BestAssetLimited claims to provide global forex, CFD, and other trading services, but it operates without any genuine regulation. Investors should be cautious of its false advertising and potential financial risks.

In the forex and CFD markets, legitimate and transparent brokers not only provide reliable trading services but also ensure the safety of investors’ funds. However, some brokers attract investors with false information, leading them into financial traps. BestAssetLimited is one such platform that has recently garnered attention. Despite claiming to be regulated by multiple authorities, a thorough investigation reveals that these claims are unfounded. This article will analyze BestAssetLimited’s background, domain registration information, regulatory status, minimum investment requirements, and the features of a suspected scam, helping investors understand its potential risks.

1. Overview: Basic Information About BestAssetLimited

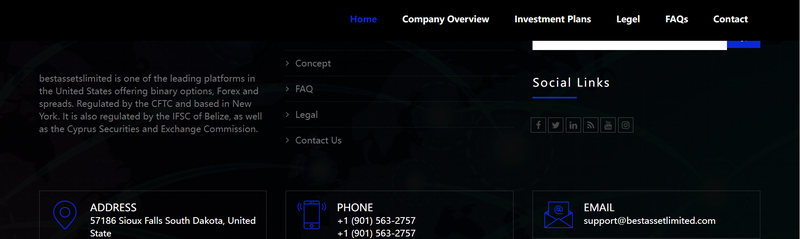

BestAssetLimited is a CFD broker registered on November 16, 2023, claiming to offer users access to forex, options, and CFDs through its proprietary trading platform. The company’s website also states that it does not provide services in countries where it might violate local laws, appearing to emphasize its compliance. However, BestAssetLimited lacks transparency in several key areas, raising serious concerns about its business background and actual operations.

1.1 Alleged International Regulatory Background

According to its website, BestAssetLimited claims to be headquartered in New York, USA, and regulated by the following authorities:

- U.S. Commodity Futures Trading Commission (CFTC)

- Belize International Financial Services Commission (IFSC)

- Cyprus Securities and Exchange Commission (CySEC)

Additionally, the company claims to be registered with Companies House in the UK, providing registration number SRBNFRX354564656646. While this information appears to suggest that BestAssetLimited is a legitimate global trading platform, further investigation reveals that these claims are false.

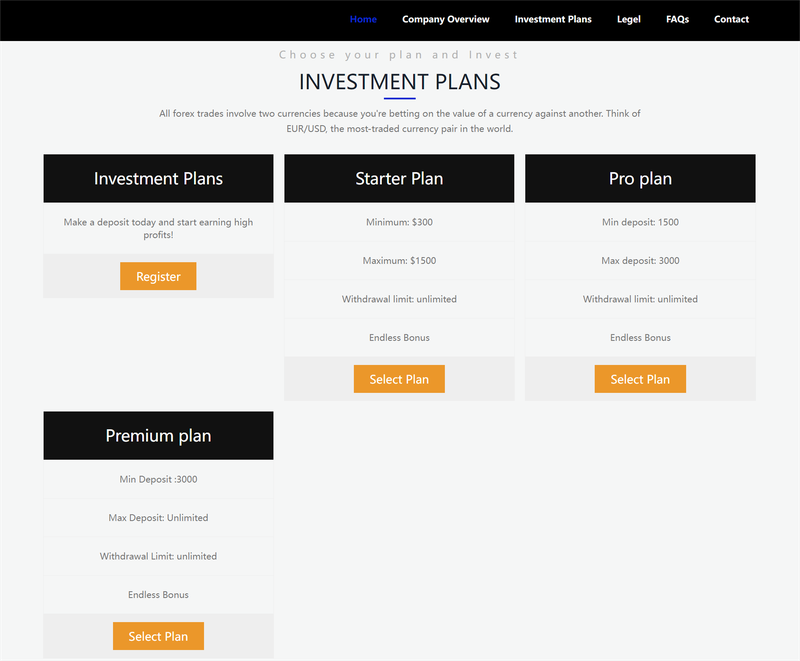

1.2 Three Investment Plans

BestAssetLimited offers three investment plans: Starter Plan, Pro Plan, and Premium Plan. Each plan has different minimum and maximum investment amounts, promising users “unlimited bonuses” and withdrawals. These attractive conditions may seem to offer flexible, high-return opportunities for investors, but the risks lurking behind these promises should not be ignored.

- Starter Plan: Minimum investment of $300, maximum of $1,500

- Pro Plan: Minimum investment of $1,500, maximum of $3,000

- Premium Plan: Minimum investment of $3,000, no maximum limit

While these plans may seem appealing, they raise significant concerns about transparency and fund security. The following sections will delve into the platform’s domain information, regulatory issues, and suspected scam features.

2. Domain Information: Concerns About Short-Term Registration

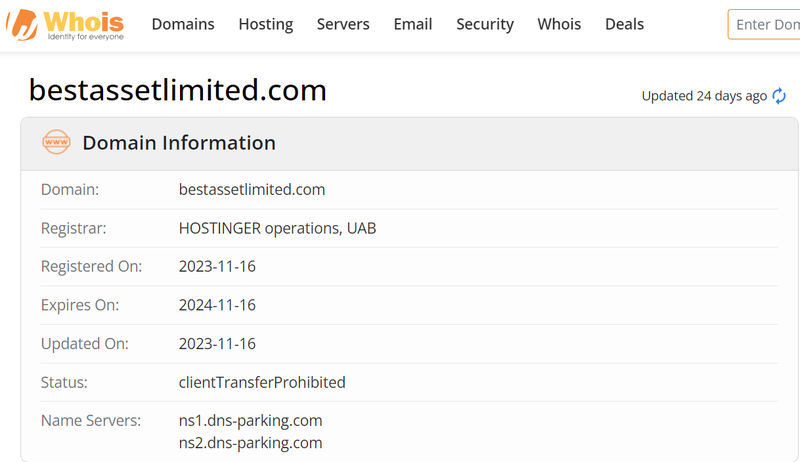

Analyzing domain registration details can provide insight into a platform’s operational history and potential stability. BestAssetLimited’s domain was registered on November 16, 2023, making it a newly established trading platform with a very short operating history.

2.1 Risks of Short-Term Domain Registration

Platforms with domain registrations of only a few months often struggle to build enough market credibility. In financial markets, especially forex and CFD trading, a platform’s history and track record are crucial factors in assessing its reliability. Long-established trading platforms typically demonstrate stable operations and compliance records, while newly formed platforms lack such history.

Short-term domain registrations are also frequently associated with scam platforms. These platforms often attract investors quickly, then shut down after accumulating funds, leaving investors with significant losses. BestAssetLimited’s short registration period and lack of market validation are reasons for investors to remain highly cautious.

2.2 Lack of Transparency in Domain Information

BestAssetLimited does not provide detailed domain registration information or background on the technical support behind the platform on its website. Legitimate financial trading platforms typically disclose domain registration details and offer transparent technical support and legal protections for users.

Conclusion: BestAssetLimited’s domain registration is very recent, and the platform has not undergone long-term market validation. Combined with the lack of operational transparency, this increases the likelihood of instability and high risk. Investors should exercise caution.

3. Registration and Regulatory Issues: The Dangers of Fake Regulation

When selecting a financial trading platform, regulation is one of the most critical factors for investors to consider. Legitimate platforms are usually overseen by credible regulatory authorities to ensure operational compliance and fund security. However, BestAssetLimited’s regulatory claims are highly questionable, and its registration information is difficult to verify.

3.1 False Regulatory Claims

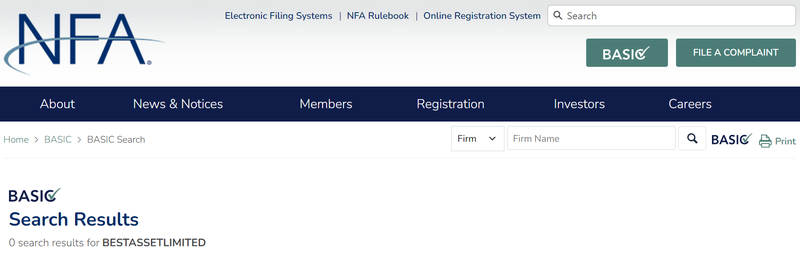

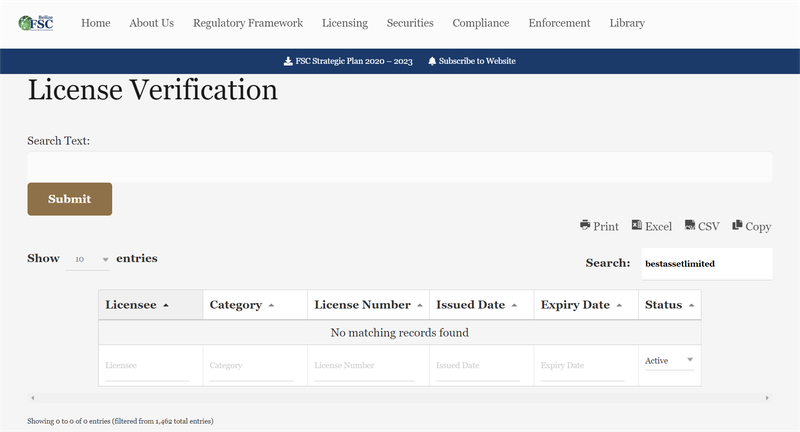

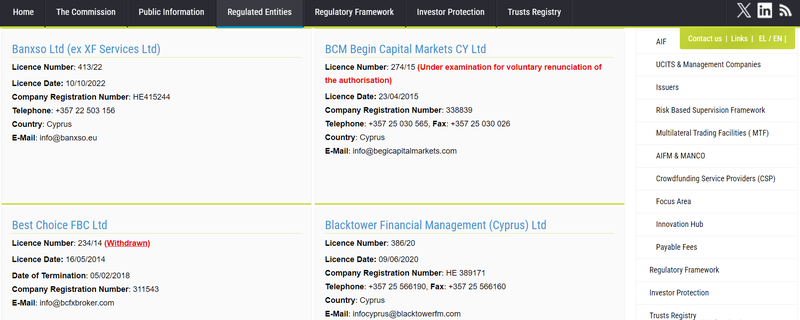

BestAssetLimited’s website claims it is regulated by several well-known international regulatory bodies, including the U.S. CFTC, Belize’s IFSC, and CySEC. However, further investigation shows these claims are false:

- CFTC and NFA (National Futures Association): BestAssetLimited does not appear on the NFA’s regulatory list. The NFA is a key U.S. regulator responsible for ensuring platforms meet strict legal and financial standards, but BestAssetLimited is not approved by this body.

- Belize’s IFSC: Similarly, BestAssetLimited is not listed on Belize’s IFSC regulatory database, meaning its claim of regulation by Belize is also false.

- CySEC: CySEC is an important European financial regulator, but BestAssetLimited does not appear in CySEC’s registration database, further proving that its regulatory claims are untrue.

3.2 Fake Registration with Companies House

BestAssetLimited also claims to be registered with Companies House in the UK under registration number SRBNFRX354564656646. However, after a search, this number does not exist in the official Companies House database. The false registration information indicates that BestAssetLimited is attempting to deceive investors by creating a false sense of legitimacy, while in reality, it is not subject to any legal oversight.

Conclusion: All of BestAssetLimited’s regulatory claims are false. The platform is not supervised by any reputable financial regulatory authority, meaning investors’ funds are not protected, and the platform’s legality is questionable.

4. Concerns About Minimum Investment Amounts: The Trap Behind High Investment Thresholds

BestAssetLimited offers three different investment plans, each with different minimum investment amounts. The minimum starts at $300, which may seem low and attract novice investors, but there are potential risks behind these investment thresholds.

4.1 The Trap of Low Investment Thresholds for New Investors

The Starter Plan’s minimum investment of $300 is likely to attract inexperienced investors unfamiliar with the market. However, once funds are deposited, investors face more than just trading risks. Low investment thresholds are designed to lure in a large number of investors. Once the platform accumulates enough funds, it may disappear with the money. This is a common tactic used by fraudulent platforms.

4.2 Unrealistic Promises of High Returns

Each of BestAssetLimited’s investment plans promises “unlimited bonuses” and unrestricted withdrawals, seemingly offering great flexibility and high returns to investors. However, such terms hide significant risks. Legitimate trading platforms are usually subject to strict withdrawal regulations to prevent money laundering and other illegal activities. BestAssetLimited’s promise of unrestricted withdrawals suggests that the platform may not be under any real financial oversight.

Conclusion: BestAssetLimited’s low investment threshold may seem attractive, but it could be part of a scam to lure in as many investors as possible. Investors should be wary of this tactic to avoid unnecessary financial losses.

5. Suspected “Pig Butchering” Scam: The Potential Fraud Behind BestAssetLimited

In recent years, “pig butchering” scams have become common, particularly in financial trading platforms. This type of scam typically uses false promises of high returns to lure investors, ultimately stealing their funds. BestAssetLimited displays many signs of a “pig butchering” scam, and investors should be highly cautious.

5.1 What is a Pig Butchering Scam?

A “pig butchering” scam involves manipulating investors with promises of high returns, encouraging them to continue investing more and more funds. Once the scam operators accumulate enough money, they either shut down the platform or freeze accounts, leaving investors unable to retrieve their funds.

In financial markets, pig butchering scams often use promises of fast profits, high returns, and enticing trading conditions to attract unsuspecting investors. After drawing in substantial investments, the scammers either shut down the platform or restrict withdrawals, causing investors to lose all their money.

5.2 Pig Butchering Characteristics in BestAssetLimited

BestAssetLimited’s operational model closely aligns with the typical characteristics of a pig butchering scam:

- False Regulatory Claims: By claiming regulation by several well-known authorities, BestAssetLimited tries to present itself as a legitimate and compliant platform to gain investors’ trust.

- Low Investment Thresholds and High Returns: With a minimum investment of just $300 combined with promises of unrestricted withdrawals and bonuses, BestAssetLimited uses a classic tactic to attract many inexperienced investors and get them to invest more.

- Lack of Transparency: The platform provides no clear contact information, and its registration and regulatory information cannot be verified. This lack of transparency makes it difficult for investors to seek recourse when problems arise.

Conclusion: BestAssetLimited exhibits several characteristics typical of a pig butchering scam. Investors should remain highly vigilant and avoid falling into its financial trap.

6. Conclusion: High Risks of BestAssetLimited Revealed

Through an in-depth analysis of BestAssetLimited’s background, domain registration, regulatory issues, and investment plans, it is clear that the platform has serious transparency issues, and its false regulatory claims raise doubts about its legitimacy. When choosing a financial platform, investors should prioritize those regulated by reputable financial authorities and avoid platforms with opaque information and a lack of long-term market validation.

The signs strongly suggest that BestAssetLimited is likely a well-designed financial scam. When faced with attractive investment plans and promises of high returns, investors should remain cautious and avoid falling victim to misleading advertising that could result in financial losses.

Frequently Asked Questions (FAQ)

- Is BestAssetLimited regulated?

BestAssetLimited claims to be regulated by several international authorities, but investigations reveal these claims are false, and the platform is not under any legitimate regulation. - When was BestAssetLimited’s domain registered?

BestAssetLimited’s domain was registered on November 16, 2023. Its operating period is very short, and it has not undergone long-term market validation. - What investment plans does BestAssetLimited offer?

BestAssetLimited offers three investment plans: Starter Plan, Pro Plan, and Premium Plan. The minimum investment starts at $300, with no maximum limit for the Premium Plan. - Is BestAssetLimited’s minimum investment amount reasonable?

While the minimum investment of $300 may seem low, it is often a tactic to lure novice investors, and the platform carries high risks. - What is a pig butchering scam?

A pig butchering scam lures investors with promises of high returns, encouraging them to invest more. The platform eventually closes or restricts withdrawals, causing investors to lose their funds. - How can I identify a legitimate trading platform?

Investors should verify the platform’s registration and regulatory status, ensuring it is overseen by reputable financial authorities such as the FCA, CySEC, or ASIC, to safeguard their funds.