BoveiPro is a new online trading platform offering contracts for difference (CFDs) on forex, commodities, stocks, and cryptocurrencies. The platform claims to be headquartered in London and to be regulated by the National Futures Association (NFA) in the U.S. However, further investigation reveals inconsistencies in its registered address and doubts about its regulatory status. This article thoroughly examines BoveiPro’s background, address discrepancies, lack of regulatory certification, account requirements, leverage-related risks, and unclear payment methods to provide a clearer understanding of potential risks.

1. Background of BoveiPro: A New Online Trading Platform

1.1 Basic Information about BoveiPro

BoveiPro is an online platform that provides various financial products through its official website, boveipro.org. According to the platform, it offers a broad array of products, including forex, commodities, stocks, and cryptocurrency CFDs. Multi-asset platforms like BoveiPro provide investors with diverse investment options, but users must be cautious about the platform’s legitimacy and regulatory status.

1.2 BoveiPro’s Operational Goals

BoveiPro claims to be aimed at the global financial trading market, providing services through innovative technology and a seamless user experience. However, as a new entrant, BoveiPro lacks transparency in many areas and has yet to build a solid reputation. New trading platforms are typically riskier due to a lack of established risk control and customer feedback mechanisms. When choosing platforms like this, investors should pay close attention to the company’s regulatory credentials and the authenticity of its operational background.

2. Domain Registration Information: A Newly Established Platform

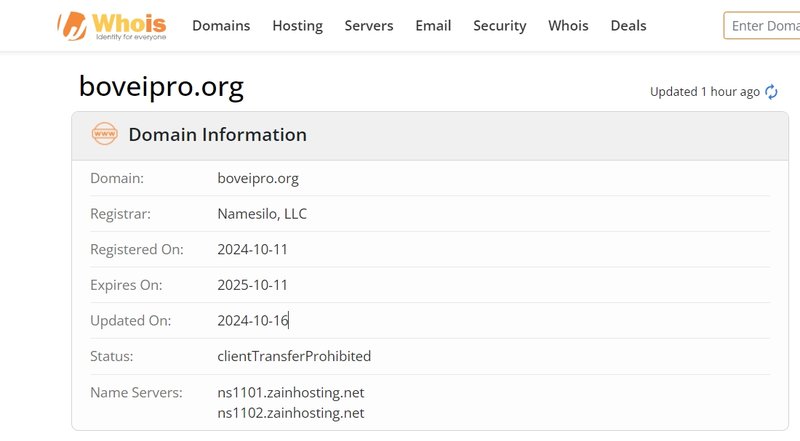

2.1 Basic Domain Registration Details

BoveiPro’s official domain, boveipro.org, was registered on October 11, 2024. This recent registration date suggests BoveiPro is a newly launched platform. Domain registration length is an essential factor for investors since longer-registered domains generally have a more established operational history. Given BoveiPro’s short registration history, it is not yet validated by the market over time.

2.2 Operational Risks Facing New Platforms

Newly established trading platforms generally face greater operational risks, including cash flow issues, limited user feedback, and underdeveloped security mechanisms. BoveiPro’s recent launch means that it may lack mature systems and risk controls, raising questions about its reliability. Investors should exercise caution when selecting a new platform, especially one without a solid reputation or experience in the industry.

3. Address Discrepancies: Conflicting Information on BoveiPro’s Location

3.1 The Address Claimed on the Official Website

On its website, BoveiPro claims its operational address is One Canada Square, Canary Wharf, E14 5AA, London, a prestigious location in London’s financial district. However, for a newly established platform, such an upscale location could mean high operating costs, which raises questions about the authenticity of this address.

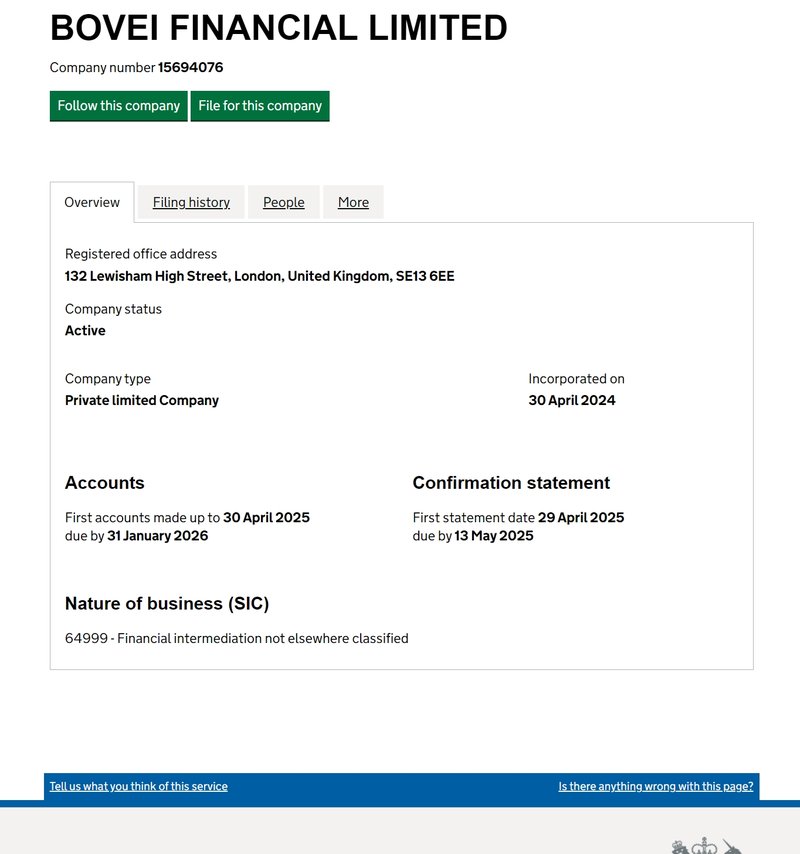

3.2 Actual Registered Address Differences

Further investigation reveals that BoveiPro’s registered address is 132 Lewisham High Street, London, United Kingdom, SE13 6EE. Additionally, company registration records indicate that BoveiPro was incorporated on April 30, 2024. The discrepancy between the registered and stated addresses suggests a lack of transparency in the company’s operations and potentially misleading promotional practices.

3.3 Risks Associated with Address Inconsistencies

For investors, the consistency of a trading platform’s operational and registered addresses is a key indicator of trustworthiness. If a platform provides a false address, it may hinder investors’ ability to track down the platform’s actual operations when disputes arise. Inconsistent address information can increase investors’ doubts about the platform’s legitimacy, adding to the uncertainty of using it.

4. Regulatory Doubts: BoveiPro Lacks Valid Regulatory Certification

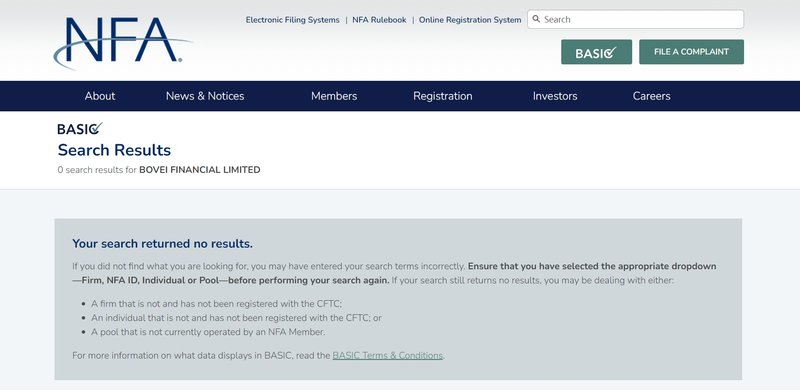

4.1 Claims of NFA Regulation, but No Actual Certification

BoveiPro claims it is regulated by the U.S.-based National Futures Association (NFA). However, further investigation shows that the platform is not registered with the NFA or any other major financial regulatory authority. Regulatory certification is essential to ensuring a trading platform’s legitimacy and adherence to financial industry standards. Without valid regulation, BoveiPro may fall short in key areas, such as fund management, trading transparency, and client protection.

4.2 The Role of FCA Regulation and Its Importance

The United Kingdom’s Financial Conduct Authority (FCA) is one of the most respected financial regulatory bodies worldwide, ensuring market transparency, fairness, and consumer protection. FCA-registered companies typically meet stringent financial requirements and adhere to strict client fund segregation and transparent reporting practices. In the U.K., companies conducting financial business without FCA authorization lack legal protections, which poses risks to client funds.

4.3 High Risks of Operating Without Regulation

Unregulated platforms lack an effective recourse for clients in case of disputes and do not provide any formal fund protection. BoveiPro’s lack of supervision from the FCA or other major financial regulatory bodies leaves client funds potentially vulnerable. For investors, it is safer to choose platforms authorized by regulatory agencies like the FCA or NFA to ensure their rights are protected.

5. Account Structure and Minimum Deposit Threshold

5.1 BoveiPro’s Account Types and Minimum Deposits

BoveiPro offers a variety of account types to cater to different investment needs:

- Bronze Account: Minimum deposit of $500, $0.01 per share, minimum fee of $1.5.

- Silver Account: Minimum deposit of $5,000, $0.008 per share, minimum fee of $1.5.

- Gold Account: Minimum deposit of $10,000, $0.007 per share, minimum fee of $1.5.

- Platinum Account: Minimum deposit of $25,000, $0.006 per share, minimum fee of $1.25.

- Diamond Account: Minimum deposit of $50,000, $0.005 per share, minimum fee of $1.

5.2 High Deposit Requirements Investors Should Note

The minimum deposit requirements at BoveiPro are relatively high, especially for Silver, Gold, and other premium accounts. Compared to other mainstream brokers, BoveiPro’s entry threshold is steep for small-scale investors. For beginners, high deposit requirements pose a risk, as they expose significant capital to a platform that lacks proven security and regulatory transparency.

6. Risks of High Leverage: High Leverage Means High Risk

6.1 Leverage Options for Retail and Professional Clients

BoveiPro offers high leverage, with different settings based on client type and asset class:

- Retail Clients: 1:30 leverage for major currency pairs, 1:20 for minor currency pairs, indices, and gold, 1:10 for other commodities and metals, 1:5 for stocks and ETFs, and 1:2 for cryptocurrencies.

- Professional Clients: Up to 1:200 leverage for major currency pairs, 1:100 for metals (excluding silver), 1:40 for commodities, indices, and silver, 1:20 for stocks and ETFs, and 1:5 for cryptocurrencies.

6.2 Risks of High Leverage

While high leverage offers trading flexibility, it significantly amplifies risk, especially in volatile markets. High leverage can result in substantial losses in a short time, making it risky for inexperienced traders without effective risk management strategies. Investors should exercise caution when using high leverage and ideally have strong market knowledge and risk control abilities.

7. Ambiguous Payment Methods: Lack of Transparency in Funds Flow

7.1 Limited Information on Payment Options

BoveiPro provides limited details on its deposit and withdrawal policies, showing only icons for Visa, MasterCard, and Skrill at the bottom of its website. The absence of clear information on deposit and withdrawal processes, fees, and timeframes makes it challenging for investors to understand how their funds will flow.

7.2 Potential Risks of Ambiguous Payment Information

Transparency in funds flow is crucial for investors. Clear information on deposit and withdrawal fees, processes, and timeframes is essential for protecting user funds. If these are not provided, investors may encounter unexpected charges or fund freezing risks. Ambiguous withdrawal policies can impact users’ ability to manage their cash flow effectively, increasing the cost and potential delays in fund movement.

8. Conclusion: Is BoveiPro a Suitable Choice for Investors?

While BoveiPro offers a range of financial products and high leverage flexibility, its lack of transparency in several key areas—including address discrepancies, missing regulatory certification, high deposit requirements, and vague payment methods—casts doubt on its reliability. Investors should pay close attention to the platform’s regulatory status and security measures before considering BoveiPro, ensuring they avoid unnecessary risks due to non-compliance or lack of transparency.

9. FAQ

1. Is BoveiPro regulated by a financial authority?

BoveiPro claims to be regulated by the NFA, but it is not actually registered with the NFA or any major financial regulatory authority. Investors should be cautious when choosing unregulated platforms.

2. What is the minimum deposit requirement on BoveiPro?

Minimum deposits start at $500 for the basic account, with higher-tier accounts requiring up to $50,000.

3. What leverage does BoveiPro offer?

BoveiPro’s leverage cap is 1:30 for retail clients and up to 1:200 for professional clients, varying by product.

4. Can BoveiPro’s registered address be trusted?

There is a discrepancy between BoveiPro’s website address and its registered address, which may indicate potential misrepresentation.

5. What payment methods does BoveiPro support?

BoveiPro displays support for Visa, MasterCard, and Skrill, but lacks detailed information on deposit and withdrawal procedures and fees.

6. How can investors choose a safe trading platform?

It is recommended to prioritize platforms regulated by agencies like the FCA or NFA to ensure fund safety and protect investor rights.