Fecc Global claims to offer diverse trading services, but concerns about its legitimacy persist. Is it trustworthy or a scam? This article examines its background, regulation, and user feedback to find out.

1. Overview of Fecc Global

Fecc Global presents itself as a global financial services platform offering diverse trading options. According to its website, the platform supports various trading tools and asset classes, including forex trading, precious metal investments, energy markets, and trending cryptocurrencies. While the platform’s claims may appear convincing, a closer inspection reveals several points of concern.

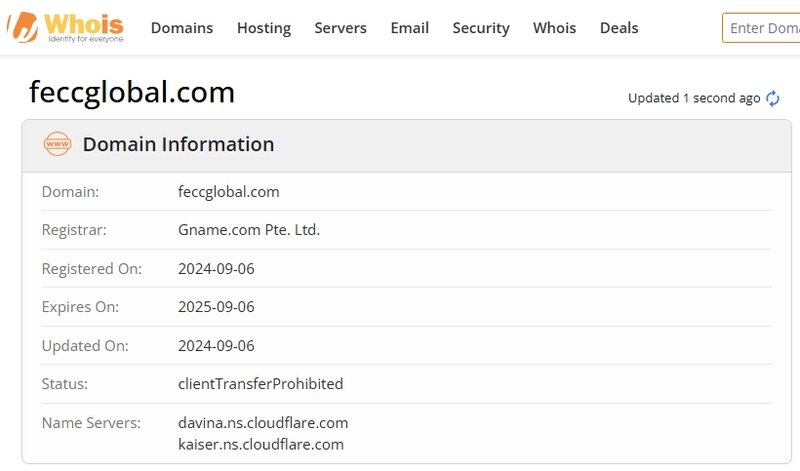

First, Fecc Global’s domain name was registered on September 6, 2024, indicating a short operational history. Compared to established platforms with years of industry experience, its brief history raises questions. Additionally, its official address, listed as Denver, Colorado, USA, could not be verified through publicly available business registration records. Furthermore, the website lacks detailed legal documentation, such as a comprehensive privacy policy, risk disclosures, and disclaimers, which are hallmarks of reputable companies.

2. Regulatory Issues

2.1 Why Regulation Matters

The legitimacy of a financial investment platform often hinges on whether it is regulated by reputable authorities. Regulated platforms undergo strict oversight, ensuring transparency, fairness, and the protection of investors’ funds. Without proper regulation, a platform’s activities could be questionable, leaving investors vulnerable to potential risks.

2.2 Fecc Global’s Regulatory Status

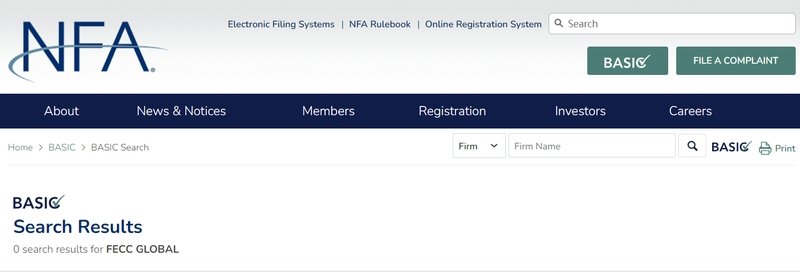

Fecc Global claims to operate globally, but investigations reveal that it is not regulated by any recognized financial authority. In the United States, the National Futures Association (NFA) is a key regulatory body for forex and futures trading platforms. However, a search for “Fecc Global” on the NFA website yielded no results. Similarly, no records were found with the UK Financial Conduct Authority (FCA) or the Australian Securities and Investments Commission (ASIC).

The absence of regulatory certification raises significant concerns. Unregulated platforms often lack legal accountability, making it difficult for investors to recover funds in cases of disputes.

3. Fecc Global’s Trading Services

3.1 Claimed Offerings

Fecc Global advertises its services as covering the following asset classes:

- Forex Trading: Including major currency pairs like EUR/USD and GBP/USD.

- Precious Metals: Offering CFDs on gold and silver.

- Energy Markets: Supporting commodities like crude oil and natural gas.

- Stock Indices: Such as the Dow Jones and Nasdaq indices.

- Cryptocurrency Trading: Enabling trades in popular digital currencies like Bitcoin and Ethereum.

3.2 User Experiences

Despite its diverse offerings, user feedback highlights several issues with Fecc Global’s trading services:

- Limited Asset Accessibility: Some users reported that not all advertised asset classes were available for trading.

- High Trading Costs: While the platform claims to have transparent fees, users found its spreads and commissions relatively high.

- Technical Challenges: Frequent delays and lags in the trading system were reported, especially during periods of high market activity.

- Lack of Analytical Tools: The platform provides minimal tools for market analysis, hindering users from making informed decisions.

These shortcomings significantly impact the trading experience and raise doubts about the platform’s capabilities.

4. Customer Service and Feedback

Customer service plays a crucial role in building trust between a financial platform and its users. Unfortunately, Fecc Global has faced criticism in this area.

4.1 Slow Response Times

Many users have reported long wait times when seeking assistance. Whether it’s technical issues or withdrawal requests, responses often take hours or even days.

4.2 Unhelpful Support

Several users described the support staff as unprofessional and evasive. Queries are often met with vague answers or ignored altogether, leading to frustration among users.

4.3 Frequent Complaints

Withdrawal difficulties are among the most common complaints. Some investors stated that their withdrawal requests were delayed indefinitely, with reasons such as “incomplete account verification.” In extreme cases, withdrawals were outright denied, further eroding trust in the platform.

The combination of poor service quality and opaque practices has led to widespread dissatisfaction among users.

5. Investment Risks and Potential Scams

5.1 Risks of High-Return Promises

Fecc Global emphasizes the potential for high returns in its promotional materials but seldom highlights the inherent risks of trading. In reality, all financial investments carry risk, and platforms that excessively promote “high returns” should be approached with caution.

5.2 Withdrawal Challenges

Many users have reported significant difficulties in withdrawing their funds. Even after completing “account verification,” withdrawal requests are often delayed or rejected. This behavior is a red flag, potentially indicating liquidity issues or misuse of client funds.

5.3 Lack of Transparency

Fecc Global’s lack of transparency is evident in several areas:

- No clear information about where and how client funds are stored.

- No detailed breakdown of fees and costs.

- No disclosure of its financial operations or corporate structure.

These transparency issues make it difficult for investors to assess the platform’s reliability, increasing the risk of financial loss.

6. How Investors Can Protect Themselves

When evaluating investment platforms, particularly ones like Fecc Global with questionable practices, investors must remain vigilant. Here are some tips:

6.1 Verify Platform Credentials

- Check the platform’s regulatory status on official websites of bodies like NFA, FCA, or ASIC.

- Ensure the platform provides clear legal documentation and certification.

6.2 Start Small

- Begin with a small deposit to test the platform’s services and withdrawal process.

- Watch for unusual behaviors, such as delayed transactions or account discrepancies.

6.3 Beware of High-Return Promises

- Avoid platforms that guarantee “low risk, high returns.” Such claims are often misleading.

- Focus on platforms that present realistic expectations and comprehensive risk disclosures.

6.4 Rely on User Reviews

- Read genuine reviews from other investors to understand the platform’s strengths and weaknesses.

- Participate in discussions on reputable financial forums for additional insights.

7. Conclusion: Fecc Global’s Current Status and Future Outlook

After an in-depth examination, Fecc Global exhibits several red flags:

- Lack of regulatory oversight by any recognized financial authority.

- Poor user feedback, particularly concerning withdrawal difficulties and customer service.

- Limited transparency in its operations, fees, and corporate information.

While Fecc Global’s marketing may appeal to novice investors, the risks associated with unregulated platforms far outweigh the potential benefits. Investors are strongly advised to prioritize regulated platforms with proven track records of reliability and transparency.

Frequently Asked Questions (FAQs)

1. Is Fecc Global regulated by any financial authority?

No, Fecc Global is not registered with any major regulatory authority like NFA, FCA, or ASIC.

2. Is it safe to trade on Fecc Global?

Due to its lack of regulation and numerous user complaints, trading on Fecc Global poses significant risks.

3. Why are withdrawals difficult on Fecc Global?

Users have reported frequent delays or outright denials of withdrawal requests, often citing vague reasons.

4. How can I identify a legitimate investment platform?

Look for platforms with clear regulatory certifications, transparent fees, and positive user feedback.

5. Is Fecc Global suitable for beginners?

No, Fecc Global lacks educational resources and user-friendly features, making it unsuitable for new investors.

6. What should I do if I suspect a scam?

Report the platform to local financial authorities and retain all transaction records for evidence.

Final Reminder:

Investments carry risks, and selecting a trustworthy platform is crucial. Make informed decisions and prioritize your financial safety.