IVZ FX claims to be a multi-asset trading platform offering forex, precious metals, commodities, indices, stocks, and cryptocurrency trading. However, in-depth investigation reveals its false regulatory claims, zero website traffic, poor design, and other suspicious elements. Here’s a comprehensive breakdown of how IVZ FX operates, exposing its fraudulent nature.

1. IVZ FX’s Company Background: Fact or Fiction?

IVZ FX states that its headquarters are in Australia and provides a contact address on its official website. However, a search in the Australian Business Registry shows that this company does not exist. What’s even more alarming is that the address provided belongs to the Australian branch of the well-known investment company Invesco. This blatant attempt to “borrow credibility” only deepens doubts about its legitimacy.

1.1. The Intent Behind a False Address

Using the address of a reputable company is a deliberate tactic to instill trust among investors. However, when this lie is uncovered, IVZ FX’s credibility crumbles entirely. This strategy not only demonstrates a lack of transparency but also raises questions about whether there is a real operational team behind the platform.

2. False Claims of SEC Regulation

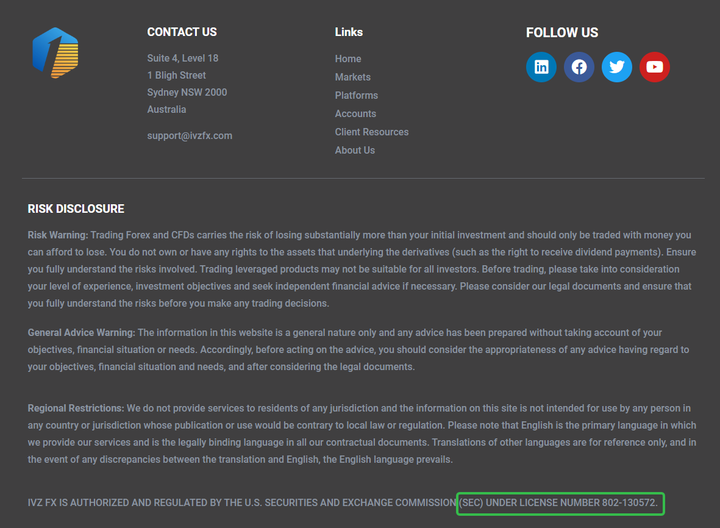

IVZ FX’s website footer boldly claims that it is regulated by the U.S. Securities and Exchange Commission (SEC), providing a seemingly valid SEC registration number. However, an investigation into the SEC database reveals that this number belongs to a company named INVESCO ALPHA INC, not IVZ FX.

2.1. Misrepresentation of SEC Regulation

INVESCO ALPHA INC is merely an “Exempt Reporting Adviser” (ERA), subject to far fewer regulatory requirements than a fully registered Investment Adviser (RIA). This means that even though INVESCO ALPHA INC is loosely associated with the SEC, its oversight is minimal. IVZ FX’s use of this information to pose as a regulated platform is nothing but a marketing ploy.

2.2. Consequences of False Regulation Claims

IVZ FX’s deception not only misleads unsuspecting investors but also damages the credibility of the SEC. Investors who trust such fraudulent claims risk significant financial losses.

3. Zero Website Traffic: A Platform Without an Audience

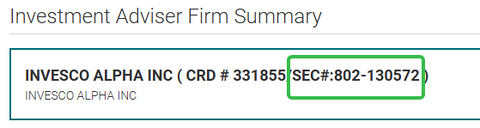

Data from Ahrefs reveals that IVZ FX’s website receives virtually zero traffic. This stark reality undermines IVZ FX’s claim of being a “global service provider.”

3.1. The Implications of Zero Traffic

For a trading platform, website traffic is a key indicator of its popularity and market presence. IVZ FX’s complete lack of traffic suggests that it is neither attracting users nor providing any credible service.

3.2. Challenges of a New Platform

IVZ FX’s website was registered as recently as June 2024. While new platforms often face growth challenges, failing to achieve even minimal market traction is a major red flag.

4. “Watered-Down” Educational Resources

IVZ FX’s website offers some educational resources, including an economic calendar, forex guides, and market news. However, closer inspection reveals significant issues with these materials.

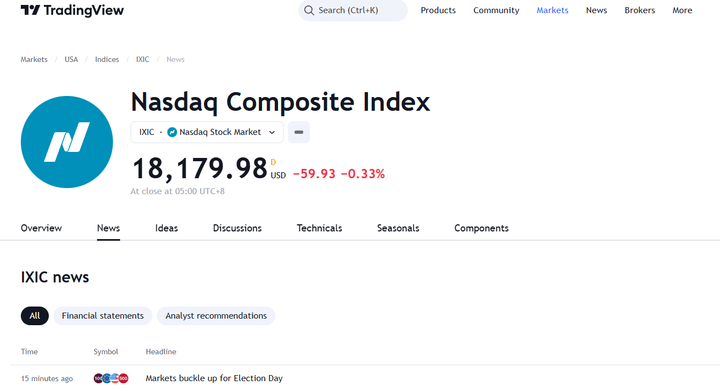

4.1. Redirecting to Third-Party Websites

The so-called “daily market news” links directly to TradingView’s website rather than providing proprietary content. This outsourced approach reflects a lack of expertise and effort in creating genuine resources for users.

4.2. Questionable Data Accuracy

While IVZ FX’s economic calendar lists various market data points, it provides no information on their sources or accuracy. Relying on such unverified data could expose investors to unnecessary risks.

5. Social Media Icons: Pure Decorations

IVZ FX’s website features four social media icons, seemingly implying an active online presence. However, these icons lead nowhere, as there are no actual links to social media pages.

5.1. The Deceptive Nature of Fake Social Media Links

Legitimate trading platforms often use social media to engage with users, share updates, and provide educational content. IVZ FX not only lacks any social media activity but deliberately misleads users with non-functional icons.

5.2. A Poor User Experience

This lack of attention to detail not only detracts from the user experience but also highlights IVZ FX’s disregard for professionalism, reinforcing suspicions about its authenticity.

6. Website Design: A Template-Based Operation

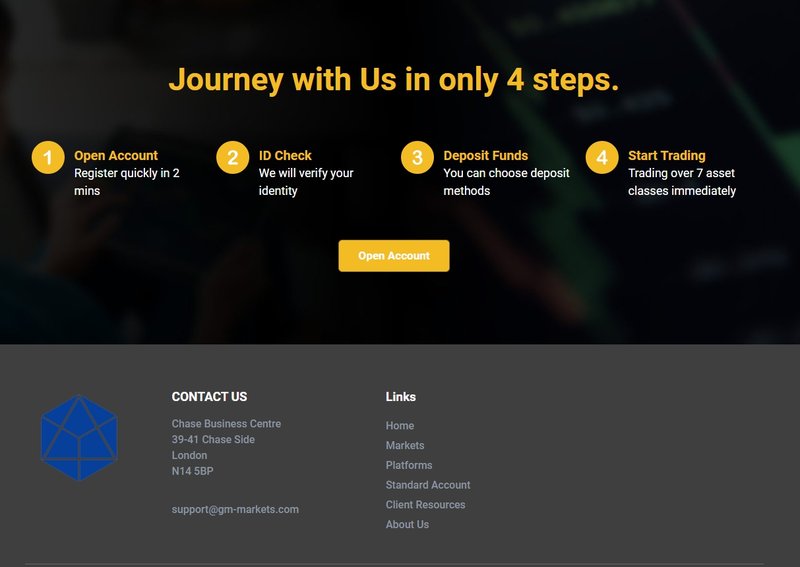

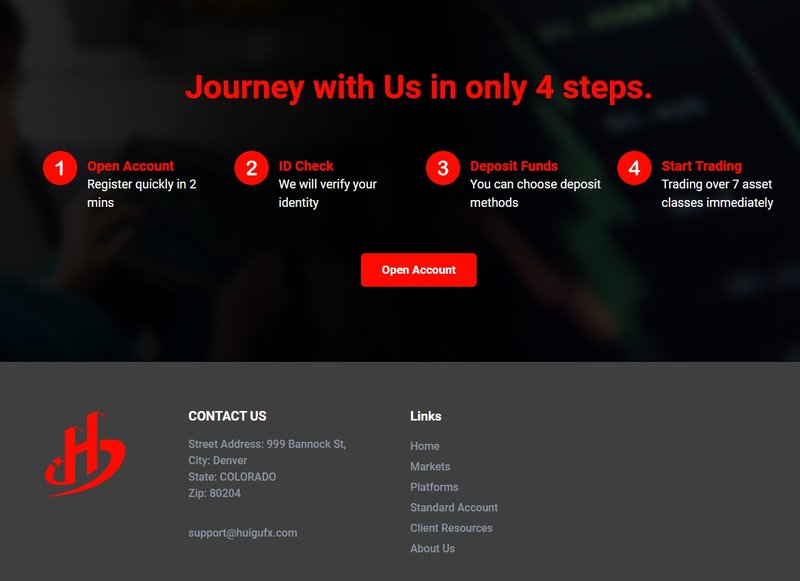

IVZ FX’s website design is basic and unoriginal, resembling a pre-made template. Further investigation reveals that websites for Goldman Capital and Huigu are nearly identical to IVZ FX’s, with only the names changed.

6.1. Characteristics of a Template Website

Template-based websites are often quickly assembled with minimal effort or cost. This reflects a lack of investment in creating a unique and trustworthy brand image.

6.2. Why the Lack of Customization Matters

A legitimate platform would invest in user-centric design and functionality tailored to client needs. IVZ FX’s reliance on generic templates contradicts its claim of being a “global trading platform.”

7. Conclusion: A Fraudulent Platform Full of Red Flags

From its company background and regulatory claims to website traffic and design, IVZ FX displays numerous warning signs of being a scam. Its fake SEC regulation, non-existent website traffic, inactive social media icons, and template-based design all point to its fraudulent nature.

7.1. A Warning for Investors

IVZ FX’s operations indicate that it is more focused on quick profit than legitimate business. Investors must remain vigilant, thoroughly research any platform, and avoid being swayed by flashy claims or misleading information.

Frequently Asked Questions (FAQ)

1. Is IVZ FX truly regulated by the SEC?

IVZ FX claims to be regulated by the U.S. Securities and Exchange Commission (SEC). However, upon investigation, the SEC registration number they provided actually belongs to another company (INVESCO ALPHA INC). This company is not IVZ FX and is classified only as an “Exempt Reporting Adviser” (ERA), meaning it is not under strict regulation. IVZ FX’s regulatory claim is completely false.

2. Why does IVZ FX have zero website traffic?

Data analysis reveals that IVZ FX’s website traffic is virtually non-existent. A legitimate trading platform would at least have some user visits. This lack of traffic suggests that the website exists merely as a facade to deceive investors.

3. Are IVZ FX’s educational resources reliable?

IVZ FX’s educational resources are unreliable. Their so-called “daily market news” redirects users to a third-party website (TradingView), and the accuracy of their economic calendar data cannot be verified. These resources appear to be more of a marketing gimmick than genuine tools for investors.

4. Why can’t IVZ FX’s social media accounts be accessed?

Although IVZ FX displays several social media icons on its website, these icons are not clickable and do not link to any actual social media pages. This indicates that they do not operate any social media accounts and that the icons are merely decorative, designed to mislead users.

5. How is IVZ FX connected to other fraudulent platforms?

IVZ FX’s website design is almost identical to that of other exposed scam platforms, such as Goldman Capital and Huigu. These platforms use the same templates, suggesting that they may be operated by the same group or individual to create multiple fraudulent websites quickly.

6. How can one determine if a trading platform is trustworthy?

To determine if a trading platform is trustworthy, consider the following factors:

- Verify the platform’s regulatory claims with official regulatory bodies.

- Ensure the platform has consistent website traffic and authentic user reviews.

- Check for clear and transparent company background and contact information.

- Avoid platforms with poorly designed websites or unclear resource origins.

- Look for active and genuine social media accounts maintained by the platform.

Investors should thoroughly evaluate any platform to avoid falling victim to scams like IVZ FX.