With the continuous development of global financial markets, investors are facing an increasing number of choices when selecting a Contracts for Difference (CFD) broker. Topmax Global Limited (hereinafter referred to as “Topmax”) is a CFD broker established in 2019, offering services in forex, cryptocurrencies, stocks, and precious metals. While relatively new to the financial market, the platform has attracted considerable attention from investors due to its diverse product offerings and features. However, before engaging in trading on such platforms, investors need to understand its background, regulatory situation, services, and potential risks in detail.

In this article, we will comprehensively analyze Topmax’s operational background, regulatory information, offered trading accounts and platforms, deposit and withdrawal methods, as well as potential risks, providing investors with a thorough reference guide.

1. Company Background and Development

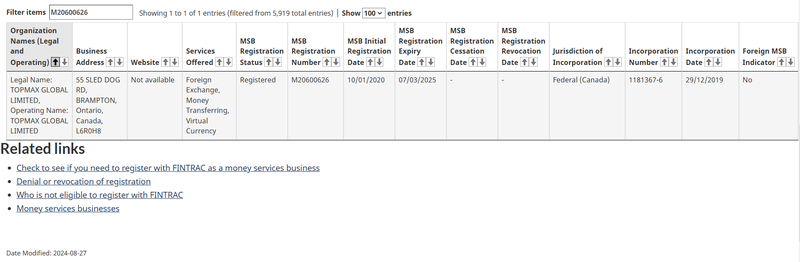

Topmax Global Limited is a CFD broker established on December 29, 2019, with its registered office located in Oakville, Ontario, Canada. The company primarily operates in offering CFD trading services for forex, cryptocurrencies, stocks, and precious metals. It is registered under the company number 1181367-6, and it has been listed with the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC) as a Money Services Business (MSB). However, detailed information regarding the company’s founders or management team is not disclosed on its official website, which raises concerns about the transparency of the company’s background.

Topmax primarily focuses on CFD trading, offering a range of financial products including forex, cryptocurrencies, stocks, and precious metals. CFDs are complex financial instruments that allow investors to speculate on price movements of underlying assets without actually owning the assets. Compared to traditional stock or forex markets, CFD trading offers greater leverage and flexibility but also comes with higher risks.

2. Regulatory Status and Compliance Analysis

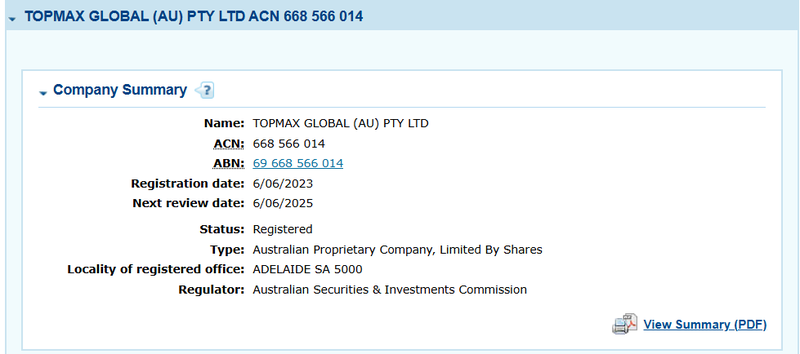

As a financial service provider, the regulatory compliance of Topmax is a crucial consideration for investors when choosing a platform. According to publicly available information, Topmax operates through two companies: Topmax Global Limited in Canada and TOPMAX GLOBAL (AU) PTY LTD in Australia.

- Topmax Global Limited (Canada)

Topmax is registered in Canada and listed with the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC). The primary role of FINTRAC is to ensure compliance with Canada’s Proceeds of Crime (Money Laundering) and Terrorist Financing Act (PCMLTFA). However, FINTRAC does not directly regulate CFD trading or market activities, meaning that Topmax’s compliance with market regulations may be weak in the realm of financial derivatives trading. - TOPMAX GLOBAL (AU) PTY LTD (Australia)

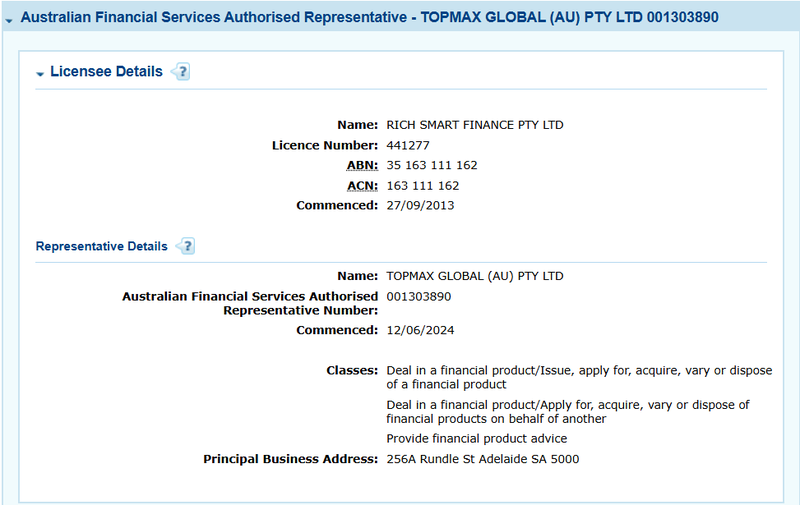

The Australian entity of Topmax is registered and based in Adelaide. It operates as an ASIC Authorized Representative but does not hold an Australian Financial Services License (AFSL) directly. This arrangement means that the compliance of the platform primarily relies on its license holder, which may result in weaker regulatory oversight compared to entities holding an AFSL themselves. In cases of disputes or non-compliance, the delineation of responsibility between the authorized representative and the license holder could be complex.

2.1 Regulatory Challenges and Risks

While Topmax provides some regulatory information, its overall compliance is not robust, especially in the CFD and financial derivatives markets. The fact that FINTRAC’s regulatory scope is limited to money services, rather than derivatives trading, suggests that Topmax’s operations in Canada may not be sufficiently regulated.

On the other hand, although Australian regulation is relatively strict, the absence of a direct AFSL and the reliance on an authorized representative may weaken the overall compliance framework, potentially exposing investors to regulatory risks.

3. Trading Accounts and Trading Conditions

Topmax offers two main types of trading accounts: ECN accounts and Standard accounts. Each account type caters to different kinds of investors, providing different leverage, spreads, and commission structures.

3.1 ECN Account

The ECN account is designed for professional traders who require low spreads and high trading frequency. The key features of the ECN account are as follows:

- Maximum Leverage: Forex 1:500, Metals 1:100, Indices and Commodities 1:100

- Spreads: Starting from 0 pips, ideal for high-frequency traders

- Minimum Trade Size: 0.01 lots, offering flexibility for traders with small capital

- Commission: From $7 per lot, depending on the trading volume and product

- Forced Liquidation Level: 50%, when the account loss reaches a certain level, the system will automatically close positions

- Overnight Interest: Competitive overnight rates, beneficial for longer-term traders

3.2 Standard Account

The Standard account is suitable for low-frequency traders or beginners. It offers lower commissions and higher spreads, making it ideal for traders who are more focused on reducing trading costs:

- Maximum Leverage: Forex 1:500, Metals 1:100, Indices, and Commodities 1:100

- Spreads: Starting from 1 pip, higher spreads are more suitable for infrequent traders

- Minimum Trade Size: 0.01 lots, providing flexibility for various trading styles

- Commission: From $0 per lot, reducing trading costs

- Forced Liquidation Level: 50%, similar to the ECN account

- Overnight Interest: Similar competitive rates as the ECN account

4. Trading Platform: MetaTrader 5 (MT5)

Topmax uses MetaTrader 5 (MT5), a popular and advanced trading platform for multi-asset trading. MT5 supports a variety of assets, including forex, stocks, futures, cryptocurrencies, and precious metals. Some of the key advantages of MT5 are as follows:

- Advanced Charting Tools: MT5 includes a range of technical analysis tools, including trend lines, indicators, oscillators, and more, enabling investors to analyze the market with precision.

- Multiple Order Types: MT5 supports various order types, such as market orders, limit orders, stop orders, and more, allowing traders to adjust their strategies according to market movements.

- Automated Trading: MT5 supports Expert Advisors (EAs) for automated trading, catering to traders who prefer algorithmic trading strategies.

- User-Friendly Interface: The MT5 platform offers a clear and easy-to-use interface, suitable for traders of all experience levels.

5. Deposit and Withdrawal Methods and Customer Service

Despite offering various financial products, Topmax’s website does not explicitly list available deposit and withdrawal methods, minimum deposit requirements, or associated fees. Investors will need to contact the platform directly for clarification on these details.

Topmax does not appear to have official accounts on major social media platforms like Facebook, Twitter, or Instagram. Investors can only contact the broker through the phone number and email provided on the website. This method of communication may be less convenient for clients, especially in urgent situations when instant support is necessary.

6. Potential Risks and Investor Considerations

6.1 Regulatory Gaps and Risks

Although Topmax is registered in Canada and Australia, its regulatory environment is far from comprehensive. The limited scope of FINTRAC’s oversight, combined with the reliance on an authorized representative in Australia, means that Topmax’s operations in both countries are not fully regulated. Investors should carefully consider these potential gaps in regulatory protection before engaging in trading.

6.2 Lack of Transparency in Fund Management

Topmax does not clearly disclose how client funds are managed or which company is responsible for holding investors’ funds. This lack of transparency raises concerns about the security of investor funds, especially if the platform encounters financial difficulties or disputes.

7. FAQ

1. What types of trading accounts does Topmax offer?

Topmax offers ECN and Standard accounts, each catering to different types of traders. The ECN account is designed for high-frequency traders, while the Standard account is ideal for low-frequency traders or beginners.

2. What is the maximum leverage offered by Topmax?

Topmax offers a maximum leverage of 1:500 for forex and 1:100 for metals, indices, and commodities.

3. What trading platforms does Topmax support?

Topmax uses MetaTrader 5 (MT5) as its primary trading platform, supporting a variety of assets including forex, stocks, futures, cryptocurrencies, and precious metals.

4. What deposit and withdrawal methods does Topmax support?

Topmax does not publicly list its deposit and withdrawal methods on the website. Investors should contact the platform directly for further information.

5. How regulated is Topmax?

Topmax is registered with FINTRAC in Canada and operates as an ASIC-authorized representative in Australia. However, its regulatory oversight is limited, especially in the realm of financial derivatives trading.

6. Where can I contact Topmax customer service?

You can contact Topmax customer service via the phone number and email provided on their official website. The platform does not have official social media accounts.