NKVO, an online cryptocurrency trading platform claiming to have launched in 2007, raises concerns due to its lack of transparency and regulatory support. Caution is advised when using this platform.

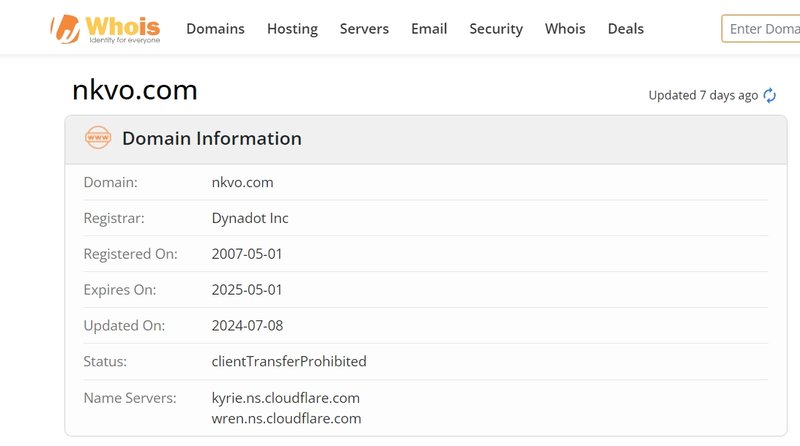

1. Domain Registration: Long History but No Security Assurance

NKVO’s domain was registered on May 1, 2007. While a long-standing domain might suggest longevity, it does not directly indicate safety or legitimacy. Generally, reputable financial platforms openly display their company registration details, including the name of the registered company and operational information. However, NKVO’s website lacks detailed information about its corporate background. This absence of legal registration and operational transparency leaves the platform’s legitimacy in question.

2. No Company Registration: The Platform’s Operational Background Is a Mystery

Typically, financial platforms will clearly provide details about their registered company, including corporate name, headquarters address, and legal qualifications. However, NKVO has not offered these essential details on its website. This lack of transparency could be a red flag, especially in the financial trading sector. Investors find it difficult to assess the platform’s legality and whether it complies with local and international regulations.

2.1 The Impact of Missing Corporate Registration Details

For participants in financial markets, company registration details offer assurance that the platform is operating within a legal framework. When a platform lacks registration information, user protections are limited, leaving users without a legal recourse if any dispute or security concern arises. This lack of information may make it challenging for investors to safeguard their funds when using NKVO.

3. No Regulatory Support: Platform’s Legitimacy Is at Significant Risk

Compliant financial platforms typically need approval from the financial regulators in their country or region. For example, U.S.-based trading platforms must be regulated by the U.S. Securities and Exchange Commission (SEC), while UK-based platforms are overseen by the Financial Conduct Authority (FCA). For users, regulatory oversight is a critical indicator of platform safety and reliability.

3.1 Risks of Operating Without Regulation

Without oversight from regulatory authorities, investors lack legal protection for their funds and personal information. With no regulatory support, NKVO’s operational practices cannot be validated for legality, nor can the safety of user funds on the platform be guaranteed. This situation implies that traders choosing NKVO may face higher financial risks.

3.2 Importance of Regulation: Protecting Investor Rights

Regulated trading platforms are typically required to follow strict fund segregation practices to prevent co-mingling company and user funds, thereby protecting user funds. Additionally, regulated platforms must offer anti-money laundering safeguards and data protection for customers. Since NKVO lacks such regulation, users face greater risks due to missing protections.

4. Opaque Trading Information: Account Types and Fees Not Disclosed

Most professional trading platforms publicly disclose account types and corresponding trading terms, such as leverage, spreads, and commissions, allowing users to evaluate trading costs and risks. However, NKVO provides no detailed descriptions of account types or trading terms, leaving fees and costs entirely unclear. This lack of information not only prevents users from assessing costs but also leaves room for hidden fees.

4.1 Importance of Transparent Account Types and Conditions

When opening an account, investors typically consider the account type, deposit requirements, fees, and other specific conditions. The more transparent the account types, the more users can be aware of costs and choose appropriately based on their risk tolerance. NKVO’s failure to disclose these essential details leaves users uncertain about potential costs during transactions, which impacts the user experience.

4.2 Potential Risks of Unclear Fees

If users are unaware of the platform’s fee structure before trading, they may encounter high hidden costs or unpredictable trading conditions. This not only can lead to unnecessary trading losses but also creates distrust between investors and the platform, leading to financial security risks.

5. Undisclosed Trading Software: Platform’s Technical Reliability Is Questionable

NKVO does not disclose the trading software it uses, nor does it clarify whether it employs widely recognized systems (such as MetaTrader 4 or MetaTrader 5) or a proprietary trading platform. The software a platform uses affects the overall user experience, especially in terms of real-time trading, technical analysis, and stable market price updates. Without information on its software, NKVO makes it challenging for users to assess its technical framework and reliability.

5.1 The Role of Trading Software

Established platforms typically use well-known trading software, ensuring speed and accuracy in trades and avoiding order delays. If a platform lacks transparent software details, users cannot assess if the system is backed by a reliable infrastructure, casting doubts on trading quality.

5.2 Technical Risks with NKVO

Undisclosed trading software may lack adequate security, functionality, and stability. Users choosing such a platform may experience data lags or inaccurate trade execution, which can greatly affect trading operations and increase investment risks.

6. Opaque Deposit and Withdrawal Methods: Fund Flow at Risk of Blockage

Compliant platforms typically detail deposit and withdrawal methods, such as bank transfers and e-wallets, and specify processing times and fees to help users manage their funds. However, NKVO has not clarified its accepted deposit and withdrawal methods or any associated fees. This lack of transparency regarding fund flow creates uncertainties for users and increases risks related to fund operations.

6.1 Risks Associated with Non-Transparent Fund Management

For traders, the fluidity of deposits and withdrawals is critical as it directly impacts fund security and flexibility. If fund flow is not transparent, users may face limitations or high fees when they need to access their funds. Furthermore, a lack of clear fund flow on a platform increases the risk of delayed withdrawals or payout restrictions, potentially leading to losses.

7. Lack of Customer Support Options: Responsiveness in Question

Currently, NKVO does not provide clear customer support methods on its website. Compliant platforms generally offer a range of support channels, such as live chat, phone support, and email support, ensuring users can get timely assistance if needed. NKVO, however, does not list any specific customer support channels, so users may struggle to get help if an issue arises.

7.1 Importance of Customer Support

Timely customer support is crucial to a financial platform’s credibility, especially in cases of platform malfunction or account security issues. Without specific support channels, users on NKVO may lack vital communication pathways in case of issues, affecting their trading experience.

7.2 Impact of Lack of Customer Support Options on NKVO

Ineffective customer support could leave users without assistance when sudden issues occur during trading. This lack of customer service could prevent users from resolving critical issues with their funds, further weakening trust in the platform.

8. Absence of Educational Resources and Market Analysis: Limited Support for Beginners

NKVO does not provide any educational resources or market analysis tools. Typically, established financial platforms offer educational materials, market trend analysis, and technical training to help novice investors better understand the market and trading strategies. NKVO’s lack of resources leaves new users with limited guidance, increasing the risk of poor trading decisions.

8.1 Necessity of Educational Resources

Educational resources and market analysis tools can improve users’ investment knowledge and help them make informed trading decisions. A platform without educational resources lacks guidance for novice investors, negatively impacting trading outcomes.

NKVO, an online cryptocurrency trading platform claiming to have launched in 2007, raises multiple concerns due to a lack of transparency, no company registration, absence of regulatory oversight, and undisclosed deposit and trading terms. These issues make it challenging for investors to trust the platform’s safety. Potential users are advised to carefully assess these risks before choosing NKVO, as unneeded financial risks could arise.

FAQ

1. Is NKVO regulated by financial authorities?

NKVO does not provide any information about financial regulation, meaning users may lack legal protection when trading on the platform.

2. Are trading fees and terms disclosed?

NKVO does not disclose account types, trading fees, or other essential trading terms, leaving users uncertain about platform costs.

3. What trading software does NKVO use?

NKVO has not specified its trading software, making it difficult for users to assess its technical reliability and functionality.

4. How can I deposit or withdraw funds on NKVO?

NKVO does not disclose its deposit or withdrawal methods or any associated fees, creating uncertainty for users when managing their funds.

5. Does NKVO provide customer support?

NKVO does not list specific customer support methods, making it difficult for users to get timely assistance if issues arise.

6. Are there any educational resources on NKVO?

The platform does not provide educational resources or market analysis, making it particularly limited for beginner traders.