FXBTG, a New Zealand-registered forex and CFD broker, has legitimate registration details but lacks regulatory oversight, raising concerns about the safety of investor funds.

Company Background and Services Overview

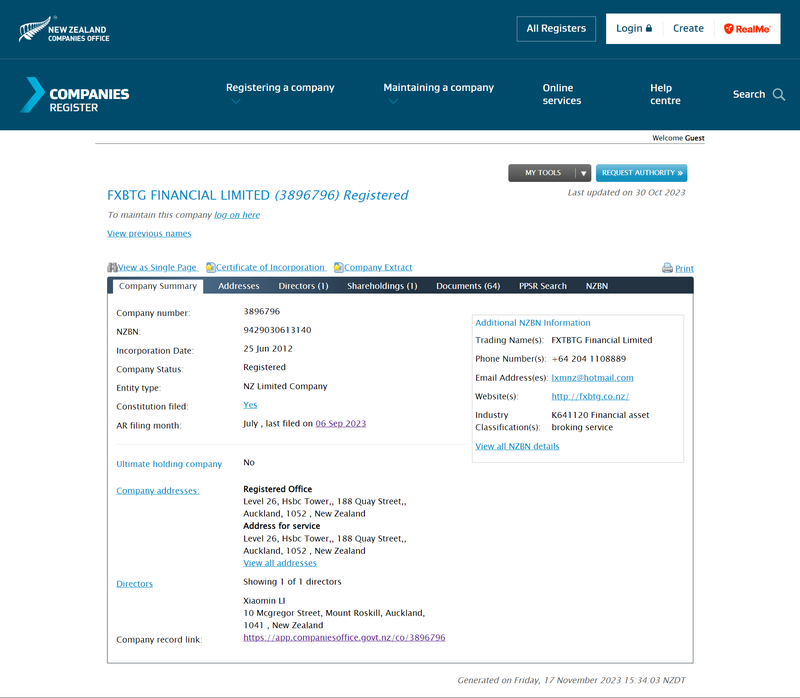

FXBTG was established on June 25, 2012, and is registered in New Zealand under the name FXBTG FINANCIAL LIMITED, formerly known as HD PROPERTY MANAGEMENT LIMITED. Although it is registered in New Zealand, its main operations are based in Kuala Lumpur, Malaysia. FXBTG provides a range of trading services in forex, precious metals, futures, stocks, and commodities through Contracts for Difference (CFDs). This cross-border setup allows the company to expand its reach, particularly in Asia and Southeast Asia.

The FXBTG website supports multiple languages, including English, Simplified Chinese, Traditional Chinese, Indonesian, and Vietnamese, aiming to attract investors from diverse markets. However, the company clearly states that it does not offer services to certain jurisdictions such as Afghanistan, Hong Kong, Belgium, Japan, and the United States, likely due to regulatory restrictions in these regions.

Despite its global reach, FXBTG’s operations raise concerns regarding its compliance and the safety of funds held on the platform.

The Risks of Missing Regulatory Information

While FXBTG’s registration in New Zealand may seem legitimate, this alone does not guarantee that it operates safely or complies with industry regulations. Regulatory oversight is essential in the financial industry to ensure that companies adhere to legal standards and protect investor funds. However, FXBTG has failed to disclose any valid regulatory credentials on its website.

1. Lack of Regulatory License

FXBTG lists a New Zealand registration address at HSBC Tower, Quay Street, Auckland. However, checks with major financial authorities like the New Zealand Financial Markets Authority (FMA), the Australian Securities and Investments Commission (ASIC), and other international regulators show no official licensing records for FXBTG.

A lack of regulatory status means that FXBTG is not legally bound by the rules and protections enforced by financial authorities. This exposes investors to significant risk, as funds held with the company are not protected under any legal framework. Should FXBTG face operational issues, platform closure, or bankruptcy, retrieving funds would be extremely difficult.

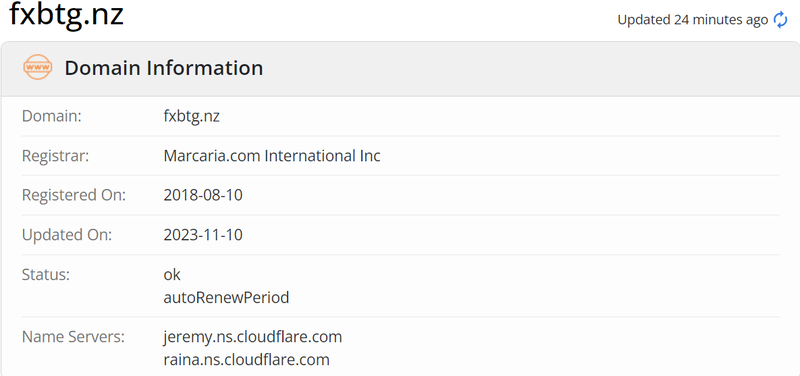

2. Domain Registration and Operational Concerns

In addition to its lack of regulatory information, FXBTG’s domain registration raises questions about the company’s management and long-term viability. According to a Whois lookup, the FXBTG website domain was registered on August 10, 2018, and was set to expire on November 10, 2023. As of November 17, 2023, the domain registration had expired. This raises concerns about the company’s operational stability, as an expired domain may signal internal mismanagement or financial troubles, or it may even indicate that the company is winding down its operations.

For a financial services company, maintaining an active domain is crucial for ongoing business operations. The fact that FXBTG allowed its domain to expire could indicate serious internal issues, putting investor funds at risk.

The Potential Dangers of Unregulated Brokers: Case Studies

To better understand the risks associated with FXBTG, it’s helpful to look at other cases involving unregulated brokers. These examples highlight how the lack of regulatory oversight can lead to significant investor losses.

Case Study 1: The Sudden Collapse of an Eastern European Forex Platform

In 2019, a forex platform based in Eastern Europe, Global Trade, rose quickly, attracting thousands of investors from multiple countries. The company advertised innovative technology and offered high-leverage CFD trading. However, despite claims of being regulated in multiple jurisdictions, investigations revealed that Global Trade held no legitimate licenses and relied on third-party providers for authorization.

Two years later, Global Trade abruptly shut down, freezing investor accounts and locking away millions in client funds. Since the company operated without proper regulatory oversight, investors had no legal recourse to recover their money. The platform’s collapse serves as a cautionary tale about the risks posed by unregulated brokers.

FXBTG shares similarities with Global Trade, particularly in its lack of disclosed regulatory oversight. Investors using an unregulated broker like FXBTG face significant risk, as recovering funds may be impossible in the event of platform failure.

Case Study 2: A Fraudulent African Forex Broker

In 2020, an African forex broker, GoldFX, became infamous for fraudulent activities. The company attracted many investors through social media ads, promising high returns and quick withdrawals. After a few months of operations, the platform suddenly shut down, and clients found themselves unable to withdraw their funds. Investigations revealed that GoldFX had never been regulated, and its management was highly opaque.

GoldFX’s fraud highlighted how vulnerable investors can be when dealing with unregulated brokers. Unregulated platforms, especially those offering high leverage and promises of high returns, often lack the transparency and financial safeguards necessary to protect investor funds. While FXBTG has not been accused of fraud, its lack of regulatory oversight and transparency regarding fund management pose similar risks to investors.

FXBTG’s Risks and How Investors Should Protect Themselves

Given FXBTG’s unregulated status, investors must adopt a cautious approach when dealing with the platform. Below are several strategies to mitigate the risks associated with unregulated brokers:

1. Verify Regulatory Credentials

Before investing with any forex or CFD broker, investors should verify the company’s regulatory status through official financial authorities. FXBTG, despite being registered in New Zealand, has not disclosed any financial service licenses. Investors can verify licenses through entities such as the New Zealand Financial Markets Authority (FMA) or the Securities Commission Malaysia.

2. Review Fund Management Policies

Transparent fund management is a key indicator of a reliable financial service provider. Reputable brokers often outline their fund management policies on their websites, including segregated accounts for client funds and deposit protection schemes. FXBTG has not provided any details about how it manages client funds, raising red flags about potential fund mismanagement or misuse.

3. Be Cautious with High Leverage and High Returns

Unregulated platforms often attract investors by offering high leverage and promises of large returns. However, high leverage comes with significant risks, and unregulated brokers are not bound by the same safeguards as regulated companies. Investors should carefully consider their risk tolerance and avoid engaging in risky trades with unregulated brokers.

4. Research the Broker’s Reputation

Before opening an account with any broker, investors should thoroughly research the company’s reputation. This can be done by checking financial forums, reading reviews, and monitoring social media discussions about the broker. Although FXBTG has expanded globally, its lack of regulation may have already sparked concerns among some users. Researching the broker’s reputation can help investors better assess the risk of using the platform.

Frequently Asked Questions (FAQ)

1. Is FXBTG regulated by the New Zealand Financial Markets Authority (FMA)?

No, there is no evidence that FXBTG is regulated by the New Zealand Financial Markets Authority or any other major financial regulator.

2. Are funds safe with FXBTG?

Since FXBTG is unregulated and provides no transparency regarding its fund management, the safety of investor funds is questionable. Funds may be at risk if the platform experiences operational issues.

3. Why does FXBTG not offer services to certain countries?

FXBTG does not offer services in certain jurisdictions, including Afghanistan, Hong Kong, Belgium, Japan, and the United States, likely because it lacks the regulatory approval needed to operate legally in those areas.

4. How can I verify if a forex broker is regulated?

Investors can verify a broker’s regulatory status by checking the official website of financial authorities in the broker’s country of operation. For example, in New Zealand, you can verify licenses through the FMA, and in Malaysia, you can check with the Securities Commission Malaysia.

5. What does FXBTG’s expired domain mean for its business?

An expired domain could indicate mismanagement or financial instability within the company. It may also suggest that the company is winding down operations. Investors should be cautious about such signals.

6. How can investors avoid the risks of unregulated brokers?

Investors should choose brokers with clear regulatory records, transparent fund management policies, and positive reputations. Conducting due diligence and verifying a broker’s legitimacy is essential to avoiding unregulated platforms.