This article analyzes Castle Market’s company background, domain registration, regulatory status, account types, spreads, and leverage to help investors assess the platform’s potential risks and credibility.

1. Company Background

Castle Market Ltd is an online platform that claims to offer forex trading services, with its official website at https://castle-market.com. The company claims to be registered in the Comoros and to operate under the financial regulatory authority of the region. However, upon deeper investigation, there are significant doubts about the platform’s company background and legitimacy.

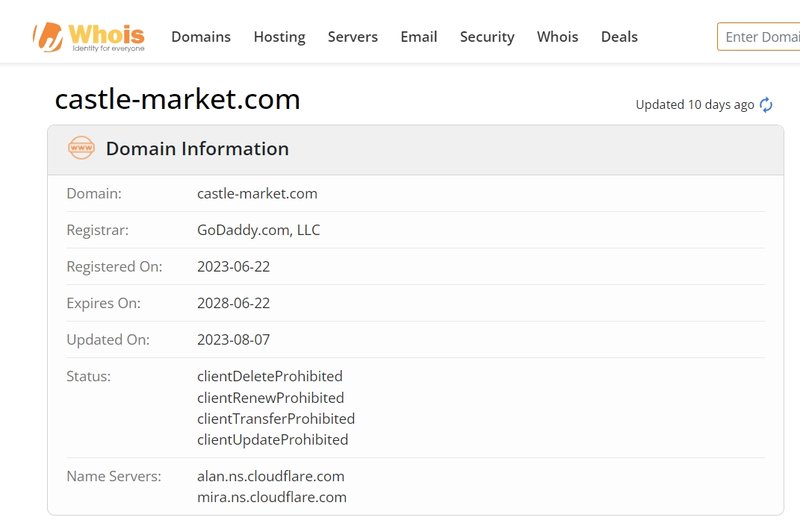

The platform registered its domain on June 22, 2023, indicating it has operated for only a short time without long-term market validation. Legitimate financial platforms typically provide transparent company registration information, office addresses, and other critical details to demonstrate compliance and transparency. However, Castle Market has failed to provide these key details, raising concerns about its legitimacy.

In the financial market, a transparent company background is a crucial indicator of a platform’s trustworthiness. If a platform lacks a clear background and doesn’t ensure the safety of investor funds, investors should exercise caution and avoid placing their money in such opaque trading platforms.

2. Domain Information

2.1 Domain Registration Time

According to Whois, Castle Market’s domain was registered on June 22, 2023. This indicates that the platform has been operating for only a few months. Short-term registered platforms often carry higher operational uncertainty due to a lack of market validation and history. Newly established platforms face higher credibility and operational risks compared to long-standing financial platforms that have undergone years of testing.

Platforms with short registration periods are more prone to fraud. These platforms may operate for a period to accumulate client funds, then quickly shut down when problems arise, making it difficult for investors to recover their money. This situation is particularly common in forex and contract for difference (CFD) trading, so investors should be cautious of short-term platforms.

2.2 Lack of Registration Information

Although Castle Market claims registration in the Comoros, verification shows no registration information in the region’s databases. Legitimate financial service platforms register in their home countries or regions, and investors can verify this information. However, Castle Market does not provide a specific registration number or company certificate, casting doubts on its legitimacy.

The Comoros lacks recognition as a global financial center and has relatively lax financial regulations. Some questionable platforms exploit this loophole, claiming registration there to evade stricter oversight. The lack of detailed registration information for Castle Market further raises doubts about its compliance.

3. Lack of Effective Regulation

3.1 False Regulatory Claims

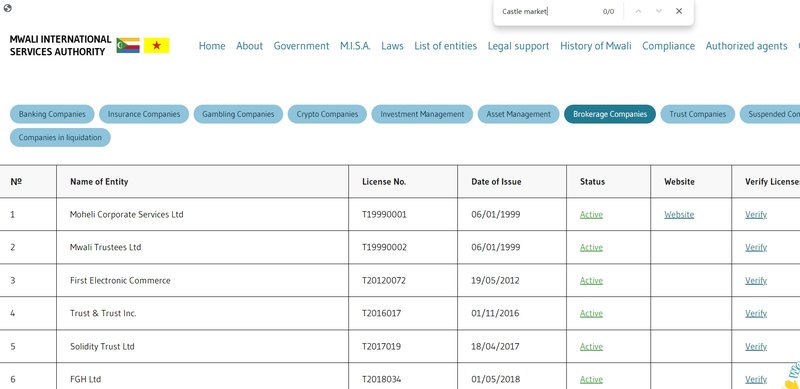

Castle Market claims to be regulated by the Moheli International Services Authority (MISA). However, a search of MISA’s records revealed no registration or regulatory information related to Castle Market. This suggests the platform’s regulatory claims are false and misleading.

Legitimate forex platforms are usually regulated by internationally recognized financial authorities such as the UK’s Financial Conduct Authority (FCA), the Australian Securities and Investments Commission (ASIC), or the Cyprus Securities and Exchange Commission (CySEC). These regulatory bodies impose strict requirements to ensure investor fund safety and provide legal protection. Castle Market, however, does not provide proof of regulation from these authoritative bodies, meaning the platform lacks transparency and operational safeguards.

3.2 Risks of an Unregulated Platform

An unregulated platform operates without legal oversight, placing investor funds at high risk. If the platform faces issues such as restricted withdrawals or closure, investors will not have legal protection and may not recover their losses. Castle Market is not monitored by any credible regulatory authority, and its lack of regulatory oversight increases the risk of fund misappropriation or withdrawal difficulties.

When choosing a trading platform, regulation is key to protecting investor interests. Unregulated platforms often hide significant risks, including price manipulation, withdrawal delays, or account freezes. The regulatory gaps at Castle Market raise serious questions about its transparency and compliance.

4. Questionable Account Information

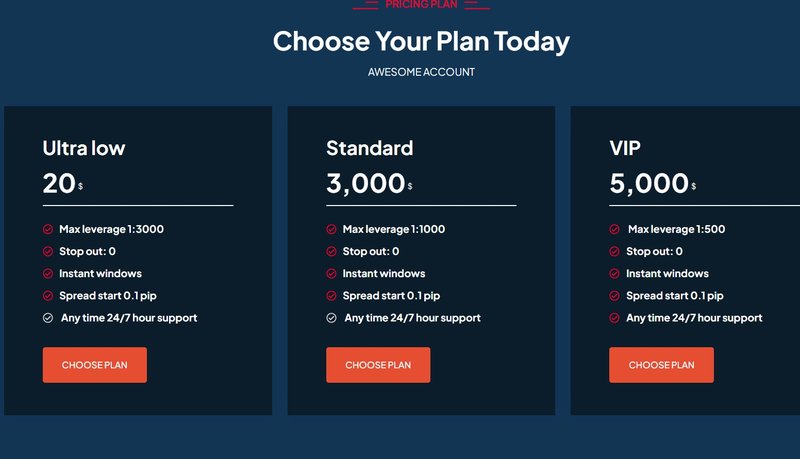

Castle Market offers three different types of accounts, which appear to be designed to meet the needs of various investors. However, the account types and trading conditions raise several concerns about transparency and potential risks.

4.1 Micro Account

The Micro account has a minimum deposit of only $20 and offers leverage up to 1:3000, which is likely to attract novice or small-scale investors. The platform uses low deposit requirements and high leverage to appeal to speculative traders.

However, high leverage exposes investors to significant risks in a volatile market. A 1:3000 leverage far exceeds the limits imposed by most global financial regulators, and for beginners, this level of leverage can quickly lead to account liquidation and complete loss of funds. Without effective risk management and regulation, investors are likely to suffer significant losses from high-leverage trading.

4.2 Standard Account

The Standard account requires a minimum deposit of $3000 and offers leverage of 1:1000. Although this account appears to provide more professional trading conditions for investors with larger funds, the platform does not provide sufficient transparency regarding other fees and conditions, especially regarding spreads and commissions.

When selecting the Standard account, investors should not only focus on leverage but also ensure the platform offers transparent fee structures. Without clear fee disclosure, investors may encounter hidden costs during trading, which can affect their profitability.

4.3 VIP Account

The VIP account requires a minimum deposit of $5000 and offers leverage of 1:500. While VIP accounts typically provide better trading conditions for high-net-worth investors, Castle Market fails to disclose important details such as commission rates, spreads, and withdrawal conditions.

High-net-worth accounts typically require stricter risk management and fee transparency. However, Castle Market does not provide sufficient information on VIP account conditions, making it difficult for investors to estimate actual trading costs. Coupled with the platform’s lack of regulation, the safety of funds in the VIP account is also questionable.

5. Unreasonable Spreads and Leverage

5.1 Excessive Leverage Risk

Castle Market’s high leverage (up to 1:3000) is one of its key selling points. While high leverage allows investors to control large trading volumes with smaller capital, it also significantly increases risk. In highly volatile markets, investors can lose their entire funds within a short period.

Most internationally recognized financial regulators set limits on leverage for retail investors. For example, the European Securities and Markets Authority (ESMA) limits leverage to 1:30, and the Australian Securities and Investments Commission (ASIC) limits leverage to 1:50. Castle Market’s leverage of 1:3000 far exceeds these limits, indicating that the platform prioritizes attracting risk-takers over protecting investor funds.

5.2 Lack of Transparency in Spreads and Commissions

Castle Market claims to offer spreads as low as 0.1 pips, but the platform does not provide a detailed fee structure, making it impossible for investors to estimate actual trading costs. Spreads are a critical factor in calculating trading expenses, and the lack of transparency suggests the platform may increase spreads or impose hidden fees.

Commissions and other trading fees also significantly impact an investor’s profitability. Castle Market does not disclose its commission structure, and investors may face unexpected costs that reduce profits. The lack of transparent trading fees further undermines the platform’s credibility.

Castle Market, as a forex trading platform, presents several serious risks. Its short domain registration, lack of transparency in company background and registration information, false regulatory claims, and lack of investor fund protection are all red flags. Additionally, the platform’s high leverage and opaque trading fee structure further increase investor risk.

Given these issues, investors are strongly advised to choose platforms that are regulated by internationally recognized financial authorities such as the FCA, ASIC, or CySEC, to ensure the safety of their funds and transparent trading conditions.

FAQ

- Is Castle Market regulated?

Castle Market claims to be regulated by MISA, but upon verification, the platform is not listed in MISA or any other authoritative financial regulator’s database, making it an unregulated platform. - When was Castle Market’s domain registered?

Castle Market’s domain was registered on June 22, 2023, and the platform has been operating for a short period, lacking long-term market validation. - What account types does Castle Market offer?

The platform offers Micro (minimum deposit $20, leverage 1:3000), Standard (minimum deposit $3000, leverage 1:1000), and VIP (minimum deposit $5000, leverage 1:500) accounts. - Are Castle Market’s spreads and commissions transparent?

The platform claims spreads as low as 0.1 pips, but it does not disclose a detailed commission structure, leaving trading fees unclear and potentially hiding additional costs. - Is Castle Market’s leverage reasonable?

Castle Market offers leverage up to 1:3000, which exceeds the limits set by global regulators for retail clients, making it extremely risky for investors. - How should I choose a safe forex trading platform?

Investors should choose platforms regulated by internationally recognized financial authorities such as the FCA, ASIC, or CySEC to ensure transparency and the safety of their funds.