Elixo Trade claims to offer a variety of financial trading services but lacks regulatory credentials and transparency. Investors should be aware of the potential risks.

I. Company Background: An Overview of Elixo Trade

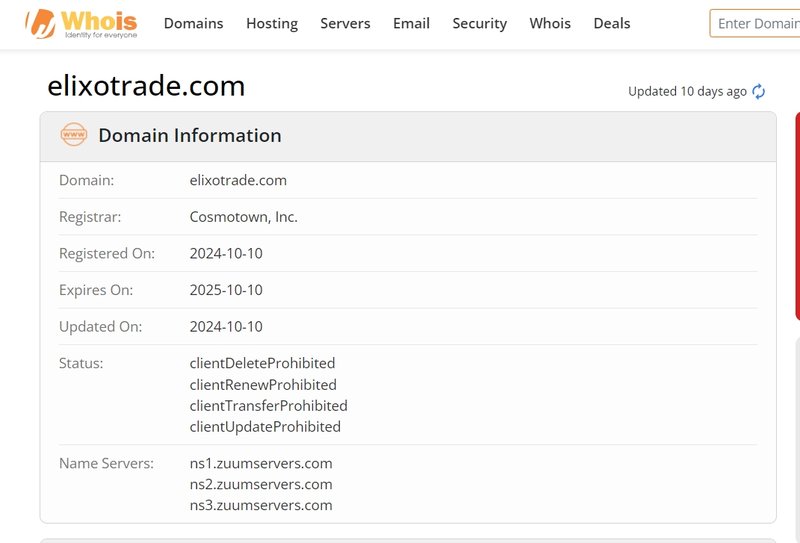

Elixo Trade is a new online financial trading platform claiming to provide services across various financial products, including forex, cryptocurrency, and commodities. The platform’s domain, https://elixotrade.com/, was registered on October 10, 2024. However, clear records of the company’s registration and operational background are yet to be found in the market. This lack of transparency raises trust concerns for investors who may consider using this platform.

II. Domain Information: Potential Risks of a Newly Registered Domain

Elixo Trade’s domain, elixotrade.com, was registered on October 10, 2024, making it a very recent entrant to the financial sector. Typically, the credibility of financial trading platforms is closely related to their market history, with long-standing platforms with user feedback generally being more stable and secure. In contrast, Elixo Trade has not yet accumulated sufficient market records or historical user reviews, posing potential trust risks for investors considering the platform.

2.1 Risks Associated with a Short-Term Domain

In the financial sector, scam platforms often attract investors through short-term domains and then close quickly once they have amassed enough funds, evading legal responsibility. The short registration history of Elixo Trade’s domain and lack of operating history warrant caution from investors to avoid substantial investments in such platforms.

III. Entity Information: No Registered Company Information

Elixo Trade claims to be a multifunctional financial platform offering diverse trading products. However, upon verification, no official company registration or physical address for Elixo Trade could be located. This indicates that Elixo Trade may not be legally registered, and its lack of disclosed corporate information poses significant challenges for investors if issues arise.

3.1 Potential Risks of an Unregistered Entity

For investors, company registration information is a critical factor in assessing the safety of a financial platform. Legitimate financial platforms typically disclose their registration information and office addresses for user verification. The lack of such information from Elixo Trade leaves investors’ funds unprotected. Should any disputes or technical issues arise, users will find it challenging to pursue recourse, with limited avenues for legal action.

IV. Regulatory Information: Elixo Trade Lacks Regulatory Credentials

In the financial industry, regulatory credentials form the foundation for a platform’s legitimacy and reliability. Elixo Trade is believed to be an unregulated platform, lacking certification from authoritative bodies like the Financial Conduct Authority (FCA). Unregulated financial platforms typically cannot ensure user fund safety, making it difficult for investors to seek legal recourse in case of financial issues. Therefore, investors should be vigilant and cautious when considering Elixo Trade as a trading option.

4.1 Risks of Unregulated Platforms

Without legal oversight, unregulated platforms may not adhere to industry standards, potentially exposing users to fund risks in trading. If a platform closes down or operates irresponsibly, users have limited avenues to reclaim funds. Recently, there have been numerous cases of unregulated platforms disappearing with investors’ funds, and this risk exists with Elixo Trade as well.

4.2 Real Cases of Unregulated Platforms

In financial markets, many unregulated platforms attract investors by promising high returns without the necessary legal backing. Certain well-known cases show how unregulated platforms use exaggerated profit claims to attract investors and then shut down when enough funds have been gathered, leading to heavy investor losses. The Bitconnect incident is one such example, where the platform promised high returns to users but collapsed due to a lack of funds, resulting in billions of dollars in losses for investors globally.

V. Account Types and High Return Promises: A Rational Evaluation of Potential Risks

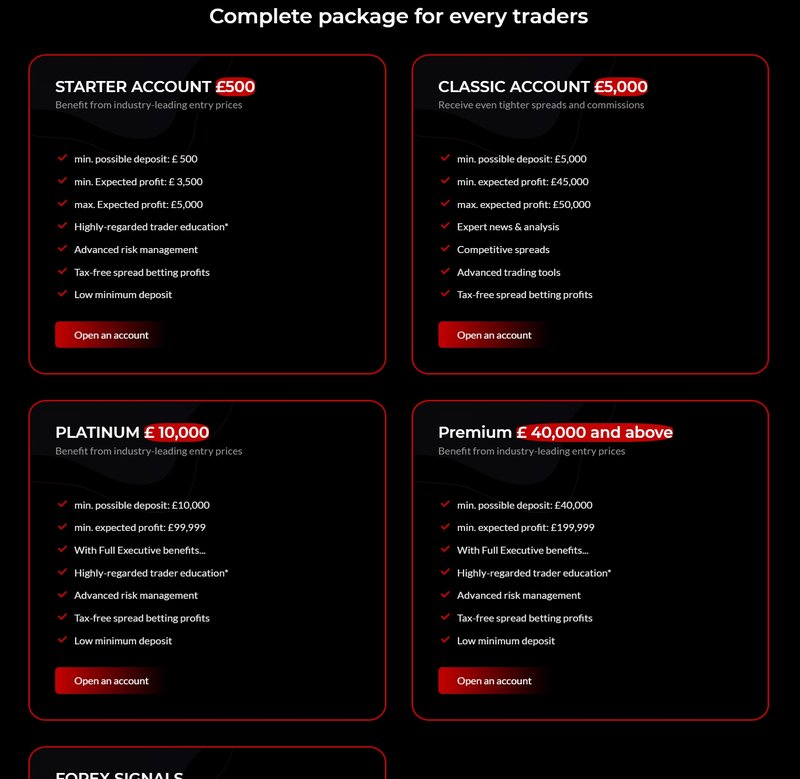

Elixo Trade offers three types of accounts designed to cater to different investor needs:

- Starter Account: Minimum deposit of £500, with projected profits ranging from £3,500 to £5,000, suitable for beginner investors.

- Classic Account: Requires a minimum deposit of £5,000, with an estimated profit of £45,000 to £50,000, aimed at experienced investors.

- Platinum Account: Minimum deposit of £10,000, with projected profits reaching up to £99,999, targeting high-end investors.

While these accounts advertise high returns, investors should critically assess their realism and feasibility. Generally, regulated financial platforms are cautious about guaranteeing high profits, making Elixo Trade’s promises questionable. Additionally, high minimum deposit requirements, particularly for accounts offering higher returns, could increase investors’ fund risks.

5.1 The Relationship Between High Returns and High Risks

In financial investments, high returns are often accompanied by high risks. For unregulated platforms, return promises may simply be a tactic to attract users, with actual profitability highly uncertain. When considering platforms like Elixo Trade, investors should account for the platform’s operational background, regulatory credentials, and market reviews to avoid overlooking potential risks due to the allure of high returns.

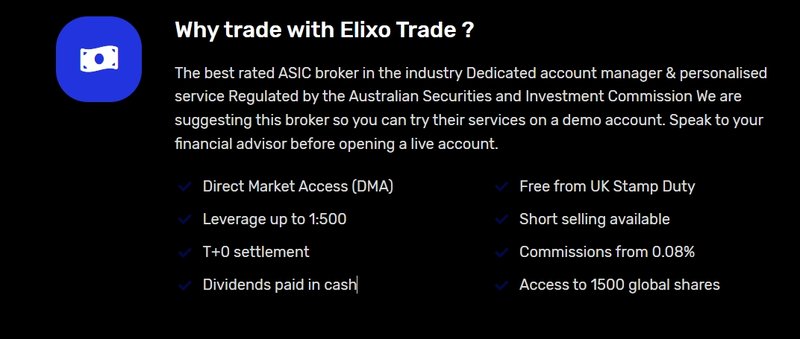

VI. High Leverage and Transaction Fees: Are the Attractive Trading Conditions Reliable?

Elixo Trade offers leverage of up to 1:500 and commission fees starting at 0.08%. While high leverage can amplify profits, it also increases risks, particularly on unregulated platforms where higher leverage often translates to higher potential losses for investors. Although the 0.08% commission may appear low, additional fees may arise during high market volatility, raising transaction costs for investors.

6.1 Risks of High Leverage

High leverage trading is often used as an attraction, yet it carries greater risks. For inexperienced investors, high leverage increases the likelihood of losses, especially on unregulated platforms without effective risk control mechanisms. Investors should carefully consider the risks of high leverage when evaluating Elixo Trade.

6.2 Lack of Transparency in Transaction Fees

Although Elixo Trade advertises low commissions, its fee structure lacks transparency, and trading costs may rise during high market volatility. On unregulated platforms, it is difficult for investors to verify actual transaction fees, and increased trading costs directly impact profitability.

VII. Conclusion: Evaluating the Investment Risks of Elixo Trade

In conclusion, Elixo Trade, as an unregulated and unsupported trading platform, presents significant investment risks. The platform attracts investors with promises of high returns, high leverage, and low commission but lacks transparent company information and regulatory credentials. Investors should exercise caution and consider reliable platforms with strong backgrounds, positive reputations, and legal standing to avoid financial losses caused by unsubstantiated profit claims. Before investing in Elixo Trade, it is advisable for investors to thoroughly assess potential risks and make informed decisions.

FAQ

1. Is Elixo Trade regulated?

No, Elixo Trade is not certified by any financial regulatory authority and is an unregulated platform.

2. When was Elixo Trade’s domain registered?

Elixo Trade’s domain was registered on October 10, 2024, making it a newly established platform.

3. Are Elixo Trade’s high return promises reliable?

Elixo Trade’s promises of high returns lack substantial basis, and investors should be cautious to avoid falling for overly optimistic claims.

4. Is Elixo Trade’s leverage ratio suitable for beginners?

With leverage up to 1:500, Elixo Trade may pose significant risks for inexperienced investors due to the potential for large losses.

5. How can I identify an unregulated platform?

Investors should verify the platform’s company registration details, regulatory credentials, and user reviews to assess its legitimacy and avoid being misled by high return promises and exaggerated claims.