Secured Meta Fx claims to be an international financial brokerage firm established in 2009, offering multiple investment plans. However, verification of its actual credentials and regulatory status reveals concerns, including possible misrepresentation on social media and company registration, as well as unrealistic return promises. Investors should approach with caution.

1. Company Background

Secured Meta Fx claims to have been established in 2009 and states that it operates across 15 countries. According to its website, the management team has over 14 years of industry experience, with monthly trading volumes reportedly exceeding $80 billion. Additionally, the company claims to have received over 30 international industry awards. These listed achievements are intended to boost its credibility within the financial market.

1.1 Company Structure and International Expansion

Secured Meta Fx claims a global reach in multiple countries, intending to convey its status as an international operator. However, a search for company specifics shows that Secured Meta Fx has not disclosed details such as office locations or the background of its operational team. International financial institutions typically provide transparent corporate information, including headquarters and branch office locations, which Secured Meta Fx lacks.

1.2 Alleged Industry Achievements

Secured Meta Fx claims over 30 industry awards but does not provide specific award information or the names of the awarding organizations. Awarding bodies typically announce recognized financial awards, such as “Best Trading Platform” or “Customer Service Award,” publicly. The awards mentioned on the Secured Meta Fx website are vague and lack credibility.

2. Domain Information and Registration Timing

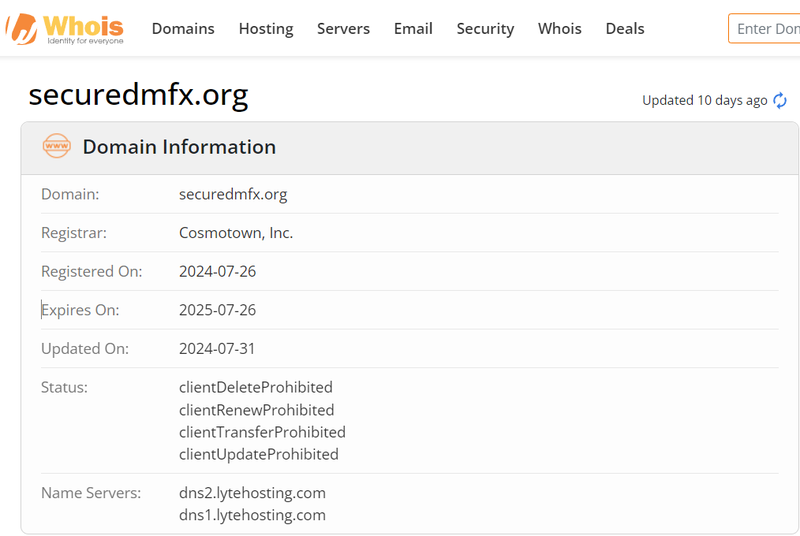

2.1 Discrepancies in Domain Registration Dates

Secured Meta Fx claims it began in 2009, but research shows its domain was registered only recently. This discrepancy raises questions, as a legitimate company founded long ago would likely have registered its domain name early on. The mismatch between the claimed founding year and domain registration adds to concerns about potential misrepresentation.

2.2 Multiple Suspected Related Websites

Further investigation revealed that several websites with almost identical content and layout to Secured Meta Fx also exist, including Livo Fx Trade, Zenith Financial Group Market, and Golden Pawn Trades Market. Such similarities appear in page layouts, service descriptions, and investment plans. Similarly designed websites often indicate that the same team controls them, aiming to attract investors from different regions. Fraudulent financial schemes commonly use this approach, launching multiple brands to create a semblance of legitimacy.

3. Issues with Registration and Regulatory Compliance

3.1 Authenticity of Australian Registration Number

Secured Meta Fx claims to be registered in Australia with the company registration number 2018AD947. However, a search with the Australian Business Register (ABR) reveals no matching information. Legitimate financial companies typically have complete and public records with their national business registries. The absence of such information for Secured Meta Fx further deepens doubts about its compliance and authenticity in the financial sector.

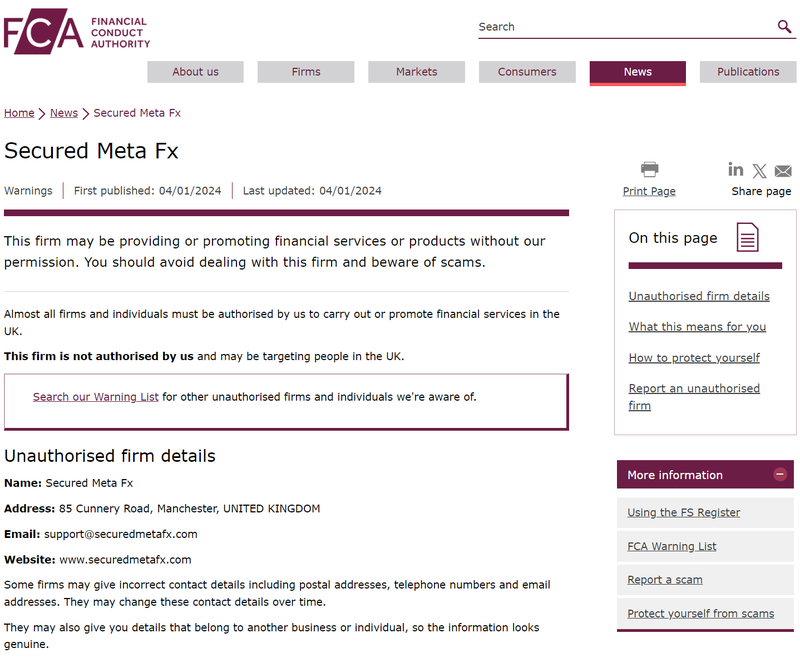

3.2 FCA Warning in the UK

On April 1, 2024, the UK Financial Conduct Authority (FCA) issued a warning about Secured Meta Fx, stating that the company lacks authorization to provide financial services in the UK. This means that all financial activities by Secured Meta Fx within the UK are unlawful, and the contact details and company address it provides may be fake. The FCA warning raises further concerns, suggesting the company engages in non-compliant activities and makes it difficult for investors to safeguard their funds.

4. Fake Social Media Links and Lack of Transparency

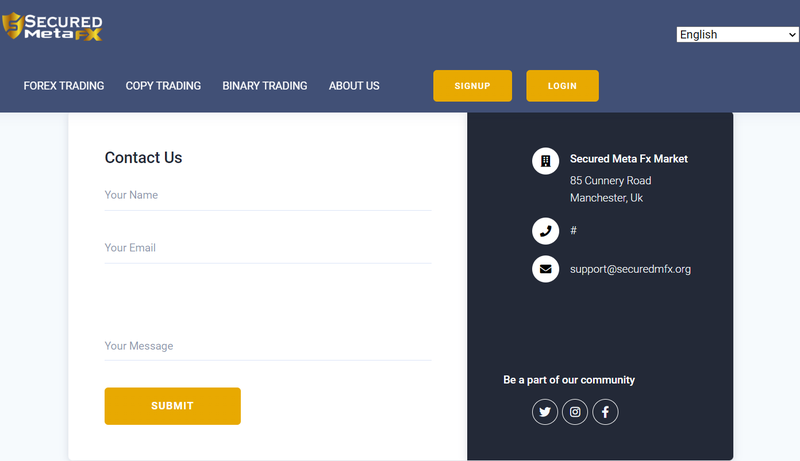

4.1 Fake Social Media Links

The Secured Meta Fx website displays social media icons for platforms like Facebook, Instagram, and Twitter. However, clicking these icons reveals that they do not link to any actual company pages. Typically, legitimate financial institutions use social media to promote their brand and communicate with clients, increasing their transparency and credibility. Secured Meta Fx lacks these channels, instead using inactive links to create a false sense of authority on its website.

4.2 Lack of Transparency in Company Information

In addition to missing social media profiles, Secured Meta Fx does not disclose information about its actual company management, financial experts, or trading teams. Legitimate financial companies often display the backgrounds and qualifications of their management team to earn clients’ trust. Secured Meta Fx’s lack of disclosure adds to concerns over its authenticity and regulatory compliance.

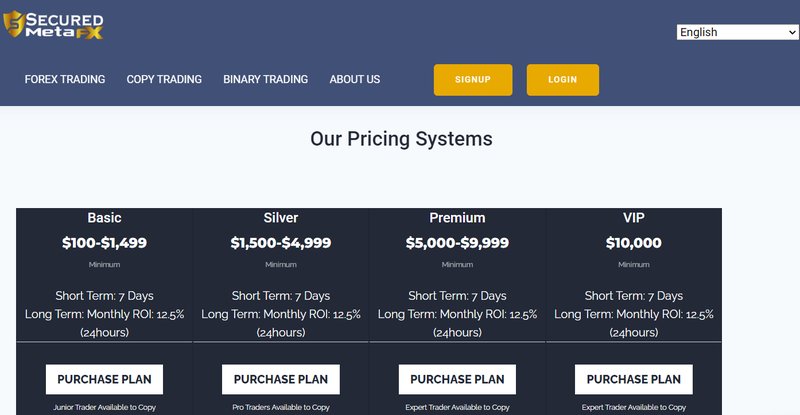

5. Doubts about Investment Plans and Return Rates

Secured Meta Fx offers clients four investment plans—Basic, Silver, Premium, and VIP. Each plan involves different investment amounts and anticipated returns (ROI), with a fixed monthly return rate of 12.5%.

5.1 Analysis of Each Investment Plan

- Basic: Investment between $100 and $1,499, term of 7 days, monthly ROI of 12.5%, with daily profit settlements.

- Silver: Investment between $1,500 and $4,999, term of 7 days, monthly ROI of 12.5%, with daily profit settlements.

- Premium: Investment between $5,000 and $9,999, term of 7 days, monthly ROI of 12.5%, with daily profit settlements.

- VIP: Minimum investment of $10,000, term of 7 days, monthly ROI of 12.5%, with daily profit settlements.

5.2 Unusually High Return Rates

The fixed 12.5% monthly ROI promised by Secured Meta Fx, regardless of market performance, is highly unusual in financial markets, which are subject to volatility. Such a high fixed return promise is typically a red flag for potential financial scams, as high returns in legitimate financial markets are difficult to sustain over time. Fixed high returns are often a hallmark of Ponzi schemes, where incoming funds are used to pay out early investors rather than actual investment growth.

6. Lack of Transparency in Fund Transfer Methods

6.1 Unpublished Deposit and Withdrawal Methods

Secured Meta Fx has not disclosed its fund transfer methods or related fees on its website. Legitimate financial companies typically provide clear information about deposit and withdrawal options, processing times, and any additional fees so that investors can manage their expectations regarding fund movement. The lack of such information on Secured Meta Fx’s website raises concerns over the safety of funds.

6.2 Control over Fund Flow

The investment plans and profit settlements outlined by Secured Meta Fx suggest that the company exerts significant control over investor funds. Daily profit settlements may seem to offer liquidity, but under high fixed returns, the risk of fund misappropriation remains high. Without a transparent system for fund flows, investors cannot track the status or safety of their money, increasing the risk of potential fund misuse.

7.

Secured Meta Fx presents numerous concerns in its founding date, registration information, social media, fund transparency, and promised returns. The company’s website claims high returns, numerous international awards, and regulatory compliance, but verification shows these claims to be questionable at best. In addition, the FCA warning and domain registration data confirm Secured Meta Fx’s questionable credibility. Investors should exercise caution and choose regulated financial institutions that provide transparency, realistic returns, and investor protections.

FAQ

Q1: Is Secured Meta Fx a regulated company?

A: No, Secured Meta Fx does not have any formal authorization from any national regulatory authority. It has been listed on the Financial Conduct Authority (FCA) warning list, indicating potential compliance risks.

Q2: How can I verify if a financial company is regulated?

A: You can check the relevant national regulatory authorities, such as the FCA in the UK or ASIC in Australia, to confirm a company’s registration and authorization status.

Q3: Is the fixed monthly return rate of 12.5% realistic?

A: Fixed high monthly returns like 12.5% are unrealistic in legitimate financial markets. Given market volatility, fixed high-return promises often indicate potential financial scams.

Q4: What are the risks of investing in Secured Meta Fx?

A: Risks include a lack of regulatory oversight, lack of transparency in fund flows, false promises of high returns, and missing social media pages, which could make it difficult to recover funds or lead to substantial losses.

Q5: How can I protect myself from being scammed by fake platforms?

A: Always verify registration details and choose regulated financial institutions. Avoid high-return promises and carefully review terms, fees, and transaction conditions before investing.