CentFX Company Background: A Detailed Overview of the Forex Broker

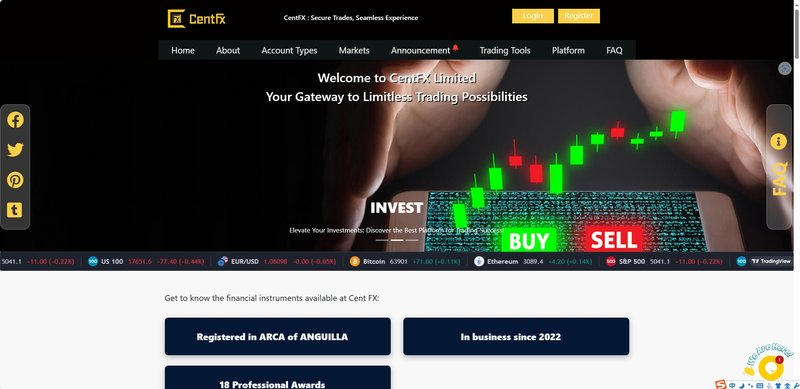

CentFX is a forex broker headquartered in Anguilla, registered in 2022 under the entity CentFX Limited, with the registration number A000000971. The company’s official address is Anguilla, No. 8 Cassius Webster Building, Grace Complex, The Valley, 1330. It primarily deals with forex, precious metals, cryptocurrencies, and indices.

Domain History and Company Background

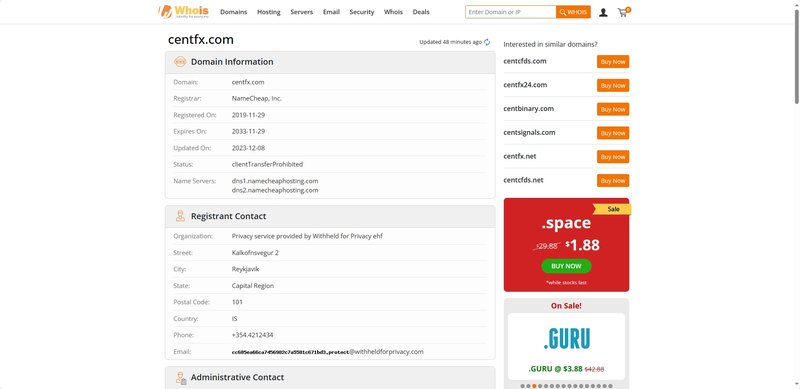

According to Whois, CentFX’s domain was registered on November 29, 2019. This indicates that the company set up its online platform before its official registration. This practice is not uncommon in the forex industry; many firms register domains in advance to prepare for future operations. However, the domain registration predates the company’s official registration by two years, which might hint at some underlying concerns. Investors should pay close attention to the alignment between the company’s founding date and the domain registration date, as discrepancies can sometimes indicate a lack of transparency or misleading advertising.

CentFX’s Regulatory Information: Legitimate or Misleading?

Claimed Regulatory Status

CentFX’s website claims that CentFX Limited is authorized and regulated by the Financial Services Commission (FSC) of Mauritius, with license number GB23201644. Such a regulatory claim is typically made to build trust and establish legitimacy with potential investors.

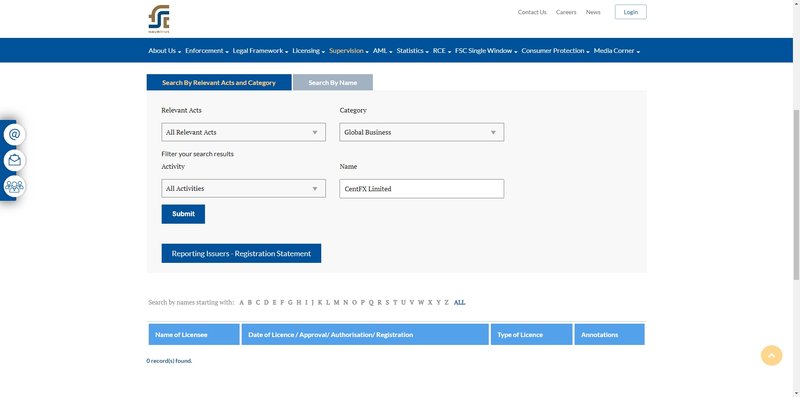

Investigation: Discrepancies in Regulatory Claims

However, upon investigating the FSC’s public database, no records of CentFX Limited being licensed could be found. This strongly suggests that CentFX’s website may be providing false regulatory information. It’s crucial for investors to verify the regulatory claims of any broker they consider, as companies that misrepresent their regulatory status may lack safeguards and transparency, posing significant risks such as fund misappropriation or sudden market exit. Authentic regulatory information is key to protecting investor interests, so confirming a broker’s legitimacy is essential.

CentFX’s High Leverage Advantage: Opportunities and Risks

The Appeal of Leverage

High leverage is a major attraction in the forex market. CentFX offers leverage up to 1:500, allowing traders to execute large trades with minimal capital. This high leverage can amplify potential profits but also significantly magnifies risks. For example, even small market movements against a trader’s position can lead to substantial losses or margin calls.

The Risks of High Leverage

For novice traders, high leverage may seem enticing but should be approached with caution. Traders who are not adequately trained or experienced in using leverage may quickly incur losses due to market volatility. Selecting a platform that offers a range of leverage options and learning proper risk management strategies is crucial for ensuring safe trading.

CentFX’s Spreads: Are They Truly Transparent?

What Are Spreads?

Spreads are one of the most common fee structures in the forex market, representing the difference between the buying and selling prices. It is the primary source of revenue for brokers, and the lower the spread, the lower the trading costs for investors.

CentFX’s Disclosure on Spreads

CentFX claims to offer competitive spreads but does not clearly specify spread values on its website. This lack of transparency is concerning for investors. Most reputable and transparent brokers publicly list the spreads for their major currency pairs, allowing traders to compare and make informed decisions. When a platform is vague about spreads, it could indicate hidden fees or less favorable trading conditions than advertised.

To protect their interests, investors should request detailed information on spreads before using a platform and compare the conditions with those offered by other brokers. Transparent brokers usually display bid-ask spreads openly rather than concealing them or providing vague information.

Funds Not Accessible Immediately: CentFX’s Deposit and Withdrawal Policies Explained

Deposit Methods and Fees

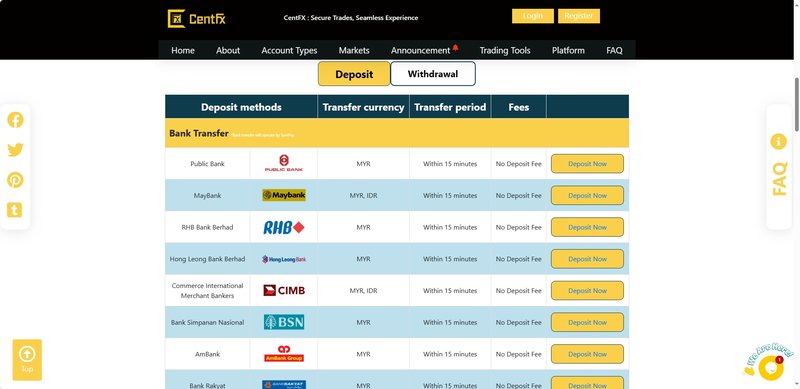

CentFX offers several deposit options, including bank transfers, electronic payments, and cryptocurrencies. According to the information on its website:

- Bank Transfer: Funds are credited within 15 minutes with no deposit fees.

- Electronic Payment: Takes between 15 minutes to 3 days, with STICPAY charging a 1% fee, while other methods have no fees.

- Cryptocurrencies: Funds are credited within 15 minutes with no deposit fees.

While these methods appear flexible, investors should be mindful of the time differences and fees, especially when urgent deposits are needed, as bank transfers and electronic payments may not be the fastest options.

Withdrawal Methods and Fee Analysis

CentFX’s withdrawal policies show certain inconveniences and costs:

- Bank Transfer: Withdrawals take up to 3 days and incur a 3% fee.

- Electronic Payment: Takes between 15 minutes to 3 days, with STICPAY charging a 5% fee, Perfect Money 1.5%, and other methods 2.5%.

- Cryptocurrencies: Takes up to 3 days, with a network fee plus an additional 2.5% fee.

Although CentFX provides several withdrawal options, the overall process is slow, and the fees are relatively high. Such policies may affect the liquidity of funds for frequent traders, impacting their trading efficiency and profitability. Therefore, understanding a platform’s fund movement policies is essential before selecting a forex broker, especially to avoid complications when urgent withdrawals are needed.

CentFX’s Trading Platforms and Customer Service: Technology and User Experience

Trading Platform Overview

CentFX offers a variety of trading platforms, including MetaTrader 4 (MT4) and MetaTrader 5 (MT5), which are among the most widely used forex trading software globally. MT4 and MT5 provide extensive technical analysis tools, Expert Advisors (EAs), and customizable trading interfaces suitable for traders of different levels.

However, the platform’s actual performance and stability are issues worth investigating. Some traders report delays or platform lags during high-volatility periods, which can significantly impact the accuracy and speed of trade execution. Therefore, it’s recommended that investors test the platform’s smoothness and reliability using a demo account before engaging in live trading.

Customer Support

CentFX claims to offer 24/7 customer support, with various contact options such as live chat, email, and phone. However, reviews of their customer service vary. Some users report slow response times or unresolved issues, which can be problematic for traders who rely on immediate support for trading matters. Before committing to a platform, it’s wise for investors to interact with the customer service team to gauge their responsiveness and service quality.

Is CentFX a Trustworthy Choice?

CentFX offers high leverage, diverse products, and various deposit and withdrawal options. However, its regulatory claims and withdrawal efficiency are concerning. Investors should verify CentFX’s details carefully and consider more established brokers for security and transparency.

Frequently Asked Questions (FAQ)

1. Why is CentFX’s domain registered earlier than its company founding date?

CentFX’s domain registration predates the company’s official establishment by two years. This could indicate the company’s intent to set up its online presence early, but investors should be cautious, as it could also suggest an attempt to mask the company’s background.

2. How transparent are CentFX’s spreads?

CentFX does not clearly disclose its spread levels on its website, which might indicate a lack of transparency. Investors should be cautious and compare spread information with other platforms before making a decision.

3. What deposit methods does CentFX offer?

CentFX supports bank transfers, electronic payments, and cryptocurrencies, with most deposits taking 15 minutes to process and no fees for the majority of options.

4. Why does CentFX’s withdrawal process take so long?

CentFX’s withdrawal process can take up to 3 days, especially for bank transfers, with a 3% fee, which may affect fund liquidity for traders.

5. Is CentFX’s regulatory information genuine?

There is no evidence to support CentFX’s claim of being regulated by the Financial Services Commission (FSC) of Mauritius. This raises doubts about its regulatory credibility.

6. Is CentFX suitable for beginner traders?

Given CentFX’s high leverage, unclear spread information, and restrictive withdrawal policies, novice traders should carefully consider whether the platform suits their needs.