As the global forex market rapidly expands, choosing a reliable forex broker is crucial. With the rise of new platforms, investors face the challenge of determining which platforms are safe and trustworthy. AHF ULTRA is a newly established forex broker that offers trading services in forex, stocks, commodities, and indices. However, there are numerous questions regarding the platform’s background and regulatory status. This article provides a comprehensive analysis of AHF ULTRA’s background, affiliated companies, and the regulatory concerns it faces, helping investors make more informed decisions.

1. Company Background of AHF ULTRA

According to its website, AHF ULTRA was founded on October 9, 2023, offering various financial products for trading, including forex, stocks, commodities, and indices. Although the platform claims to serve clients in the UK, Italy, Germany, the US, Turkey, and Cyprus, the company’s headquarters remain unknown. This lack of transparency can raise concerns, especially in the financial services sector.

AHF ULTRA’s website supports both English and Italian, suggesting that the company mainly targets European and North American clients. However, this does not guarantee that it is legally authorized to operate in these regions or that it is subject to local regulatory oversight. Additionally, the company does not provide services in certain jurisdictions, including Iran, North Korea, the Central African Republic, and Estonia, possibly due to sanctions or regulatory restrictions in those countries.

2. AHF ULTRA’s Registered Entity and Affiliations

AHF ULTRA lists AHFULTRA Trader LLC as its registered entity, claiming affiliation with ALPHA WEALTH MANAGEMENT LUXEMBOURG S.A. The website states that ALPHA WEALTH MANAGEMENT LUXEMBOURG S.A. holds registration as a Money Services Business (MSB). However, key regulatory bodies, including the U.S., do not have any record of this entity. Financial Crimes Enforcement Network (FinCEN) or the Financial Transactions and Reports Analysis Centre of Canada (FINTRAC). This absence of registration raises concerns about the legitimacy of the company’s cross-border money services.

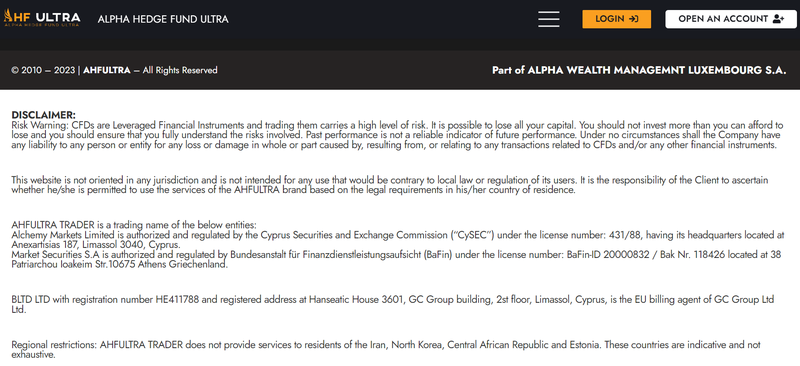

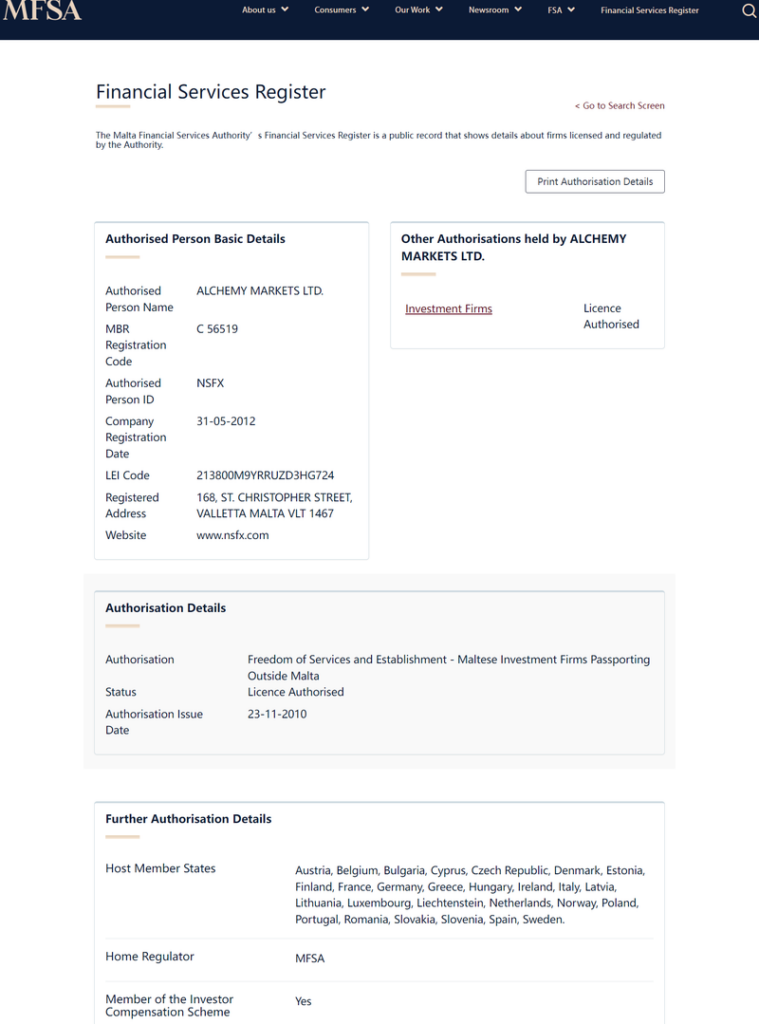

Additionally, AHF ULTRA claims affiliation with other entities, including Alchemy Markets Limited, which supposedly holds a license from the Cyprus Securities and Exchange Commission (CySEC). However, a check on CySEC’s website revealed that the company with license number 431/88 does not exist. Further investigation showed that Alchemy Markets Limited is regulated by the Malta Financial Services Authority (MFSA) and operates under the website www.nsfx.com, which has no connection to AHF ULTRA.

Another entity mentioned is Market Securities SA, which is said to be regulated by the German Federal Financial Supervisory Authority (BaFin). While Market Securities SA does have a record of cross-border services in Germany, its connection to AHF ULTRA remains unclear. These murky affiliations only add to the doubts about AHF ULTRA’s legitimacy and transparency.

3. Regulatory Questions and Inconsistencies

The legal operation of a forex broker depends heavily on strict regulatory oversight, but AHF ULTRA’s regulatory claims raise serious doubts. While the company claims to be licensed by several regulatory bodies, deeper investigation reveals discrepancies. For instance, Alchemy Markets Limited supposedly holds a CySEC license, but CySEC has no record of this license. This inconsistency suggests that AHF ULTRA may be providing false or misleading information to attract investors.

A similar issue arises with Market Securities SA. Although this entity registers in Germany, its relationship with AHF ULTRA remains unclear. Checks across multiple regulatory databases fail to provide conclusive evidence of AHF ULTRA’s proper regulation, raising further concerns about its operations and transparency. For a broker claiming to be under the jurisdiction of several reputable regulators, such vague regulatory status is a significant red flag.

4. Lack of Company Transparency

AHF ULTRA provides some background information on its website, but the transparency and accuracy of this information are questionable. Firstly, the company has not disclosed the location of its headquarters. Unlike many well-established brokers, AHF ULTRA does not provide a clear physical address or registered office, making it difficult for investors to verify its legal and operational legitimacy.

Moreover, although the company claims to be part of ALPHA WEALTH MANAGEMENT LUXEMBOURG S.A., a check with Italy’s financial regulator CONSOB reveals that ALPHA WEALTH MANAGEMENT LUXEMBOURG S.A. is authorized in other EU countries but has no branches in Italy. Furthermore, the exact registration details of this entity were not available, and it is unclear whether there is a genuine connection between AHF ULTRA and this company. The lack of transparency around these relationships makes it difficult for investors to fully trust AHF ULTRA’s claims.

5. Similarities with Other Platforms and Possible Associations

Further investigation reveals that AHF ULTRA shares striking similarities with another broker, ROIFX Trader. Both platforms have nearly identical website designs and content layouts, even using the same regulatory information. This high level of similarity suggests that the two platforms may have been designed using the same template or by the same development team. However, a more worrying possibility is that both brokers could be operated by the same group of individuals.

If two brokers are sharing the same regulatory information, it raises the possibility that this information is either fabricated or reused to deceive different groups of investors. This practice is not uncommon in the forex industry, where unscrupulous brokers use multiple websites to appear legitimate but fail to provide genuine regulatory backing. The close resemblance between AHF ULTRA and ROIFX Trader significantly undermines the credibility of both platforms.

6. AHF ULTRA’s Customer Service and Geographic Restrictions

AHF ULTRA provides services to clients in several countries, including the UK, Italy, Germany, the US, Turkey, and Cyprus. However, it does not offer services to residents of certain high-risk countries, such as Iran, North Korea, the Central African Republic, and Estonia. This restriction is likely due to international sanctions or regulatory requirements.

Despite this, AHF ULTRA’s legitimacy in other countries remains unclear, especially since the company has not provided verifiable regulatory authorization for key markets like the UK and the US. This raises serious concerns about the legality of its services in those regions. Additionally, the website only supports English and Italian, which limits its appeal to non-English or non-Italian speakers.

7. Ambiguous Relationship with Reputable Regulators

Another significant issue with AHF ULTRA is its ambiguous relationship with well-known regulatory authorities. Although the company mentions several global regulators, including CySEC and BaFin, investigations reveal no direct business connection between these entities and AHF ULTRA. This lack of clear regulatory ties raises doubts about whether the company operates legally.

Upon checking the websites of these regulators, AHF ULTRA is not listed as a licensed entity. In particular, the license number claimed by Alchemy Markets Limited does not exist, and Market Securities SA’s registration is incomplete and difficult to trace. Investors should be wary of AHF ULTRA’s claims of regulation to avoid potential financial loss due to inaccurate information.

8. Conclusion: Is AHF ULTRA Trustworthy?

Based on AHF ULTRA’s company background, its affiliated entities, regulatory status, and similarities with other platforms, the credibility of this broker raises multiple concerns. First, the company fails to provide clear regulatory information, and many of the affiliations and regulatory claims do not hold up under scrutiny. Second, the strong resemblance between AHF ULTRA and ROIFX Trader suggests the possibility of shared operations, which further undermines trust in its legitimacy.

Moreover, the lack of transparency regarding its headquarters, opaque affiliate relationships, and vague regulatory status make investors wary. Although the company offers a wide range of financial products for trading, its unclear regulatory and operational framework presents significant risks to investors.

Frequently Asked Questions (FAQs)

- Is AHF ULTRA regulated by any financial authority?

- AHF ULTRA claims regulation by multiple authorities, but investigations reveal discrepancies or inaccuracies in these claims.

- Where is AHF ULTRA’s headquarters located?

- AHF ULTRA has not disclosed its headquarters, raising concerns about the company’s transparency.

- What is the relationship between AHF ULTRA and Alchemy Markets Limited?

- AHF ULTRA claims affiliation with Alchemy Markets Limited, but CySEC records show no such regulated entity, casting doubt on this relationship.

- What languages does AHF ULTRA support?

- AHF ULTRA’s website is available in English and Italian, targeting primarily European and North American clients.

- Is there a connection between AHF ULTRA and ROIFX Trader?

- AHF ULTRA and ROIFX Trader share very similar website designs and regulatory claims, suggesting possible shared ownership or operations.

- Is AHF ULTRA legally operating in key markets?

- While AHF ULTRA claims to serve multiple countries, its lack of verifiable regulatory approval in those regions raises serious legal concerns.