As the forex market continues to expand, more and more new brokers are emerging, and HeroFX is one of them. Established in 2023 and headquartered in Saint Lucia, HeroFX offers trading services for forex, precious metals, cryptocurrencies, and other financial instruments. But the real question is, how reliable is this broker? Let’s delve into its background, regulatory status, and trading features to uncover the truth.

1. HeroFX’s Operational Background: Rising Star or Temporary Player?

Short Operational History Raises Questions

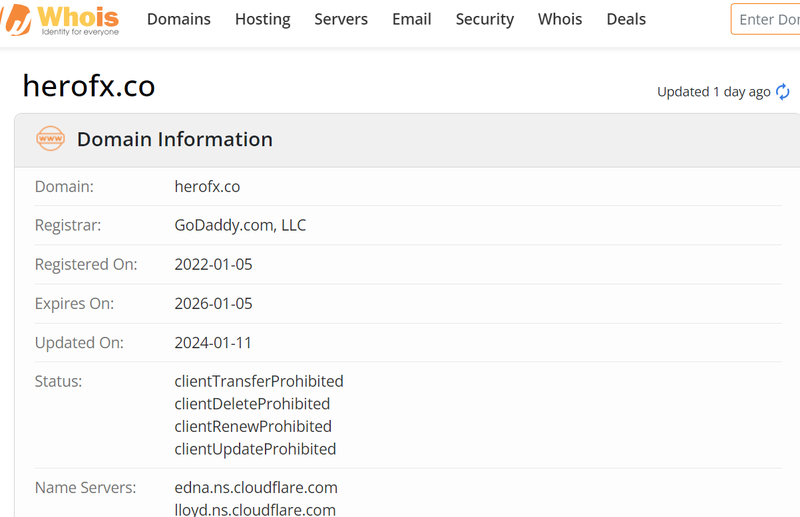

HeroFX’s official website domain was registered in July 2023, giving the company a little over a year of operational history. Such a short timeframe raises concerns about its long-term stability in the highly competitive forex industry, where trust and reputation are critical.

Ambiguous Office Address

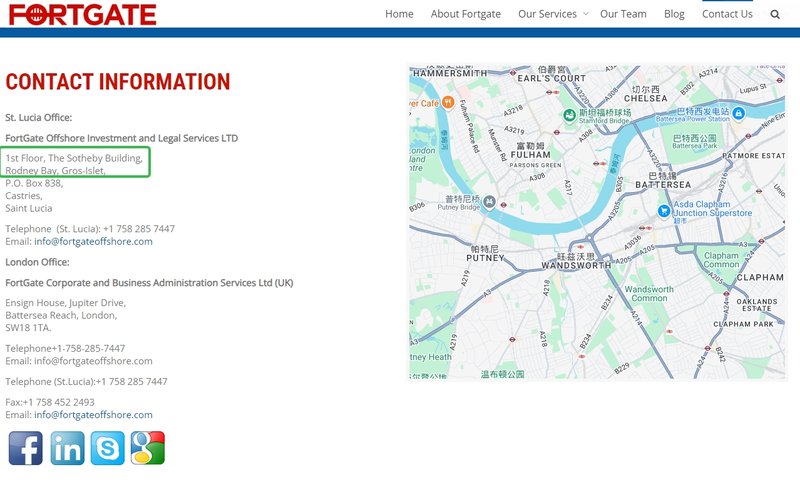

HeroFX claims its office is located on the first floor of The Sotheby Building in Rodney Bay, Saint Lucia. However, further investigation reveals that this address is a shared office space used by multiple companies. This raises questions about the company’s actual operational presence—whether it truly operates from there or is merely using it as a registered address remains unclear.

2. Regulatory Status: Operating in the Shadows

No Recognized Regulatory Oversight

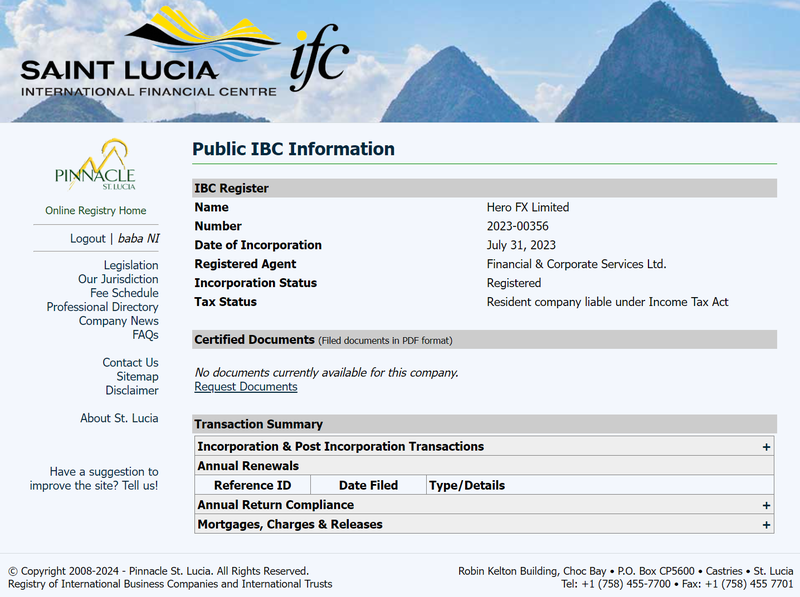

Although HeroFX is registered in Saint Lucia with a registration number of 2023-00356, it does not appear in the database of the Saint Lucia Financial Services Regulatory Authority (FSRA). Additionally, the company is not listed with internationally recognized regulatory bodies like the UK’s FCA, Australia’s ASIC, or the US’s FINRA.

The Implications of Being Unregulated

Operating without regulation exposes traders to significant risks. In the event of platform issues or financial disputes, users have no formal recourse or regulatory body to mediate or protect their interests. This lack of oversight makes HeroFX a risky choice for investors.

3. Diverse Trading Instruments: Attractive Yet Risky

HeroFX provides access to a wide range of trading products, including forex, precious metals, indices, energy, futures, and cryptocurrencies. The variety caters to different trading preferences:

- Forex Trading: Covers major currency pairs as well as some exotic pairs, catering to both conservative and high-risk traders.

- Cryptocurrency: Offers a selection of digital asset trading options, though specific details remain sparse.

Despite the diversity of offerings, the broker’s unregulated status undermines confidence in its ability to deliver a secure trading environment. Investors should be cautious, as safety should always trump attractive features.

4. Account Types and Features

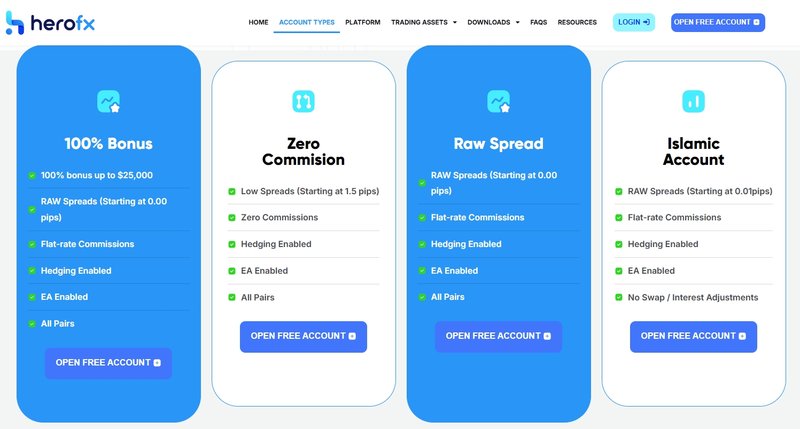

Raw Spread Accounts: Appealing to Low-Cost Traders

HeroFX promotes its “Raw Spread Account,” boasting spreads starting from 0.00 pips and aiming to provide transparent trading costs. This account also supports hedging and EA (Expert Advisor) automated trading, making it suitable for high-frequency traders and those relying on algorithmic strategies.

While these features appear competitive, their effectiveness relies heavily on the broker’s integrity. Without regulatory backing, the appeal of low spreads may simply be a marketing tactic.

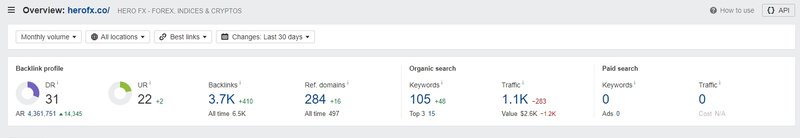

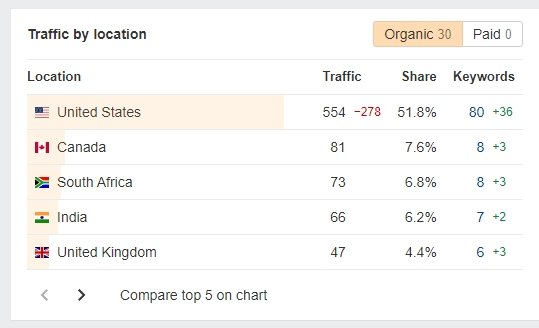

5. Traffic Data: Limited Market Penetration

According to third-party data, HeroFX’s website receives approximately 1,100 visits per month, with over 50% of the traffic coming from the United States. Other regions, such as Canada, South Africa, and India, contribute marginally. Such low traffic indicates that HeroFX has not yet gained significant market recognition or trust on a global scale.

6. Customer Support and Educational Resources: A Serious Deficiency

Minimal Customer Support

HeroFX provides only an email address as a point of contact for customer support, with no live chat or phone assistance available. This lack of immediate support options can be highly inconvenient for users seeking quick resolutions.

Sparse Educational Materials

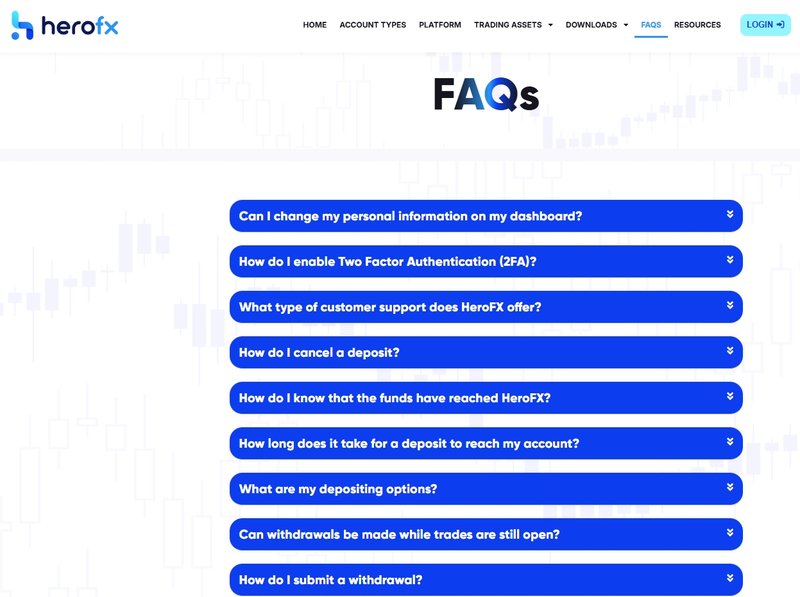

For novice traders, access to comprehensive educational resources is crucial. However, HeroFX offers only a basic FAQ page and a short 42-second promotional video on its website. This is far from adequate for users looking to build trading knowledge or develop effective strategies.

7. Conclusion and Recommendations

HeroFX, as a new player in the forex brokerage space, offers diverse trading products and attractive account features. However, its unregulated status and lack of operational transparency make it difficult to trust. In the financial market, selecting a broker with proven reliability and regulatory compliance is critical.

Recommendations for Investors:

- Prioritize brokers regulated by reputable authorities such as the FCA, ASIC, or FINRA to ensure your funds are safeguarded.

- Conduct thorough research on any broker’s background and user reviews before committing your money.

- Avoid unregulated platforms, even if they offer seemingly attractive trading conditions.

Investor protection and financial security should always come first. Don’t let the lure of low costs blind you to the potential risks of dealing with an unregulated broker.

Frequently Asked Questions (FAQ)

1. Is HeroFX regulated?

HeroFX is currently not regulated by any internationally recognized regulatory body. It is only registered as an International Business Company in Saint Lucia, which poses significant risks to investors regarding fund security and dispute resolution.

2. What trading products does HeroFX offer?

HeroFX provides a range of financial products, including forex, precious metals, cryptocurrencies, indices, energy, futures, and stocks. These offerings cater to both mainstream and niche markets, aiming to meet diverse investor needs.

3. Is the Raw Spread Account offered by HeroFX worth considering?

The Raw Spread Account features spreads starting from 0.00 pips and supports hedging and EA automation. However, due to HeroFX’s lack of regulatory oversight, investors should proceed cautiously and prioritize fund security.

4. How reliable is HeroFX’s customer support?

HeroFX offers limited customer support, with only an email contact option available. There are no live chat or phone support options, which may delay assistance when users encounter issues.

5. Is HeroFX suitable for beginner traders?

HeroFX’s educational resources are minimal, consisting of only a FAQ page and a brief promotional video. It is not an ideal platform for beginners who need comprehensive educational support to develop their trading skills.

6. How can I determine if a broker is reliable?

To assess a broker’s reliability, consider the following factors:

- Whether it is regulated by reputable authorities such as FCA, ASIC, or FINRA.

- Transparency of company information and its market reputation.

- Availability and quality of customer support.

- User reviews and industry analysis.