OTA Markets, founded in 2024, offers a range of trading products. However, its lack of regulatory oversight and insufficient transparency raise significant concerns for investors.

Company Background: The Founding and Operations of OTA Markets

1.1 Recently Established with Limited Experience

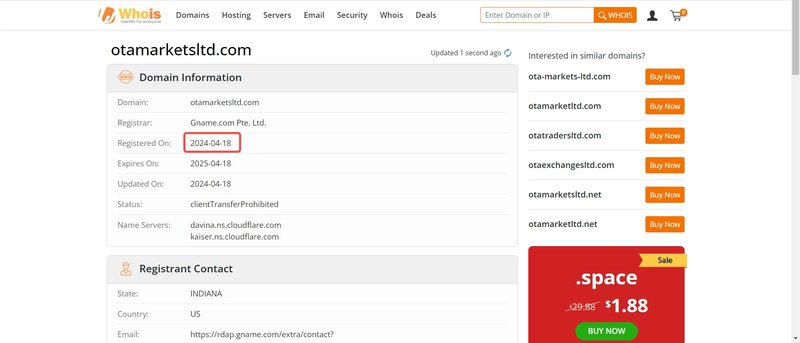

OTA Markets registered in 2024 with headquarters at 30 Hudson St, Jersey City, NJ, USA. The company’s domain, created on April 18, 2024, reflects its brief operational history and limited industry experience. Investors typically seek brokers with established track records for greater reliability and security, making OTA Markets a riskier choice due to its newness and lack of reputation.

1.2 Unregulated Status and Registration Issues

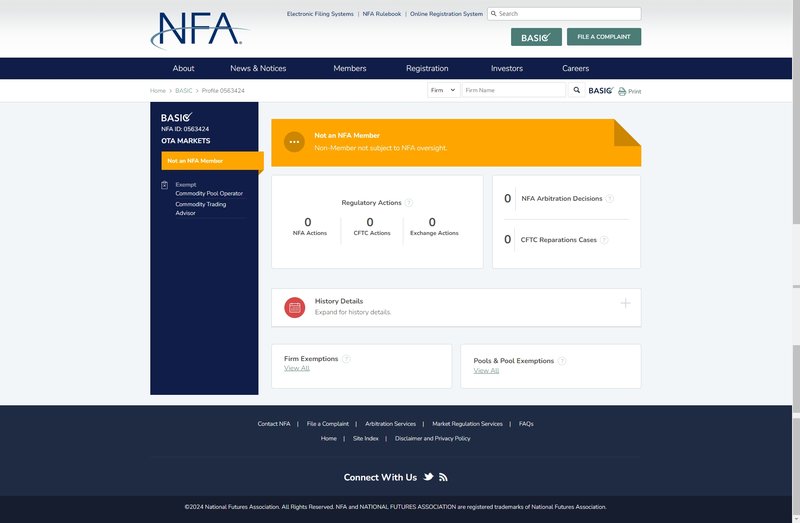

OTA Markets Co. Ltd. operates as a registered entity in the US but is not regulated by the National Futures Association (NFA); it is only registered as a non-member entity. As such, OTA Markets’ business practices are not monitored by the NFA, which raises concerns for investor protection. Regulatory oversight is crucial to ensure lawful, safe trading and to hold brokers accountable, protecting investors from potential losses due to misconduct.

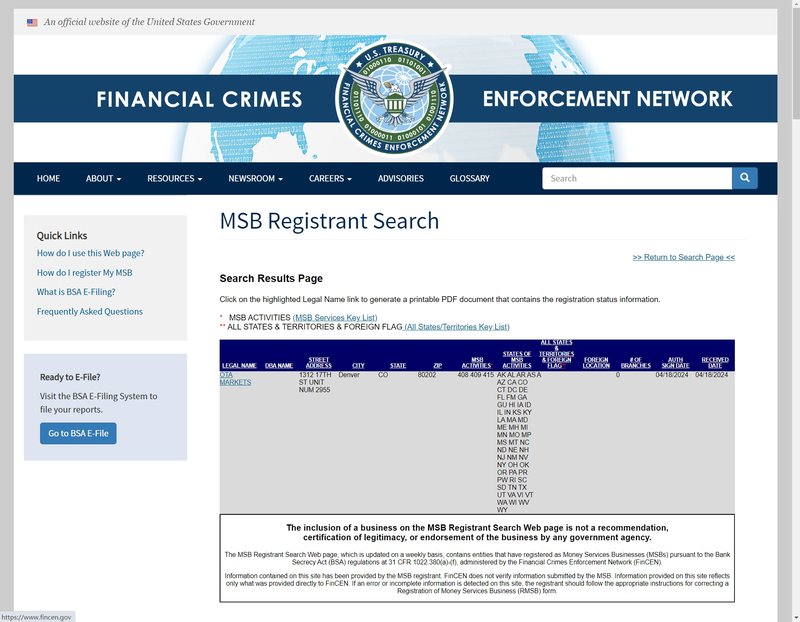

1.3 Misleading MSB Registration

Although OTA Markets holds a Money Services Business (MSB) ID from the US, this does not equate to financial regulatory oversight. The MSB’s focus is primarily on anti-money laundering and financial crime prevention, rather than monitoring trading practices. This type of registration may mislead investors into thinking OTA Markets is regulated; in reality, it does not ensure any oversight of its trading services.

Domain Analysis: New Domain Raises Credibility Concerns

2.1 Domain Registration Details

OTA Markets’ domain was registered on April 18, 2024, suggesting a lack of long-term market presence. Brokers with newly registered domains are generally higher-risk due to the potential for rapid closure resulting from regulatory or financial issues. A trading platform’s reliability and operational stability are critical factors for investors when selecting a broker.

2.2 Risks of Short-Term Platforms

Short-lived platforms often lack industry reputation and may shut down at any time due to market pressures or operational issues. Investors must exercise extreme caution when choosing brokers with short operational histories, as such brokers may not provide long-term customer protections or secure fund handling.

Trading Products: Diverse Offerings but Lacking Key Details

3.1 A Range of Financial Products

OTA Markets claims to offer multiple financial products, including forex, precious metals, crude oil, and indices, providing a diverse range of investment opportunities. For example, investors can trade major currency pairs (such as EUR/USD and GBP/USD) and cross-currency pairs (such as EUR/GBP and AUD/JPY). While these products provide variety for different trading preferences, the lack of transparency around conditions poses issues.

3.2 Lack of Essential Trading Information

However, OTA Markets fails to disclose detailed trading conditions on its website, including spreads, leverage, and fees, which are crucial for understanding costs and risks. Spread and leverage details directly impact trading costs and risk levels, so the absence of such information makes it difficult for investors to make informed decisions.

Regulatory Issues: A High-Risk Platform Without Proper Oversight

4.1 Risks of Non-Membership Status

OTA Markets’ registration status as a “non-member” entity with the NFA means it is not subject to any regulatory scrutiny. The US forex and futures markets are tightly regulated by entities like the NFA to ensure transparency and provide investor protections. Without membership, OTA Markets has no obligation to uphold these standards, leaving investors’ funds and activities unprotected.

4.2 Limited Scope of MSB Registration

The MSB ID that OTA Markets holds does not provide regulatory coverage for its trading activities. MSB registration is primarily aimed at preventing money laundering and other illegal activities but does not regulate financial product trading. Investors may mistakenly believe that the MSB ID offers security; however, it does not cover the safety of trading activities.

Risks of Information Opacity: Potential Dangers for Investors

5.1 Issues from Lack of Transparency

OTA Markets’ website lacks comprehensive information on account types and trading conditions, leading to an overall lack of transparency. For investors, having incomplete information about costs and risks makes decision-making difficult. Transparent trading information allows investors to assess risks accurately, whereas opaque brokers often pose challenges and hidden dangers.

5.2 Impact of Insufficient Transparency on Investment Decisions

Opaque brokers can easily take advantage of investors through unclear fees or unfavorable trading conditions. OTA Markets’ lack of transparency makes it difficult to gauge the actual costs and risks of trading with them, suggesting that investors should exercise caution when dealing with this broker.

Conclusion: Investors Should Approach OTA Markets with Caution

In summary, OTA Markets offers a range of trading products, but its short operational history, lack of effective regulation, and insufficient transparency significantly increase investment risks. In terms of regulatory status, trading information, and customer support, this platform does not meet the standards typically expected by financial investors. Investors should carefully consider these risks before choosing to trade with OTA Markets.

FAQ

- Is OTA Markets regulated?

Answer: No, OTA Markets is not regulated by the National Futures Association (NFA); it is only registered as a non-member entity, lacking regulatory oversight. - Does the MSB ID ensure trading safety?

Answer: The MSB ID only applies to anti-money laundering controls and does not cover the safety of financial product trading. - What are the trading conditions on this platform?

Answer: OTA Markets has not disclosed details on spreads, leverage, or fees, making trading conditions and costs unclear. - Why are brokers with short operational histories risky?

Answer: Short-lived brokers often lack industry experience and reputation, and may lack stable fund management and security measures. - Is trading on OTA Markets safe?

Answer: Due to the lack of regulation and transparency, trading with OTA Markets carries high risks, and investors should proceed cautiously. - What products does OTA Markets offer?

Answer: The broker offers forex, precious metals, indices, and crude oil, but does not provide specific details on trading conditions.