Following the U.S. presidential election, Tesla’s stock surged by 44% in just five days. Trump’s re-election promises policy advantages, Bank of America raised its target price for Tesla to $350, and call options are even targeting $400. Musk and Trump’s unique relationship is also a major point of market interest.

1. Trump’s Re-Election Sparks New “Trump Trade,” Tesla Among Top Beneficiaries

1.1 Policy Expectations for Trump Drive Tesla’s Stock Upward

In the wake of the November 2024 U.S. presidential election, Trump’s re-election ignited a wave of market optimism about the renewed “Trump Trade.” Investors broadly expect Trump’s policies to further loosen restrictions on the energy and automotive industries, providing Tesla with a strong catalyst for growth. Tesla’s stock has risen by 44% over five trading days since Election Day, with a single-day surge of 8.96% on November 11, closing at $350—its highest level in over two years.

1.2 Musk’s Wealth Soars, Cementing His Place as the World’s Richest Person

Tesla’s stock surge not only lifted the company’s market valuation to new highs but also propelled Musk’s wealth even further. According to the Bloomberg Billionaires Index, Musk’s net worth shot up by $70 billion in just a week, reaching $335 billion—more than $100 billion above Amazon’s Jeff Bezos, further solidifying Musk’s position as the world’s richest person.

2. Trump and Musk: A Relationship of Innovation and Tension

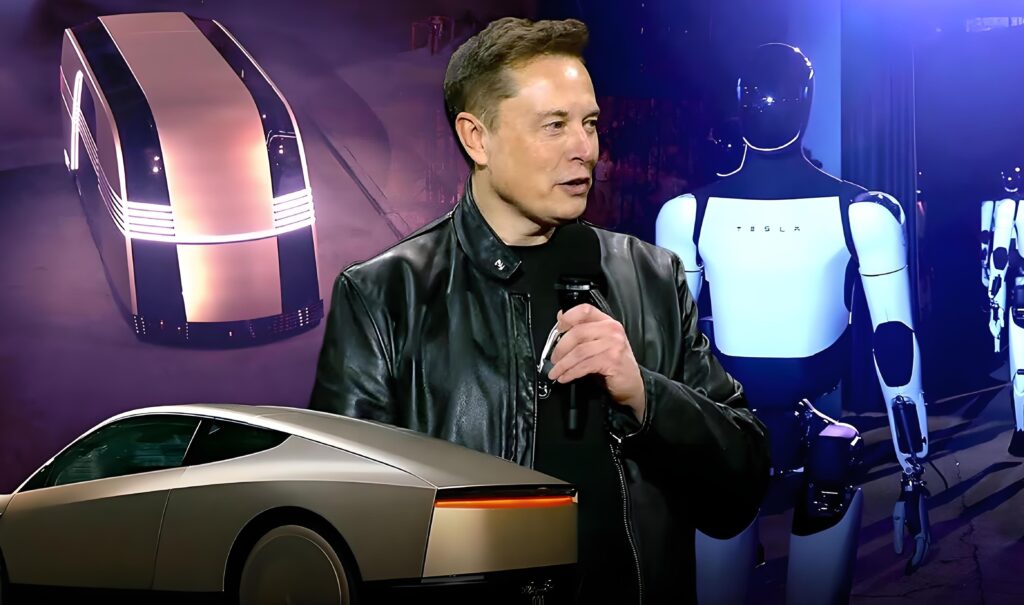

2.1 Trump and Musk’s Rise: Breaking Tradition and Embracing Innovation

Both Trump and Musk have had meteoric and unconventional rises. Trump, born into a real estate family in New York, gained national fame through his television persona and bold rhetoric, ultimately winning the U.S. presidency. His “America First” approach champions economic growth and the revitalization of American manufacturing, which has garnered strong support from the country’s industrial heartland.

Meanwhile, Musk, originally from South Africa, moved to the U.S. at 17 and earned his initial fortune through the creation of PayPal. Musk went on to found SpaceX and Tesla, pursuing ambitious visions of space exploration and sustainable energy. Like Trump, Musk became globally recognized for his visionary thinking and tenacious personality.

2.2 Early Cooperation: Trump and Musk’s “America First” Consensus

During Trump’s initial term, Musk joined Trump’s presidential advisory council, and the two found common ground on issues like manufacturing revitalization and tech innovation. Trump’s “America First” agenda sought to strengthen domestic manufacturing, a priority aligned with Musk’s U.S.-based companies, Tesla and SpaceX. Musk, in turn, publicly praised Trump’s support for American enterprises, and the two initially appeared to align on various initiatives promoting technological innovation.

2.3 Environmental Policy Differences: Musk Exits the Advisory Council

Despite this initial alignment, Trump and Musk also clashed over environmental issues. In 2017, when Trump announced the U.S. withdrawal from the Paris Climate Agreement, Musk, a vocal advocate for clean energy, publicly expressed disappointment and soon after stepped down from Trump’s advisory council. Musk’s departure highlighted his commitment to sustainability and clean energy, even if it meant parting ways with the president.

3. What Are the Policy Benefits for Tesla? A Market Expansion Opportunity

3.1 Trump’s Deregulation Opens New Opportunities for Tesla

Following Trump’s re-election, Bank of America quickly raised Tesla’s target price from $265 to $350, maintaining a “buy” rating. Bank of America analysts noted that Trump’s environmental deregulation could help Tesla consolidate its position in the electric vehicle market. Trump’s policies are expected to ease competition from traditional automakers, giving Tesla more room to grow. Tesla also plans to release a more affordable entry-level model, and the relaxed regulatory environment could further support its market expansion.

3.2 Less Stringent Autonomous Driving Oversight Favors Tesla’s Robotaxi Plan

Trump’s administration has signaled an open attitude toward autonomous driving technology, and Bank of America suggests that Trump’s deregulation could ease scrutiny on self-driving tech, which would benefit Tesla’s planned Robotaxi rollout. Musk has stated that Tesla aims to launch a commercial autonomous taxi service by 2025, and Trump’s relaxed oversight could help accelerate Tesla’s innovations in self-driving, cementing its lead in the global EV market.

4. Market’s Optimism for Tesla Stock: Call Options Targeting $400

4.1 Bullish Call Options Clustered Around $400 Target

Tesla’s rapid stock rally has sparked a wave of activity in the options market. According to data from Trade Alert, Tesla options were the most traded single-stock options, with 2.5 million contracts changing hands—more than twice the usual volume. Interactive Brokers’ Chief Strategist Steve Sosnick reported that many call options were clustered at a $400 strike price, which is about 13% above the current stock price. This heavy volume of bullish call options suggests strong market confidence in Tesla’s continued growth.

4.2 Bank of America Raises Target to $350, Boosting Investor Confidence

Following Trump’s victory, Bank of America raised Tesla’s target price to $350 and reiterated its “buy” rating. This adjustment reflects broader optimism about Tesla’s prospects, particularly under a Trump administration that supports domestic manufacturing and may offer regulatory benefits for Tesla’s core business in EVs and autonomous driving.

5. Tesla’s Future: Growth Opportunities Driven by Policy and Innovation

5.1 Market Opportunities and Challenges Under Trump’s Policies

Under Trump’s administration, Tesla’s future prospects appear bright. Trump’s intent to reduce regulation on the energy and automotive sectors could create favorable conditions for Tesla’s expansion. This may support Tesla’s market presence and accelerate its advancements in autonomous driving and Robotaxi initiatives. However, the recent surge in Tesla’s stock also raises the potential for short-term volatility, and investors should keep a close eye on policy developments.

5.2 Musk’s Vision and Persistence: Pushing the Boundaries of Technology

Musk has always been a pioneer in technology, from SpaceX’s Mars ambitions to Tesla’s advancements in autonomous driving. His vision has fueled Tesla’s rise in the EV market, and his commitment to sustainable energy and space exploration has continued to drive significant returns for Tesla and SpaceX. Musk’s entrepreneurial spirit and dedication to innovation make him one of the most influential figures of this era.

6. Trump and Musk: “Disruptors” with a Unique Relationship of Cooperation and Conflict

6.1 Trump’s “America First” and Musk’s “Technology First”

Trump and Musk’s relationship is complex and dynamic. Trump’s “America First” agenda promotes U.S. innovation and domestic manufacturing, while Musk’s ethos centers on technology-driven solutions and sustainable growth. Though their backgrounds differ, they share a common commitment to innovation, each in their own way driving transformative change in American industry.

6.2 Future Collaboration and Potential Clashes

Trump’s second term could see renewed collaboration between the two, especially in areas like autonomous driving, clean energy, and domestic manufacturing. Musk has indicated that Tesla and SpaceX will continue to strengthen their American production capabilities, supporting innovation and job creation. However, Trump’s conservative stance on environmental issues and Musk’s international business ambitions could spark future disagreements. This mix of cooperation and tension adds an intriguing dynamic to their relationship, opening up new possibilities for Tesla and the U.S. tech industry.

7. Conclusion: Can Tesla Sustain Its Growth under Favorable Policy and Market Conditions?

Tesla’s current stock rally is buoyed by Trump’s policy support and Musk’s ongoing innovations. However, the rapid rise in stock price may bring greater short-term volatility. Trump’s supportive policies, Tesla’s advancements in autonomous driving, and the release of new EV models offer significant growth potential for the company over the coming years. While keeping an eye on Tesla’s stock, investors should also carefully monitor policy shifts and market trends to make informed investment decisions.