CMG is a broker registered in the UK offering a variety of financial products for trading. However, its regulatory information is unclear, and deposit/withdrawal methods are not transparent, so investors should be cautious when choosing this platform.

Platform Background Overview

CMG (Capital Markets Giants) was founded on April 20, 2018, as a broker specializing in forex and contract for difference (CFD) trading. CMG offers a wide range of financial trading products to global investors, including forex, commodities, metals, indices, stock CFDs, bonds, and ETFs. The company’s official website is https://cmgfx.com/, and it supports both English and Arabic, serving investors from different language backgrounds. Although CMG is registered in the UK, its headquarters are in Saint Vincent and the Grenadines, a well-known offshore financial center with relaxed regulations.

Despite the variety of trading products CMG offers and its global services, the platform’s transparency concerning its corporate background and regulatory status raises many concerns. Although CMG is registered in the UK, it is not registered with any financial regulatory authority, which presents significant risks to investors’ fund security and trading environment.

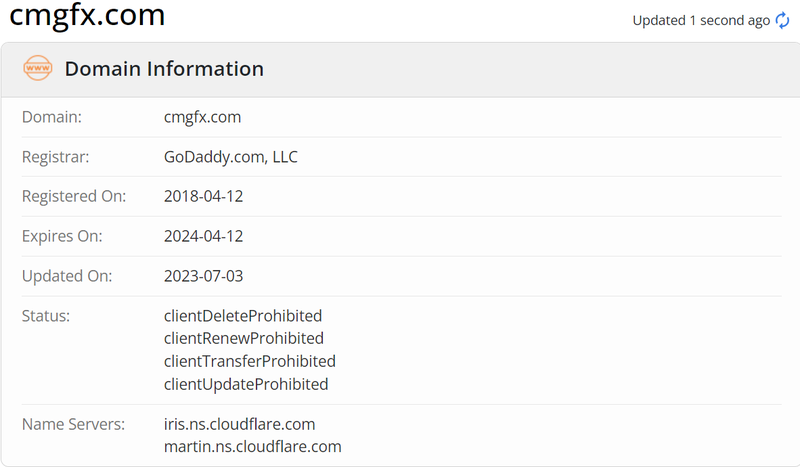

Domain Information

CMG’s official website domain was registered on April 12, 2018, close to the company’s formal registration date. Domain registration dates can provide clues about a company’s operational history, but they do not directly reflect the platform’s legality or safety. While a long domain history may suggest stability, the most critical aspects are the platform’s regulatory qualifications, trading conditions, and fund security measures.

Although CMG’s domain history dates back to 2018, indicating several years of operation, investors require more transparency on key issues such as how the company ensures fund safety and maintains fair trading practices.

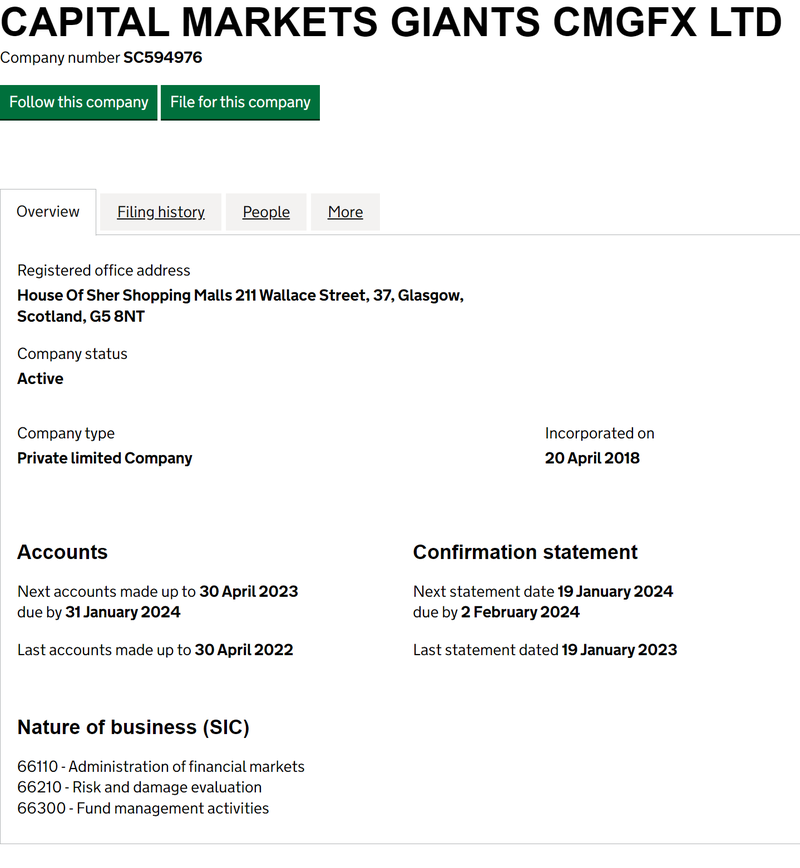

Registration Information and Risks

CMG operates under the entity CAPITAL MARKETS GIANTS CMGFX LTD, registered in the UK at House Of Sher Shopping Malls, 211 Wallace Street, 37, Glasgow, Scotland, G5 8NT, with registration number SC594976. This information can be verified through the UK’s Companies House, confirming CMG’s legal status as a registered company.

Although CMG is registered in the UK, it operates mainly from Saint Vincent and the Grenadines, a location favored by financial companies due to its lax regulatory requirements. This offshore operational model presents substantial regulatory risks. Without strict regulation, the platform may fail to properly safeguard investor fund protection, trading transparency, and corporate governance.

Risk Analysis of Registration Information:

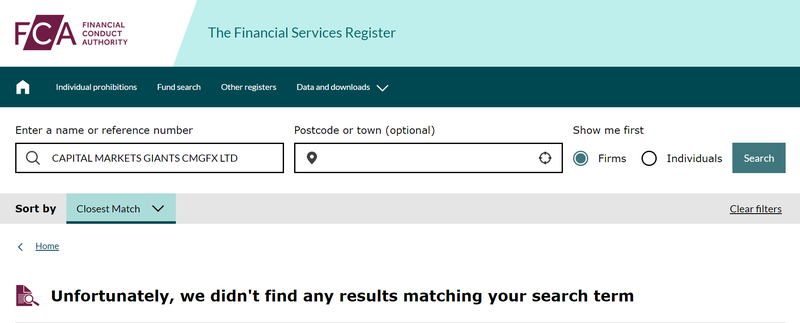

- UK Registration but No Regulation: Although CMG is registered in the UK, it is not regulated by the UK’s Financial Conduct Authority (FCA). Many investors mistakenly assume that a UK-registered company is subject to FCA regulation, but only companies registered and authorized by the FCA are under its strict financial supervision. Since CMG lacks FCA registration, it fails to meet the FCA’s stringent requirements for financial institutions.

- Offshore Operations Risk: CMG operates primarily from Saint Vincent and the Grenadines. Although legally registered, this offshore operational model enables the company to bypass stricter international regulatory requirements. In such cases, investors may struggle to obtain sufficient legal protection, and their funds may be at risk if the platform faces financial problems or mismanagement.

Concerns Regarding Regulatory Information

CMG’s website does not disclose any regulatory information, raising doubts about the safety of its trading environment. Further investigation shows that CMG lacks regulation by the FCA or any other internationally recognized regulatory body. Although the company’s registration information can be verified through the UK’s Companies House, legal registration alone does not guarantee compliance or transparency.

Risk Analysis of Regulatory Information:

- Lack of Regulatory Protection: CMG lacks regulation from the FCA or any other international authority, leaving its financial activities without external supervision. Regulated financial institutions must adhere to strict rules, such as fund segregation, auditing requirements, and customer fund protection measures. However, CMG’s lack of regulation could leave investors’ funds vulnerable, and in the event of financial difficulties, investors may struggle to seek legal compensation.

- No Investor Rights Protection: Regulatory bodies play a key role in ensuring financial platforms are transparent, fair, and secure. CMG’s lack of regulation means that its trading operations may lack independence and transparency, leaving investors with limited recourse in the event of disputes. For investors dealing with larger sums of money, this risk is particularly significant.

Account Types and Trading Concerns

CMG offers two types of live trading accounts: Super Account and Standard Account, along with a demo account. Both live accounts require a minimum deposit of 100 AUD or the equivalent in other currencies, use a market execution ECN pricing model, and offer Islamic accounts. Despite the apparent flexibility, these accounts have several hidden risks.

Super Account Concerns and Risks

- Lack of Transparency in Spreads and Commissions: The Super Account offers spreads starting from 0 pips, with a commission of $2.5 per lot. While low spreads may attract high-frequency traders, the volatility of spreads and the commission structure could affect actual trading costs. During periods of high market volatility, spreads often widen, and without regulation, there is a risk that the platform may manipulate spreads. Investors may face hidden cost increases, especially when engaging in large or high-frequency trading.

- Variable Stock CFD Commissions: CMG offers stock CFD trading through the Super Account, but the commission is variable. This variability leaves room for the platform to manipulate trading fees. Investors may struggle to predict actual costs for each trade, potentially impacting the effectiveness of their trading strategies. Unregulated platforms can change trading fees at any time, leaving investors with no recourse.

Standard Account Concerns and Risks

- Wider Spreads and Hidden Costs: The Standard Account offers spreads starting from 1 pip with no commission (except for stock CFDs). While the absence of commission may seem to reduce trading costs, wider spreads can significantly increase hidden costs. During volatile market conditions, spreads can widen further, impacting profitability.

- Lack of Transparency in Stock CFD Commissions: Although the Standard Account charges no commission for forex trades, stock CFD commissions remain variable. The platform does not clearly define the commission structure for stock CFDs, making it difficult for investors to calculate costs accurately, potentially leading to unexpected losses.

Risks of High Leverage and Market Execution

- Delays and Slippage in Market Execution: All CMG accounts follow a market execution model, meaning orders match the current market price. However, high volatility can slow execution speed, leading to slippage. Slippage refers to the difference between the expected and executed order price, and excessive slippage can increase trading costs or reduce profits. Unregulated platforms are more likely to manipulate slippage, especially during high volatility, as they may delay execution for profit.

- Potential Risks of High Leverage: CMG does not disclose specific leverage information on its website, but forex and CFD trading typically involve high leverage. While high leverage can amplify profits, it also significantly increases the risk of losses. With excessive leverage, even minor market fluctuations can lead to rapid losses or account liquidation. On unregulated platforms, there are often no limits on leverage usage, increasing investors’ risk exposure.

Risks in Deposit and Withdrawal Methods

CMG does not clearly disclose its deposit and withdrawal methods on the website. Investors can only withdraw funds by submitting a withdrawal request form, raising concerns about the security of the platform’s fund management.

Risk Analysis of Deposit and Withdrawal Methods:

- Lack of Transparency in Fund Management: The transparency of deposit and withdrawal methods directly affects the security of investor funds. Without clear information on the supported payment methods, fee standards, and processing times, investors face uncertainty in managing their funds. Some unregulated platforms impose hidden fees or delay withdrawal processing, making it difficult for investors to access their funds in a timely manner.

- Risk of Withdrawal Restrictions and Fund Freezing: Unregulated platforms often use complex withdrawal processes to restrict access to investor funds. In extreme cases, platforms may even freeze account funds, leaving investors without regulatory protection and no way to seek legal help. CMG only provides a withdrawal request form without explaining the steps or conditions for withdrawals, making it harder for investors to access their money.

CMG is a broker that offers forex and CFD trading, legally registered in the UK and offering a variety of trading products. However, the platform’s lack of transparent regulatory information and fund management methods puts investor funds at significant risk. The account types may seem flexible, but hidden fees, slippage, and commission structures can increase trading costs, while the lack of transparency in deposit and withdrawal methods further exacerbates concerns over fund security.

FAQ

- Where is CMG registered?

CMG operates under the entity name Capital Markets Giants CMGFX LTD, registered in the UK. - Is CMG regulated?

CMG lacks regulation from the UK’s Financial Conduct Authority (FCA) or any other international financial regulatory body. - What types of trading accounts does CMG offer?

CMG offers two live accounts: Super Account and Standard Account, as well as a demo account. - What are the spreads and commissions for CMG?

The Super Account offers spreads starting from 0 pips, with a commission of $2.5 per lot, while the Standard Account has spreads from 1 pip with no commission, except for stock CFD trades. - What deposit and withdrawal methods does CMG offer?

CMG does not specify its deposit and withdrawal methods on the website and only provides a withdrawal request form, with no detailed fund management information. - What are the main risks of investing with CMG?

The main risks include a lack of regulatory protection, hidden account fees, unclear deposit/withdrawal methods, and potential fund security issues.