This article examines NKVO’s company background, regulatory status, trading conditions, account types, fund security, and educational resources, revealing potential risks and urging investors to approach this platform with caution.

1. Background of the NKVO Platform

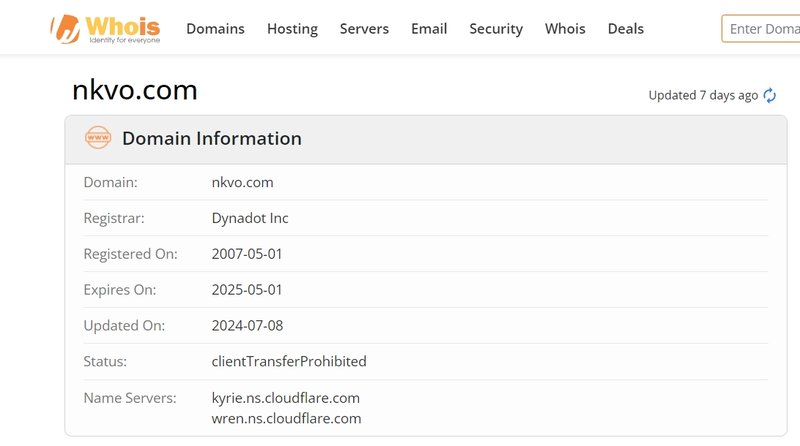

NKVO is an online cryptocurrency trading platform claiming to have been founded in 2007, with its official website located at https://www.nkvo.com/. The domain was registered on May 1, 2007, giving NKVO a long-standing presence on the internet. This domain age may initially make the platform seem stable and reliable, potentially gaining investors’ trust. However, NKVO lacks essential public information about its company registration and operating status. Without these key details, especially in the financial industry, investors may be left questioning the platform’s legitimacy and safety.

1.1 Long-Established Domain but No Registration Information

Financial platforms typically display detailed company registration information on their official websites, such as company name, registration address, and contact information. This transparency helps investors verify the platform’s legitimacy and builds trust. Although NKVO’s domain has existed for more than a decade, the website provides no company registration details or physical address, making it difficult for both novice and experienced investors to confirm if NKVO is a legitimate, licensed entity.

1.2 Unverifiable Background Raises Trust Issues

With no publicly available registration information or background on NKVO, investors cannot verify the platform’s credentials. This lack of transparency significantly impacts user trust in the platform. In the financial industry, hidden registration details may indicate potential non-compliance or even lead to concerns about risks to investors’ funds.

2. Legitimacy and Safety Concerns with NKVO

A platform’s legitimacy and regulatory compliance are crucial for investors because they directly impact user fund security and trading rights. However, NKVO performs poorly in these areas, with unclear regulatory status and legitimate operations.

2.1 Potential Risks from Lack of Regulation

Upon investigation, NKVO has not disclosed any licensing or oversight from international financial regulatory bodies on its website. Regulated platforms typically list regulatory bodies and license numbers on their websites for user verification. For example, leading regulators like the UK’s Financial Conduct Authority (FCA), the Cyprus Securities and Exchange Commission (CySEC), and the Australian Securities and Investments Commission (ASIC) all require platforms to provide detailed registration and regulatory information, including clear fund protection and trading transparency standards. Without such information, NKVO’s safety and fund legality are at significant risk.

2.2 Lack of Fund Protection Measures

A key safety measure in financial trading platforms is whether they implement client fund protection mechanisms, such as fund segregation and SSL encryption. NKVO’s official site does not provide any information about security measures to protect user funds, such as SSL encryption or client fund segregation. SSL encryption and fund segregation are industry-standard practices to protect user data and funds. Without these basic protections, NKVO’s transparency in fund management is questionable, and users’ personal data and funds may face significant risks.

3. Missing Information on Account Types and Trading Conditions

Established trading platforms usually offer various account types and clearly outline specific trading conditions, including spreads, leverage, and commissions, which help users select accounts based on their needs. However, NKVO provides virtually no information in these areas, leaving investors without a clear understanding of the platform’s offerings and fees.

3.1 Lack of Transparency in Account Types and Fee Structures

On reputable financial trading platforms, investors can typically choose from different account types (e.g., beginner accounts, professional accounts, VIP accounts), each with unique fees, leverage, and trading conditions. However, NKVO’s website does not provide any information about account types or minimum deposit requirements. This lack of transparency could leave investors without a full understanding of the trading costs involved, increasing potential financial risks.

3.2 Hidden Risks in Trading Conditions

Clear trading conditions are essential for investors to evaluate platform transparency and fee structures. Most regulated platforms list trading conditions, including spreads, leverage, and trading commissions, on their websites. NKVO, however, does not disclose these details, leaving the actual trading costs and potential hidden fees unknown. This lack of transparency makes it challenging for investors to assess the platform’s reliability and safety accurately.

4. Risks from Unclear Deposit and Withdrawal Information

NKVO’s website does not provide any specific information on deposits and withdrawals, including supported payment methods, fees, or processing times. Transparency in fund movement and ease of deposits and withdrawals are essential in financial platforms. However, NKVO’s lack of transparency in this area could indicate higher potential risks.

4.1 Unknown Deposit and Withdrawal Methods

Reputable platforms generally offer multiple deposit and withdrawal options, such as bank transfers, credit cards, and digital wallets, making it easy for users to manage funds and clearly outline associated fees and processing times on their websites. NKVO, however, has not provided any details on deposit or withdrawal methods, potentially leaving users facing unclear processes and unexpected fees. This lack of specific information may also lead to delays in withdrawal processing and additional fees.

4.2 Potential Risks from Non-Transparent Fund Flows

In the financial sector, fund security and transparency are paramount. NKVO does not provide specific information about its deposit and withdrawal processes, making it difficult to understand how funds flow within the platform. This lack of transparency makes it difficult for investors to track fund security, especially if the platform experiences technical issues or halts operations, which could pose a significant financial risk to investors.

5. Lack of Educational Resources and Market Analysis Support

A well-developed financial trading platform usually offers various educational resources and market analysis tools, helping investors understand market trends and trading rules. However, NKVO provides no educational materials, trading guidance, or market analysis tools.

5.1 Insufficient Support for Beginner Investors

Most legitimate financial platforms offer a variety of educational resources, such as introductory guides, basic market knowledge, technical analysis, and risk management courses, to help beginners establish a solid foundation. However, NKVO does not provide any such resources, increasing potential risks for novice users who trade without adequate support.

5.2 Lack of Professional Market Analysis and Real-Time Data

Professional market analysis and real-time data are essential for informed trading decisions. Many established platforms offer professional market analysis, charting tools, and trading signals to help users assess market trends more accurately. However, NKVO does not provide such tools and resources, which could lead to decision-making errors for users who rely on this platform for trading.

6. Conclusion: NKVO Platform’s Potential Risks and Investor Considerations

In summary, while NKVO has an old domain name, it lacks transparency, regulatory compliance, and fund security measures, which raises serious concerns. The platform does not disclose company registration or regulatory information, lacks transparency on account types and trading conditions, provides no specific deposit or withdrawal methods, and fails to implement any fund protection measures, all of which cast doubt on its legitimacy and security.

For investors, choosing a trading platform should prioritize the platform’s regulatory compliance and fund security, with due diligence to verify its credentials. It is advised that investors exercise caution with non-transparent platforms like NKVO to avoid potential financial risks. For those with higher requirements for fund security and trading transparency, choosing a regulated, transparent trading platform is recommended.

Frequently Asked Questions (FAQ)

1. Is NKVO regulated?

To date, NKVO has not provided any information about oversight by financial regulatory bodies, raising concerns about the platform’s legitimacy and fund safety.

2. What types of accounts does NKVO offer?

NKVO has not disclosed any account types or detailed trading conditions, so investors have no clear understanding of fees and leverage levels.

3. What deposit and withdrawal methods does NKVO support?

NKVO has not disclosed its deposit and withdrawal methods or associated fees, leaving users uncertain about transaction processes and timing.

4. Does NKVO provide any fund protection measures?

NKVO does not specify any fund protection measures, such as SSL encryption and client fund segregation, which may pose a risk to investors’ personal information and funds.

5. Does NKVO offer educational resources or market analysis support?

NKVO does not provide any educational resources or market analysis tools, so beginners and inexperienced investors should approach trading on this platform with caution.

6. How can investors determine if a trading platform is safe?

When selecting a trading platform, investors should verify its registration and regulatory information, clear account information, fund protection measures, and user reviews to ensure safe trading and data security.