Stake Elites claims to offer a wide range of financial products, but its lack of transparency regarding company registration, regulatory status, and issues with its proprietary trading platform could expose investors to significant financial risks.

1. Company Overview

Stake Elites is a forex broker established on October 26, 2022. The company offers trading services in various financial markets, including forex, stocks, indices, energy, metals, cryptocurrencies, and ETF CFDs, through its proprietary trading platform and mobile app. While Stake Elites appears to provide a comprehensive range of trading products covering major financial markets, it does not disclose crucial details such as company registration and regulatory oversight, raising concerns about its legitimacy.

Though Stake Elites claims to have a robust trading system and offers various account plans, investors should proceed with caution. This article will delve deeper into the potential risks related to Stake Elites’ legitimacy, regulatory status, and fund security.

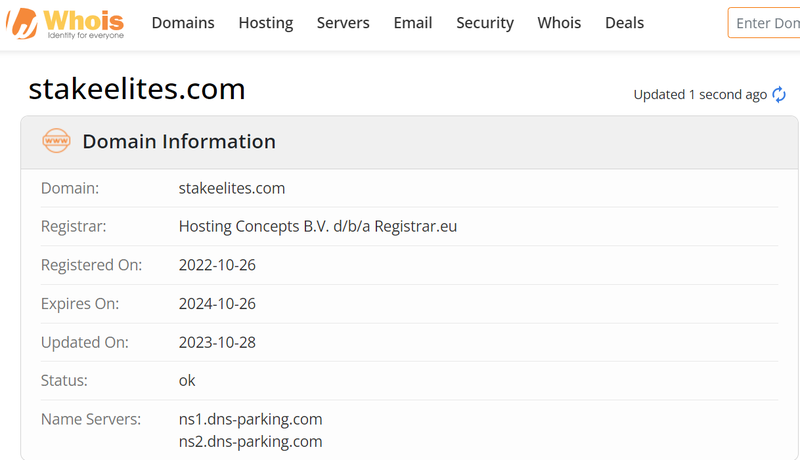

2. Domain Registration Concerns

The Stake Elites website was registered on October 26, 2022. As a relatively new platform, the short domain registration history may not provide sufficient confidence for potential investors. In the financial market, a platform’s long-term performance and customer feedback are critical to building trust. Emerging platforms, especially those lacking transparent registration and regulatory backgrounds, can make it difficult for investors to assess their safety.

Many fraudulent platforms often use newly registered domains to conduct short-term operations, luring in investors’ funds quickly and then shutting down the site or restricting withdrawals, leaving investors unable to recover their losses. The history of a platform’s domain registration helps investors understand its background. Stake Elites, with its short registration and lack of market history, could potentially hide risks unknown to investors.

The brief domain registration period, combined with a lack of a proven market record, raises further concerns about Stake Elites’ legitimacy and safety. When choosing new platforms, investors should pay close attention to the domain registration date and the company’s operational history to avoid falling into potential financial traps.

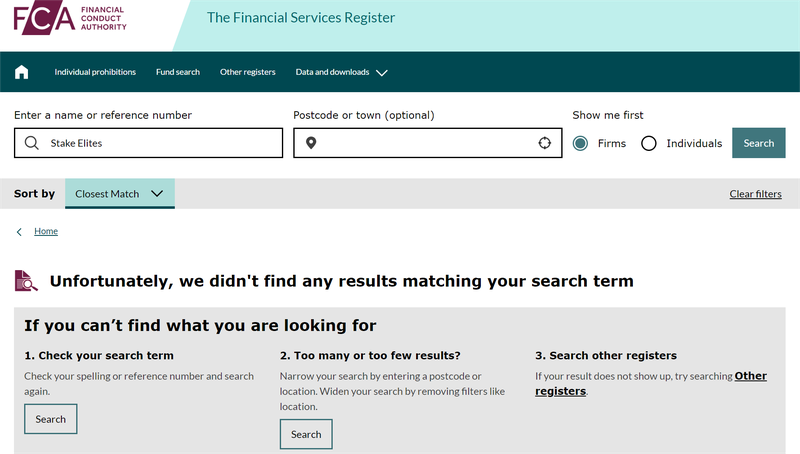

3. False Regulatory Information

The Stake Elites website does not provide any details about its company registration or regulatory status. In the financial industry, regulatory transparency is key to ensuring the safety of investors’ funds. Regulated platforms must comply with strict legal and financial market standards to protect investors’ money. However, Stake Elites’ lack of transparency in this area raises doubts about its legitimacy and the security of investor funds.

Stake Elites lists its office address as “1 Tudor St, London EC4Y 0AH, UK.” However, after investigating this address, neither the UK’s Companies House nor the Financial Conduct Authority (FCA) could verify any registered entity under this address. For a broker claiming to operate out of London, failing to appear in the UK’s main regulatory databases is a major red flag.

Platforms that use false registration and lack regulatory oversight are not uncommon in the financial market. Some platforms provide fake addresses or registration information to attract investors, but they are not subject to any regulatory oversight or audits. This leaves investors vulnerable with no legal protection or recourse in case of issues with the platform, including losing access to their funds.

4. Analysis of Registration Information

Stake Elites does not disclose its registration details on its website, which is a significant red flag. Legitimate financial institutions typically display their company registration details, country of origin, and regulatory status to build trust with investors. However, Stake Elites has not provided this information, and even the office address it claims to use cannot be verified through regulatory authorities. This lack of clarity suggests that Stake Elites may not be a legitimate forex broker.

The absence of clear registration and regulatory information indicates that Stake Elites might be evading legal oversight. This poses a serious risk to investors, as the safety of their funds depends entirely on the platform’s internal controls rather than external regulation. If the platform encounters financial issues or legal disputes, investors are at high risk of losing their funds with no means of recovery.

Some fraudulent platforms also steal or misuse legitimate company information to appear more credible. Investors must verify company registration and license status through official channels, such as regulatory agency websites, to ensure their funds are secure.

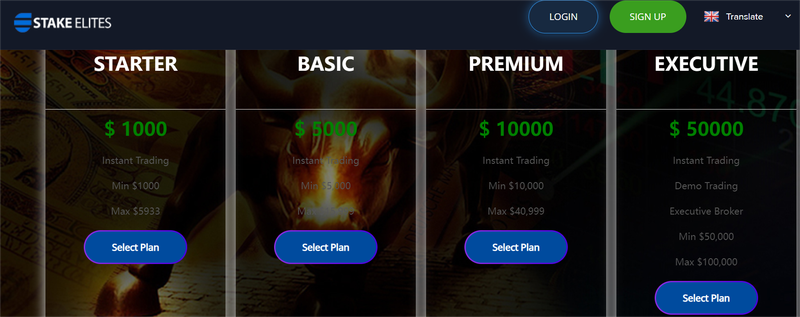

5. Trading Accounts and Fund Risks

Stake Elites offers four different trading accounts: STARTER, BASIC, PREMIUM, and EXECUTIVE. Each account requires a minimum investment ranging from $1,000 to $50,000, allowing investors to choose according to their financial capabilities. Below are the details of the four plans:

STARTER

- Minimum investment: $1,000

- Maximum investment: $5,933

- Instant trading

BASIC

- Minimum investment: $5,000

- Maximum investment: $15,999

- Instant trading

PREMIUM

- Minimum investment: $10,000

- Maximum investment: $40,999

- Instant trading

EXECUTIVE

- Minimum investment: $50,000

- Maximum investment: $100,000

- Instant trading

- Demo trading available

While these accounts appear to offer flexible investment options, with a relatively low entry threshold, there are significant risks associated with these plans. First, unregulated platforms often engage in market manipulation, restrict withdrawals, or charge excessive fees, which can harm investors.

Real-World Case: Financial Loss from High-Risk Platforms

In 2018, a forex platform attracted many investors by promising high returns and low trading costs. However, the platform manipulated market spreads, froze accounts, and denied withdrawals, resulting in massive losses for investors. The platform ultimately collapsed within a few months. Similar to this case, Stake Elites shows warning signs such as a lack of transparency and questionable account structures, which could lead to the same issues.

Stake Elites’ lack of regulatory information and unclear account structure make it possible that investors may face account freezes, withdrawal restrictions, or even lose access to their funds. Therefore, before choosing any account, investors should thoroughly consider the platform’s regulatory status and fund security measures to avoid falling into a financial trap.

6. Risks of Proprietary Trading Software

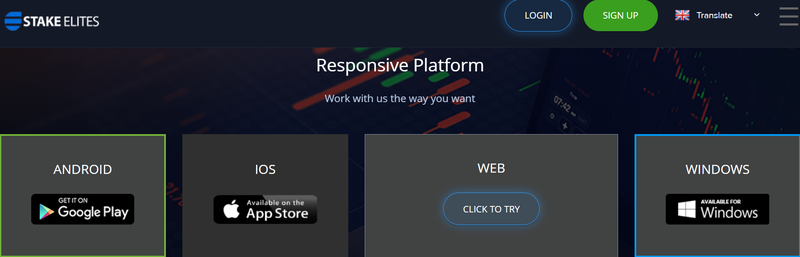

Stake Elites claims to offer a proprietary trading platform and mobile app for its users. However, upon investigation, the website only displays icons for these platforms without providing actual download links. This means investors cannot download or use the software through official channels and must rely solely on the web version for trading. This lack of transparency raises concerns about the platform’s technical capabilities and operational reliability.

Typically, legitimate brokers provide official, certified trading platform downloads, such as MetaTrader 4, MetaTrader 5, or cTrader, which are widely used and tested by investors globally. Proprietary trading platforms often face issues with technical instability, especially when developed by platforms that lack regulatory oversight. In extreme cases, unregulated platforms can manipulate prices through proprietary software or even steal user data.

The absence of an official download link for the trading platform also presents risks to users’ privacy and funds. Trading data may be stored or transmitted insecurely, making it vulnerable to hacking or misuse by the platform. Using an unverified proprietary platform poses significant uncertainties and safety risks for investors.

7. Educational Information on Professional Trading Platforms

Popular trading platforms such as MetaTrader 4 (MT4) and MetaTrader 5 (MT5) are globally trusted and widely used. Developed by MetaQuotes, MT4 and MT5 provide comprehensive technical analysis tools, automated trading features, and stable trading environments. These platforms have been tested and verified over many years, ensuring safe and transparent trading processes.

In contrast, proprietary trading software often lacks the technical robustness of these standard platforms. When choosing a trading platform, investors should opt for certified platforms to ensure safety and transparency. Proprietary platforms that have not undergone third-party verification introduce additional trading risks due to potential technical flaws and unverified security protocols.

8. Conclusion

While Stake Elites appears to offer a variety of financial market trading options, its lack of company registration transparency, regulatory oversight, and issues surrounding its proprietary trading platform present significant risks for investors. Platforms that do not provide official regulatory information often fail to protect investors’ funds, especially when accounts are manipulated, or funds are misappropriated.

When selecting a financial platform, investors should prioritize brokers that provide transparent regulatory information and use reputable trading platforms. The issues surrounding Stake Elites and its lack of operational transparency make it a high-risk option. Investors should carefully consider these risks before committing large amounts of capital to this platform.

9. Stake Elites Frequently Asked Questions (FAQ)

1. Is Stake Elites a legitimate platform?

The legitimacy of Stake Elites is questionable. The website does not provide any company registration information or regulatory status, and the office address cannot be verified through official sources

2. What financial markets does Stake Elites offer?

Stake Elites claims to offer forex, stocks, indices, energy, metals, cryptocurrencies, and ETF CFDs. However, due to a lack of regulation, investor funds may be at risk.

3. What are the risks associated with its trading accounts?

Stake Elites offers four trading accounts, with minimum investments ranging from $1,000 to $100,000. Unregulated platforms may manipulate the market or restrict withdrawals, posing risks to investors.

4. Is Stake Elites’ proprietary trading platform secure?

Stake Elites’ proprietary platform has issues with missing download links, leaving investors to rely on web-based trading, which could present privacy and fund security risks.

5. What are the main risks of investing with Stake Elites?

The primary risks include false regulatory claims, unprotected funds, potential security issues with proprietary trading software, and lack of operational transparency, which may lead to financial losses.