oversight, and the regulatory information it claims is false.

2. Are the deposit and withdrawal fees on Bit Peak high?

Bit Peak charges a high deposit fee of 5.5% for credit card transactions, with a minimum fee of $10. Withdrawal fees are not clearly disclosed, which may indicate hidden charges.

3. Does Bit Peak offer live customer support?

No, Bit Peak only offers email support and does not provide live chat or phone support. The response times are slow, and many users report unresolved issues.

4. Does Bit Peak provide educational resources for investors?

Bit Peak offers limited educational resources, mainly basic forex trading knowledge, and lacks advanced training materials.

5. Are Bit Peak’s trading conditions favorable?

Bit Peak’s trading conditions are unclear, and the platform has a high spread on standard accounts, with additional commissions on ECN accounts. The lack of transparency makes it difficult to assess whether the conditions are favorable.

6. How can I protect my funds from the risks associated with Bit Peak?

Investors should avoid platforms with false regulatory claims and opaque fee structures. Always choose brokers that are properly regulated and provide transparent pricing and clear terms.re reputable broker with solid regulatory oversight to protect your funds.